Friday’s bombshell – the National Association of Realtors‘ proposed $418 million settlement of real estate commission lawsuits – set off a frenzy of trading for stocks in the residential real estate sector.

Trading volumes in eight residential brokerage or listings companies rocketed up 319% to almost 80 million shares on Friday.

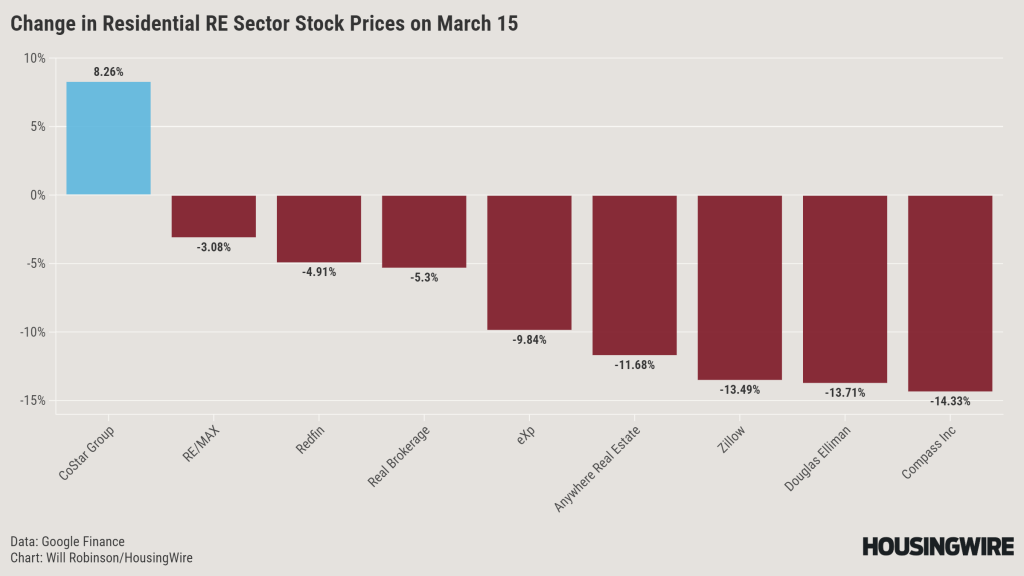

Of these eight companies – Zillow (Nasdaq: Z), eXp (Nasdaq: EXPI), Redfin (Nasdaq: RDFN), RE/MAX (NYSE: RMAX), Anywhere Real Estate (NYSE: HOUS), CoStar (Nasdaq: CSGP), Compass (NYSE: COMP), Douglas Elliman (NYSE: DOUG) and Real Brokerage (Nasdaq: REAX) – only CoStar’s stock price rose.

While CoStar’s stock climbed more than 8% on the day, the other companies’ stocks fell 4.9-14.3%. There has been some moderation in the days since, but CoStar remains the lone company up since news broke of NAR’s proposed settlement.

Of these eight companies, CoStar and Zillow are by far the largest by market capitalization. The opposite trajectories of their stock prices seem to reflect investor appetites for their different business models.

Zillow

For years, Zillow has dominated online home listings.

Last December, Zillow netted 105 million unique visitors, according to Comscore data cited in Zillow’s investor materials. That is 12 million more than Netflix and 32 million more than LinkedIn. Search engine users search “Zillow” more often than “real estate,” and “Zillow” is searched more than three times as often as competitor Realtor.com, according to the same investor materials.

The company monetizes its platform’s traffic in a variety of ways, primarily by selling leads, software-as-a-service tools for agents and advertising services. In recent years, Zillow also launched segments for rental listings and mortgage origination; it briefly operated an instant buying segment, now shuttered.

However, the company still makes the vast majority of its revenue – 75% in 2023 – from the services it provides brokers and agents in the for-sale residential market.

That revenue concentration seems to be what had investors heading for the exits on Friday.

NAR’s proposed settlement – which still needs court approval – includes several rule changes, including a new requirement that buyer agents to enter into a written buyer broker agreement with clients. It also bans NAR from setting rules that would allow a seller’s agent to set compensation for a buyer’s agent, removes commission information from MLS fields, and strikes any requirements that agents subscribe to multiple-listing services.

Regarding NAR’s proposed settlement, a Zillow spokesperson told HousingWire by email, “We strongly believe in the importance of independent representation for both buyers and sellers, as well as fair, transparent, and negotiable agent commissions. While it’s too soon to tell how changes from this settlement could influence the market, what is clear — and what Zillow has always championed — is that more transparency is a good thing. Everyone should have access to all listings, and consumers should be empowered with information about listings and how agent commissions are paid. We will continue to advocate for the best interests of consumers, which we believe also benefits agents and the industry as a whole.”

Zillow declined to comment on recent stock price movements.

Discontinuing the long-standing practice of sellers offering buyer agents compensation in their MLS listings — which some alleged was ammunition for client-steering — could lead to buyers agents receiving less compensation or being excluded from the homebuying/selling process altogether, some investors fear.

Those same investors foresee fewer buyer agents as a result, or at least fewer that will pay for the premium services Zillow offers. It is a concern Zillow acknowledged in its fourth quarter earnings materials.

“We do not have long-term contracts with many of our real estate partners,” the materials read. “Our real estate partners could choose to modify or discontinue their relationships with us with little or no advance notice.”

It goes on to note that “even modest decreases in individual spending across the real estate partner population… could have a significant negative impact on our ability to use proceeds generated from our Residential products and services to invest in our other products and services… [and] could also adversely affect our results of operations.”

In a slide in an investor presentation in February, Zillow stressed that it has worked to diversify its revenue, and buy-side related revenue was less than half – 48% – of its revenue in the second half of 2023.

That may be a slightly rosy framing of buyer agents’ impact on ZIllow’s revenues. About 73% of revenue in the period came from the residential segment, which includes revenue from seller-side agents and listings for newly constructed homes. Two of every three dollars made by the residential segment came from services for buyer agents.

And as Zillow noted in its fourth quarter earnings materials, its ability to invest in the growth of its rentals and mortgage segments – responsible for a combined 25% of revenue – depends on cash generated by the residential segment.

Then again, any potential buyer agent exodus resulting from the settlement would start with those who already struggle to land transactions. A recent study suggests as many as 70% of agents sold five or fewer homes in the past year. These agents, many of whom are only in the industry part-time, are less likely to be those paying for premium services from Zillow, suggesting a potential exodus of agents would have to be large to significantly affect Zillow’s cash flows.

CoStar

This is not the first time CoStar’s stock price has risen on news related to commission lawsuits. A KBW report last year named CoStar the “top beneficiary” of a change to the buyer agent landscape, and CoStar’s stock soared in October on news of the Sitzer/Burnett verdict.

In fact, CoStar stock has benefited so much from commission lawsuit headlines that CEO Andy Florance felt compelled to tell HousingWire in a November interview that CoStar “had zero involvement with that lawsuit.”

CoStar’s stock price started Friday morning at $87.94 and ended the day at $95.09. On Monday, it briefly hit a high of $99.09 before coming back to the $94 range later in the week. Clearly, investors see NAR’s proposed settlement as good news for CoStar, which owns Homes.com and Apartments.com, among other subsidiaries.

That is because unlike other home-search portals, Homes.com doesn’t sell homebuyer leads to buyer’s agents but provides them for free to the property’s listing agent, insulating its revenue from any effects on buyer agents that the new rules may have.

“Competitor models monetize buyer agency, taking one third of agent’s commissions,” a CoStar investor slide deck states. “Homes.com is providing millions of free leads to listing agents to help sell the home.”

CoStar doubled down on this differentiator last month when it launched subscription memberships that allow seller agents to move their listings higher in the sort order of Homes.com’s search results. The company expects this membership tier to boost residential revenues this year.

Also unlike Zillow, CoStar’s residential segment is its smallest revenue segment, responsible for just 2% of its revenue last year.

A CoStar spokesperson did not respond to a request for comment on Tuesday.