Early COVID housing policy helped servicers care for homeowners in these first nine months of the pandemic with fast forbearances and smart deferrals. Now let’s preview how this will play out for servicers, homeowners and the housing economy in 2021. We’ll begin with the top three ways homeowners are exiting forbearance so far.

Top three ways homeowners are exiting forbearance

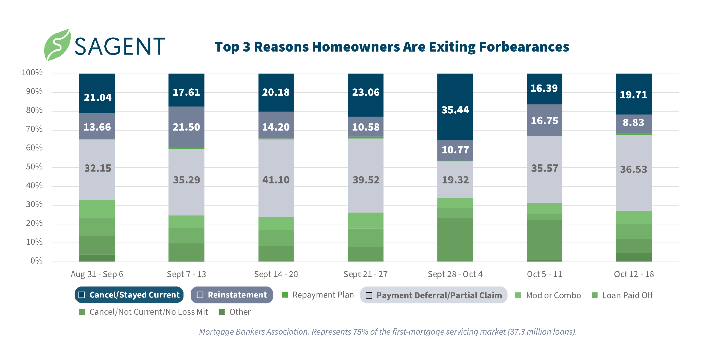

There have been three main forbearance exit trends since June. Each exit strategy provides a different perspective on the borrower experience during COVID-19.

1. Homeowners stayed current on mortgage payments

Between June and July 2020, the largest portion of borrowers exiting forbearance were those who never stopped paying their mortgage in the first place.

There are a few possible reasons for this exit behavior.

The likeliest explanation is that many borrowers enrolled in forbearance as a precaution. Unsure of how COVID-19 would impact their job status, these borrowers may have proactively requested forbearance before things got worse. Then they made their payments as planned, gained confidence that their income and employment situations were stable and eventually exited forbearance. Another possible explanation is that homeowners misunderstood or accidentally requested forbearance.

Finally, some borrowers may have never turned off automatic payments after entering forbearance.

Keeping payments current then canceling forbearance is certainly the most counterintuitive of the top forbearance exit reasons, but it has remained a top exit reason.

2. Homeowners exited forbearance with lump sum payment

Another top three forbearance exit reason since June is repaying missed payments in one lump sum, also known as “reinstatement.”

There are a couple scenarios that may have led to this.

As in reason one above, some homeowners may have requested forbearance as a precaution, then repaid the missed payments when they realized they were stable.

Or some homeowners may have requested forbearance after a job furlough, then repaid their missed payments after regaining full time work status.

It’s also worth noting that these lump-sum payers clearly saved money while in forbearance status instead of spending on discretionary items or non-mortgage debt obligations.

3. GSE deferrals allow homeowners to repay skipped payments later

The final top forbearance exit reason has been the payment deferral programs offered by Fannie Mae, Freddie Mac and Ginnie Mae. These programs let homeowners exit forbearance by starting to make payments going forward and deferring missed payments until the end of the loan’s life (which is a refi or a home sale).

Ginnie Mae already allowed this, and Fannie Mae and Freddie Mac began allowing it as part of the pandemic response. It removes the burden of a balloon payment for missed payments.

The fact that it has remained a top forbearance exit reason shows relief policies are working as intended.

Three servicer challenges heading into 2021

Another policy that has helped is the CARES Act allowing forbearances for a year. But there’s a flip side to this: the longer homeowners stay in forbearance, the harder it will be for them to get out of it.

Heading into 2021, servicers face three main challenges caring for strained homeowners.

Challenge #1: Getting borrowers to take action

Millions of borrowers proactively managed their loans in the spring, evidenced by the huge spike in forbearance requests from April to June.

Initial forbearance plans spanned either 90- or 180-day intervals, with the CARES Act allowing up to 12 months of mortgage relief – if borrowers requested a forbearance extension.

Unfortunately, many borrowers have not requested extensions. Nearly one in five forbearance exits in early October were by borrowers who did not renew their forbearance or put a loss mitigation plan in place.

This implies hardships are becoming elongated or more severe after the first 180 days since April.

Servicers must expand their borrower outreach programs to prevent homeowners from becoming needlessly delinquent.

Enhanced communication efforts should complement self-service technology to give borrowers an easy and effective way to get help.

Challenge #2: The effectiveness of payment deferral plans

Payment deferrals currently account for more than a third of all forbearance exits, an increasingly popular option since it was implemented on July 1, 2020.

But this trend may not hold, as nearly two-thirds of all forbearance plans have received extensions, and many homeowners that remain in forbearance may require more serious intervention to get their mortgages current.

Payment deferral is only viable if a borrower has recovered enough to return to their prior monthly mortgage payments. Given the widespread economic impact of COVID, many borrowers may require loan modifications to stay in their homes.

Which brings us to the third (and most important) challenge of 2021.

Challenge #3: Borrower-first recovery

In April 2021, millions of forbearance plans will expire, and servicers will have to guide borrowers through different loss mitigation paths. The silver lining of the 2008 crisis is that servicers are better equipped to handle the challenge this time around.

We have government oversight in place to ensure that servicers and borrowers are on the same page. The smart policy decisions that got us here emphasize the importance of a borrower-first policy approach.

Servicing technology also has capabilities that simply didn’t exist a decade ago, most notably:

Full systems of record for servicers to track and manage loans

Digital self-service options to empower borrowers

Full default management for every phase of loss mitigation and REO, compliant in all 50 states

These tools enable borrowers to proactively seek hardship care while servicers benefit from a more streamlined, automated workflow with reduced compliance risks and overhead costs.

Finally, servicers can utilize multiple channels to guide borrowers through various loss mitigation scenarios. Modern servicing technology will play a key role in homeowner hardship care, servicer efficiency, investor/GSE transparency, and systemic safety.

We’re already on the road to recovery

The servicing industry has risen to the challenge of providing relief to struggling borrowers during COVID-19, and is much better organized and equipped to tackle this challenge than it was in 2008. This time around, servicers have both modern servicing technology and smart policy to navigate the pandemic.

As servicers continue to work with agencies and leverage the latest tools to guide homeowners out of forbearance responsibly, technology will play a crucial role in making quick, user-friendly hardship care accessible to borrowers in need.

Today’s challenges are an opportunity for servicers to prove they’re a partner not just in good times, but also when homeowners need them most.

To read the full December/January issue of HousingWire Magazine, click here.