WFG National Title Insurance Company (WFG) is a wholly owned subsidiary of Williston Financial Group and a national title insurance underwriter dedicated to taking time and cost out of real estate transactions. By focusing on its clients and their processes, WFG helps compress the time required to close a loan and/or transfer real property ownership. By empowering industry professionals with integrated technologies, WFG provides efficient, high quality products and services through four key divisions: Direct Operations, Agency Operations, Lender Services, and WEST, its technology and digital marketing subsidiary.

WFG develops solutions in direct response to industry concerns solicited through regular engagement with its Executive Roundtable (ERT) of C-suite lending executives. The company’s post-transaction customer surveys and Net Promoter Score program rankings consistently reflect high marks for customer satisfaction across all divisions. This ongoing engagement is an example of WFG’s foundational pledge to “Communicate, Collaborate, Coexist.”

“Through our Executive Round Table (ERT) and the customer surveys we conducted in 2020 and 2021, we found that the biggest pain point for lenders – especially during the last few years’ record-high volumes – was turn-times,” said Dan Bailey. “That, plus challenges with capacity, as well as technology integration and implementation, continue to inform WFG as we develop new solutions that address our customers’ needs.”

WFG Lender Services offers a comprehensive portfolio of end-to-end origination products and services supported by:

- Real-time pricing

- One-touch ordering

- One point of contact

- LOS integration and delivery

- Consistent, world-class service

WFG’s MyHome, Blocks, and DecisionPoint products are perfect examples.

DecisionPoint instant title decisioning has provided a boost for WFG clients by reducing application to close times and loan fall-out. It analyzes property encumbrances and applicant circumstances, immediately grades the time needed to clear title and projects a completion time based on a customizable rating system. The result is delivered promptly with a pre-title report. DecisionPoint offers immediate title clearance for about a third of U.S. properties.

WFG’s Agency division operates a program called WFG Blocks, which offers title agents direct access to many of the services WFG has developed for its own operations. The six modular programs, or Blocks – Compliance Services, an Expense Management program, Human Resources, Information Security, Marketing and Sales, and Title and Settlement Services – are available as-needed, at any time and in any combination, without long-term or minimum commitments.

“The Blocks program provides a way for agents to move fixed costs to variable costs so that they are able to save money and greatly reduce overhead,” said Patrick Stone.

WFG’s MyHome streamlines the resale process and enhances consumer satisfaction by eliminating duplicate touchpoints, providing real-time status updates, enabling proactive communication and facilitating data and document collection, storage and sharing.

Additionally, MyHome Funder Dashboard gives lenders and closers instant insight into the history and status of every loan in their pipeline, as well as the steps remaining before they can get to the closing table.

“While taking time and cost out of the real estate transaction, we are empowering the Realtor, lender, and consumer with greater transparency and new technologies, including digital closing,” said Steve Ozonian. “When we all know where we stand and what’s required to close the transaction, we expedite the process and eliminate errors. DecisionPoint, MyHome, and others accomplish this and, most importantly, create a better experience for the consumer, which benefits everyone involved.”

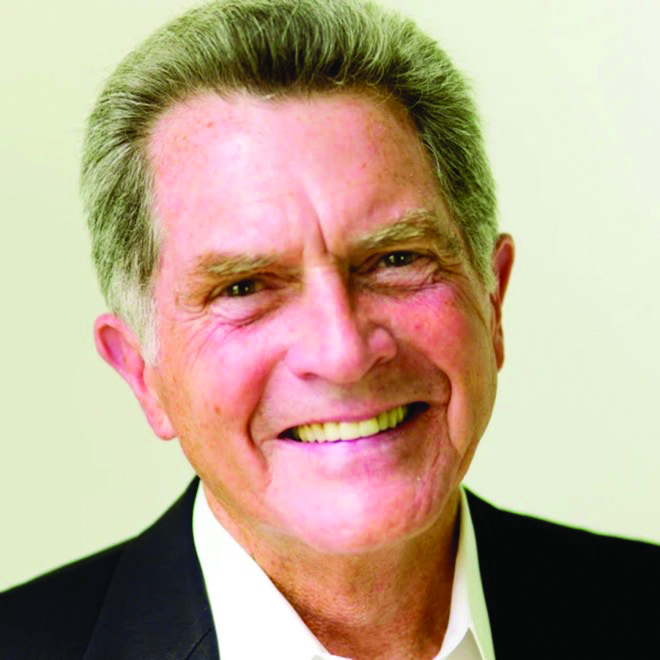

Patrick F. Stone, Founder and Executive Chairman, Williston Financial Group

A two-time HW Vanguard Award recipient, Patrick F. Stone founded WFG in 2010 and has lead the company through more than ten years of rapid growth nationally, driven by a mission to remove time and cost from the entire real estate process through communication, collaboration, and technological innovation.

Steve Ozonian, President and CEO, Williston Financial Group

Building on a track-record of leveraging technology to engineer the dramatic growth of multiple real estate related businesses, President and CEO and HW Vanguard Award winner Steve Ozonian has led WFG to near-$1 billion revenues in 2021 and current reserves of $172 million.

Dan Bailey, SVP, WFG Lender Services & WFG Enterprise Solutions

A 20-year Title industry veteran and HousingWire Insiders Award recipient, Dan Bailey is responsible for operations at WFG Lender Services, heads Enterprise Solutions’ national sales team, and has expanded the division’s client base while gaining a reputation for providing world-class customer service with truly customizable, customer-focused solutions.