Real estate investors purchasing distressed properties at foreclosure auction have been telegraphing a possible housing market slowdown for the last six months.

A deeper dive into foreclosure buyer behavior shows which markets are most likely to see a home price correction in the next six months.

Foreclosure auction buyers started bidding more conservatively in the second quarter of 2022, as measured by proprietary data from the Auction.com marketplace. Auction.com accounts for nearly half of all sales to third-party buyers at foreclosure auction nationwide.

A key measure of foreclosure auction bidding behavior is the ratio of winning bid to estimated property value — in this case the estimated “as-is” value of the property based on an exterior appraisal or drive-by broker price opinion. The inverse of that ratio is the purchase discount from the buyer’s perspective.

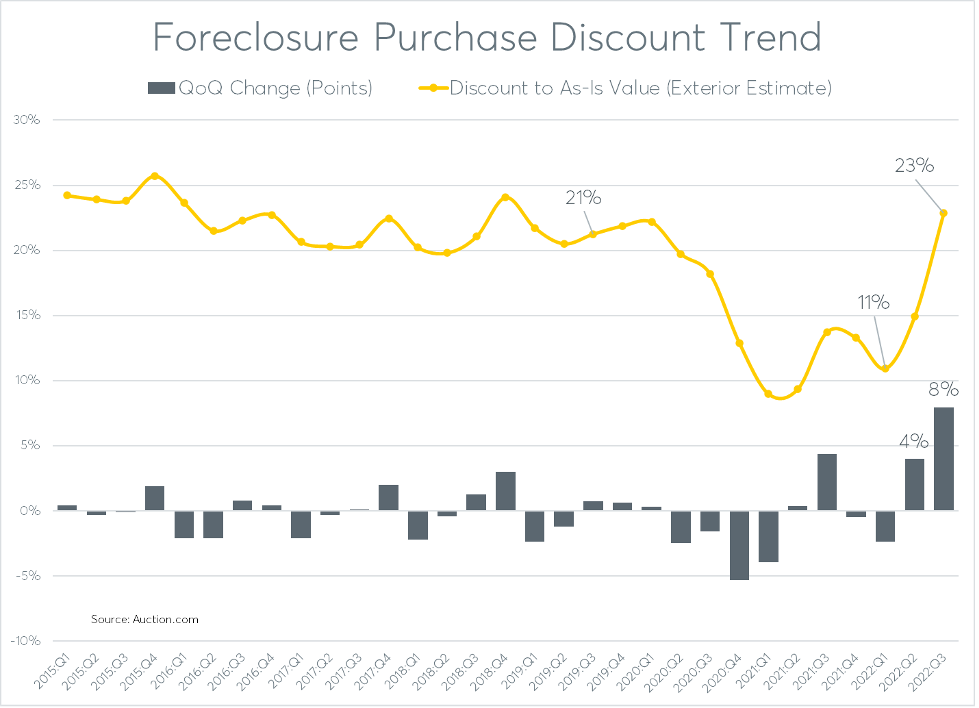

This ratio hit a year-to-date high of 89% in Q1 2022, representing an 11% average purchase discount for foreclosure auction buyers. The first quarter numbers reflect a pandemic-fueled housing fever dream that impacted the distressed housing marketplace as much as it did the retail housing marketplace.

To help put the impact of the pandemic fever dream in perspective: the average purchase discount at foreclosure auction in Q3 2019 was 21%, nearly twice the discount in Q1 2022. Prior to the pandemic, the average purchase discount at foreclosure auction had never dropped below 20% in any quarter as far back as nationwide data is available, Q1 2015.

But the fever broke in the second quarter of 2022, at least for the local community developers who are the primary buyers at foreclosure auction. These buyers typically know the dynamics of their real estate markets as well as anyone, especially since their returns depend on correctly anticipating what the market will look like in the next three to six months — the time it usually takes them to renovate a distressed property and put it back on the retail market for sale or for rent.

In the second quarter, the average purchase discount increased 4 percentage points to 15%, and in the third quarter it increased another 8 percentage points to 23% — more than twice the average discount just six months earlier and on par with the pre-pandemic average of 22%.

The reversion of average purchase discounts back to pre-pandemic norms nationwide indicates that most local real estate investors are no longer counting on the heady home price appreciation of between 15% and 20% that they enjoyed from late 2020 to early 2022. Instead, they are reverting to average purchase discounts prior to the pandemic, when home price appreciation averaged about 5% annually between 2015 and 2019.

“I don’t think we’re going to see that big drop-off (nationwide) unless unemployment rises a lot,” said Paul Lizell, a Florida-based real estate investor and coach who purchases distressed properties from Auction.com. “Where you’ll see those prices fall … Southern California, Las Vegas, Arizona, Florida will be hit.”

Price Correction Risk by Region

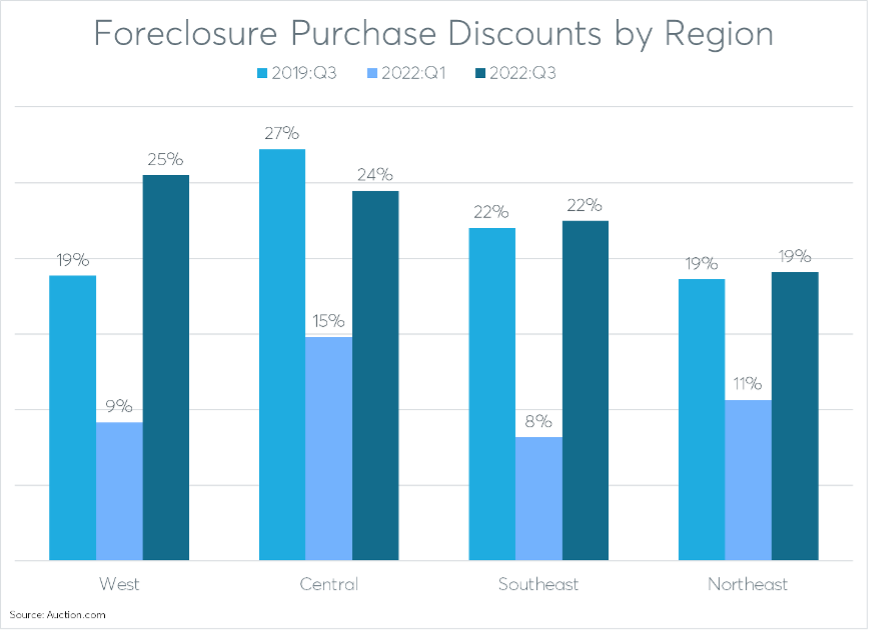

Other distressed property buyers are also anticipating a bigger slowdown — and possibly a home price correction — in some select markets. Auction.com data shows local real estate investors purchasing in the West region of the country added in an extra 16-point cushion to their average purchase discounts at foreclosure auction between Q1 2022 (9% average purchase discount) and Q3 2022 (25% average purchase discount).

The West was the only region in which the Q2 2022 average purchase discount at foreclosure auction was above pre-pandemic levels, indicating that local investors are anticipating a more severe slowdown in that region. In the other three regions, average purchase discounts in the third quarter were still at or below their pre-pandemic levels, indicating that local investors at this point are only anticipating a return to normal, boring levels of home price appreciation in those regions.

Price Correction Risk by Metro

At the metro level, the biggest risk of a home price correction as indicated by foreclosure buyer behavior was in the western market of San Francisco. Average purchase discounts at foreclosure auction in San Francisco were up 16 points in Q3 2022 compared to Q3 2019. That was the largest jump among 95 metropolitan statistical areas analyzed in the Auction.com data.

Other western markets in the top 10 for home price correction risk included Pueblo, Colorado, San Diego, Riverside-San Bernardino, California, Tucson, Arizona, and Phoenix. The average foreclosure purchase discount in Q3 2022 was at least 8 points higher than pre-pandemic levels in all five of these markets.

There were four markets outside of the West region in the top 10 for home price risk: Pensacola, Florida, Minneapolis-St. Paul, Lakeland, Florida, and Davenport, Iowa.

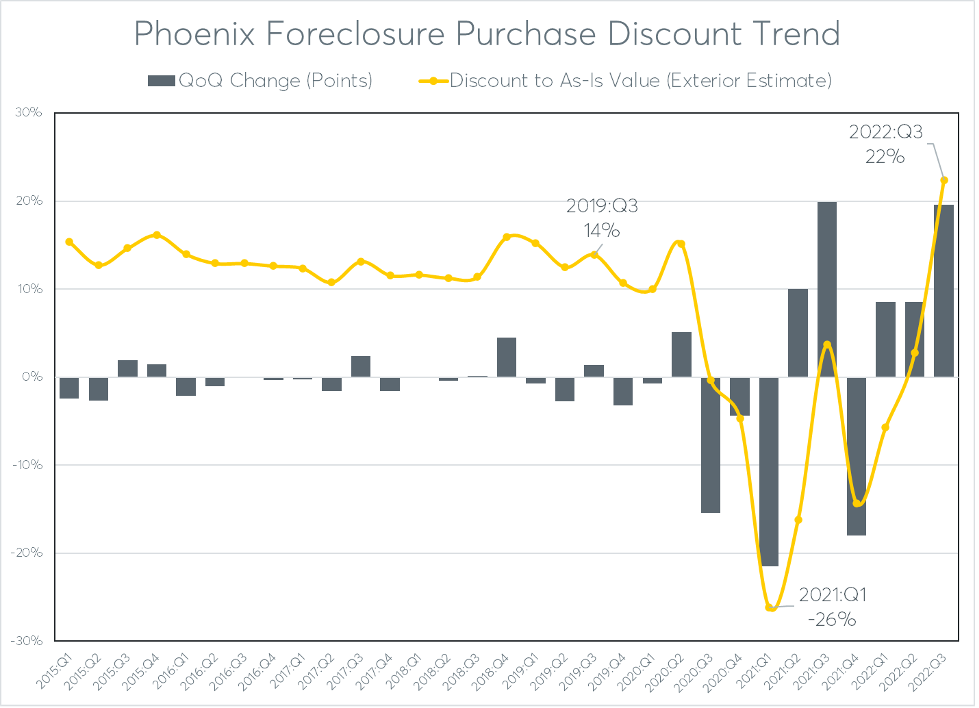

Among the top 10 for home price correction risk based on the comparison to pre-pandemic levels, Phoenix posted the biggest six-month swing in average foreclosure discounts. The average foreclosure purchase discount of 22% in Phoenix in Q3 2022 was 28 points higher than just six months earlier, when foreclosure auction buyers were purchasing properties at 6% above the estimated as-is value on average.