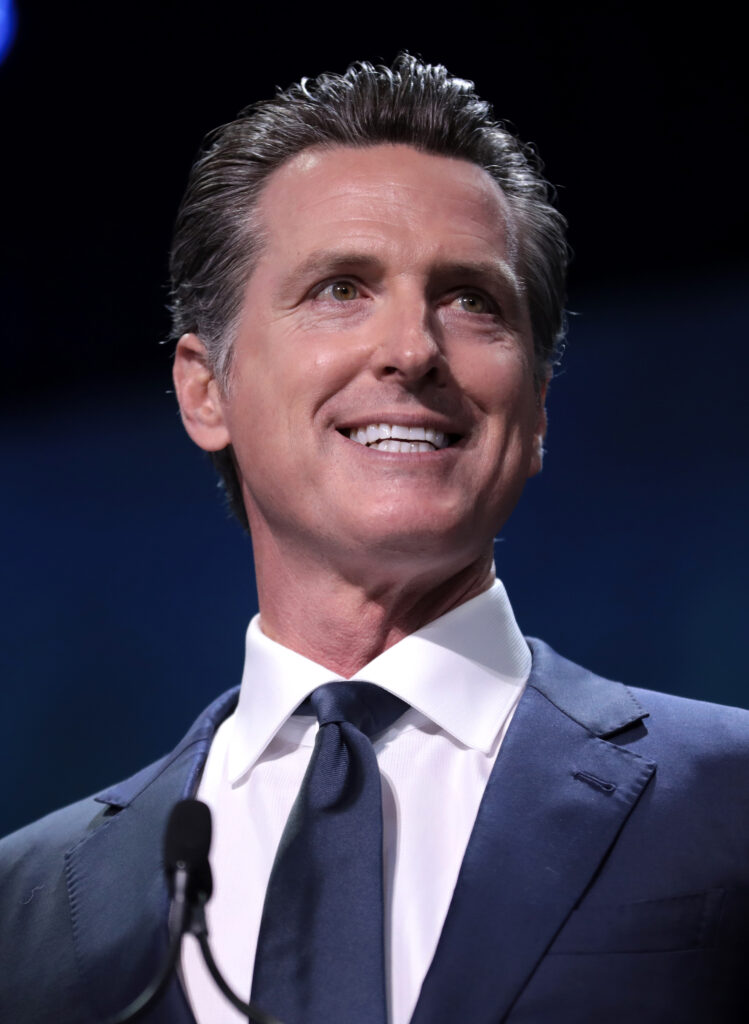

Similarly to New York before it, the state of California is touting the availability of a mortgage relief program available to its residents that also includes a reverse mortgage component. This is according to a press release publicizing the program released by the office of California Gov. Gavin Newsom (D).

“Governor Gavin Newsom today announced that California’s plan to provide $1 billion in mortgage relief grants to tens of thousands of homeowners who have fallen behind on housing payments or reverse mortgage arrearages during the COVID-19 pandemic has been approved by the U.S. Department of the Treasury, clearing the way for a full program launch in the coming weeks,” the announcement reads.

The California Mortgage Relief Program will provide assistance to an estimated 20,000 to 40,000 struggling homeowners, with funds reserved for homeowners in socially disadvantaged and underserved communities often hit hardest by the pandemic, the announcement said. According to origination data, the region including California is typically the highest-volume area in the country for the reverse mortgage industry.

In a statement accompanying the announcement, Gov. Newsom described the effort for the state government and how it will attempt to prioritize those communities most impacted by the ongoing COVID-19 coronavirus pandemic.

“We are committed to supporting those hit hardest by the pandemic, and that includes homeowners who have fallen behind on their housing payments,” Gov. Newsom said. “No one should have to live in fear of losing the roof over their head, so we’re stepping up to support struggling homeowners to get them the resources they need to cover past due mortgage payments.”

The state’s “Housing is Key” program already aimed to provide dedicated assistance to renters and landlords within the state, and this new program aims to provide targeted relief to homeowners.

The reverse mortgage application of the program comes from the source of its funding, which is the Homeowners Assistance Fund (HAF) that was a part of the American Rescue Plan Act of 2021 pursued by the Joe Biden administration and signed into law earlier this year. Immediately prior to its passage, Biden administration officials described for RMD the ways in which reverse mortgage borrowers could avail themselves of the relief funds by using them toward outstanding utility, tax or homeowners insurance payments.

“Through the mortgage relief program, past due housing payments will be covered in full – up to a maximum of $80,000 per household – with a direct payment to qualified homeowners’ mortgage servicers,” the California announcement reads. “The financial support is provided as a one-time grant that qualified homeowners will not have to repay, so that they can get caught up and have a fresh start. Funding for the program is allocated through President Biden’s American Rescue Plan Act’s Homeowner Assistance Fund.”

Read the announcement issued by Gov. Newsom’s office and visit the program’s website.