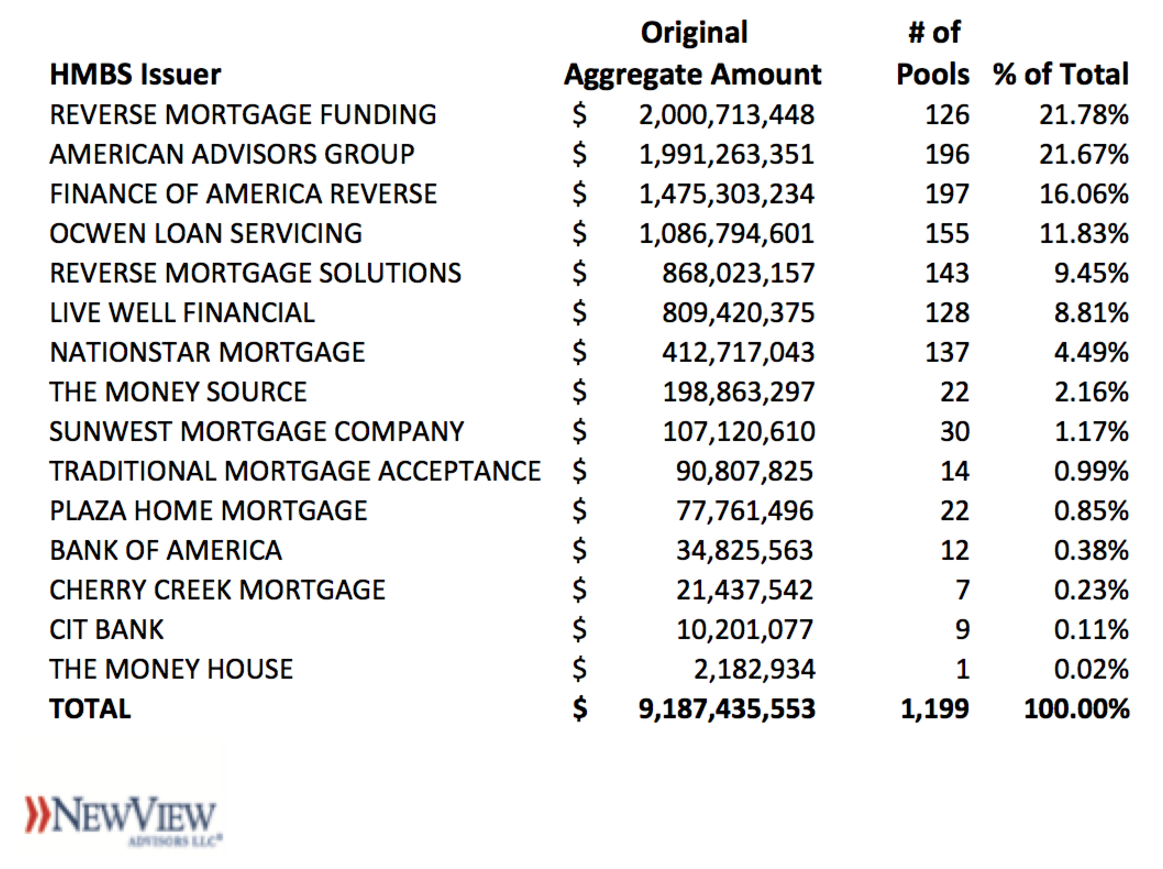

Maintaining its position achieved earlier this year, Reverse Mortgage Funding LLC finished 2016 as the top issuer of Home Equity Conversion Mortgage-backed securities (HMBS), according to the latest analysis of issuer rankings by New View Advisors.

RMF issued approximately $2.001 billion of securities across 126 total pools in 2016, as evidenced in the latest New View Advisors commentary, which was compiled from publicly available Ginnie Mae data as well as private sources.

The company’s market share of 21.78% for the year exceeded that of the second largest HMBS issuer, American Advisors Group, who RMF surpassed as the top issuer as of the third quarter of 2016.

AAG issued approximately $1.991 billion of HMBS and 196 pools during the year, for a market share of 21.67%.

(Source: New View Advisors — Click image to enlarge)

Ranking third among all issuers, Finance of America Reverse issued the largest number of pools in 2016 with 197, for an aggregate issuance amount of roughly $1.475 billion and 16.06% market share.

Rounding out the top-five HMBS issuers, Ocwen Loan Servicing ranked fourth on the year with $1.087 billion and an 11.8% market share; and Reverse Mortgage Solutions ranked fifth overall with $868 million and a total market share of 9.45%.

In all, the top-five HMBS issuers accounted for 80.8% of all HMBS issuance in 2016, up slightly from 80.6% reported during the third quarter.

“Despite the much-reported slowdown in HECM endorsements, HMBS issuance remains robust, aided by growth in tail issuance and highly seasoned pools,” states New View Advisors in its recent commentary.

Issuance volume totaled $9.187 billion for 2016, just 3% less than $9.453 billion in 2015.

Read the New View Advisors commentary here.

Written by Jason Oliva