Over the years, the inventory of affordable homes has been in sharp decline, while home prices have risen dramatically. With homes becoming increasingly unaffordable, the shortage of safe and affordable housing is affecting more and more prospective homebuyers every day. However, potential impacts go beyond individual would-be homeowners, with growing implications for society at large. This problem has no one solution, but with collaboration across the entire housing industry, together we can create more opportunities for more people to achieve sustainable, long-term homeownership.

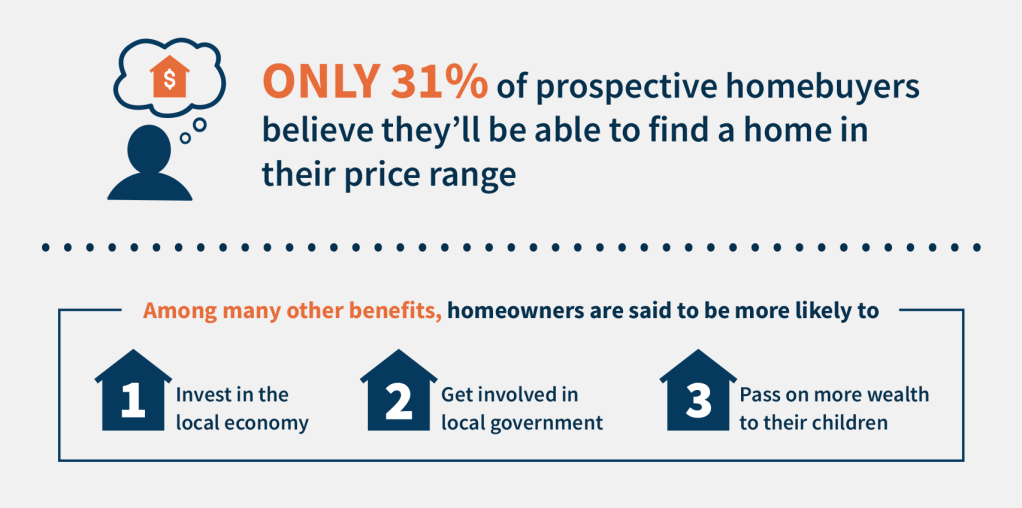

Research shows that successful homeownership has many benefits for the economy. For example, we have seen that homeowners are more likely to invest in their area’s economy, get involved in local government, and pass on more wealth to their children. With average wages increasing by only 16% since 2012, and national home prices increasing by 47%, the impact on long-term, intergenerational economic well-being could be substantial.

Only 31% of prospective homebuyers, aged 25-34, are confident they will be able to find affordable housing in their price range. Compared with previous generations, Millennials and Gen Z are entering the market with larger amounts of debilitating debt. That, combined with the fact that jobs are often concentrated in high-cost areas, is delaying homebuying significantly. Plus, the rise of COVID-19 also presents significant challenges. In a recent Fannie Mae survey, 40% of current renters report having experienced a strong impact on their overall financial health due to the pandemic.

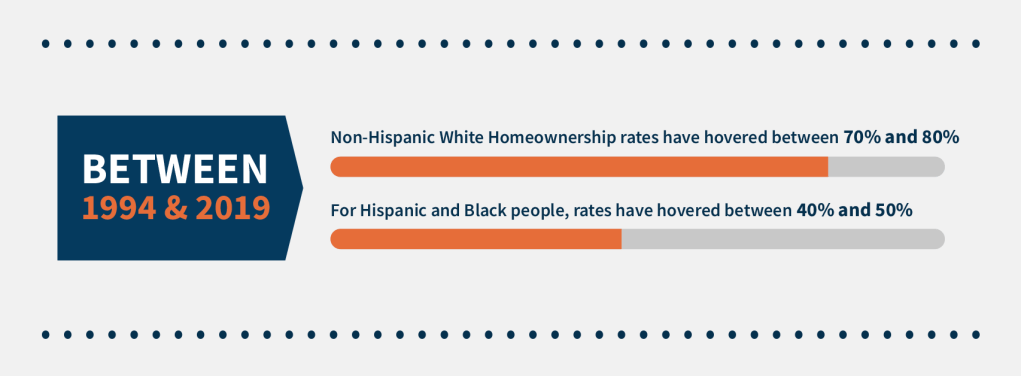

At the same time, census reports clearly illustrate the very real effects of racial inequality in housing. According to the Census Bureau, between 1994 and 2019, Non-Hispanic White homeownership rates have hovered between 70% and 80%, while rates for Hispanic and Black people remained between 40% and 50%. As Fannie Mae CEO Hugh Frater states, “Fannie Mae understands the story of housing in America includes a history of systemic racism, and we know our role in housing finance brings important responsibilities.”

So, what can we do to help solve these problems? Let’s share ideas, start conversations, and work together to make housing more affordable.

Fannie Mae believes that housing should be attainable and sustainable for all. That’s why we’re dedicated to working with our industry partners and community organizations behind this common goal. Here is how we’re putting that plan into action:

Visit FM.FannieMae.com/Affordable and read more about our plan to make housing affordable.

See our infographic to learn more about why housing affordability matters.

Sources: Fannie Mae, “Future Homebuyers,” Single-Family Strategy & Insights unpublished research (November 2019). | Fannie Mae, “Builders,” Single-Family Strategy & Insights unpublished research (December 2019). | “The Decennial Census & American Community Survey,” U.S. Census Bureau. | Hayward, “How Zoning Laws Exclude Black Families from Areas of Economic Opportunity,” Fortune (July 2020). | DiPasquale & Glaeser, “Incentives and Social Capital: Are Homeowners Better Citizens,” Journal of Urban Economics, (1999). | Evangelou, “Wage Versus Home Price Growth,” National Association of Realtors (March 2019).