Federal Home Loan Bank reform is in the air in Washington D.C.

The White House recently endorsed a plan to double FHLBanks’ mandatory contributions to affordable housing programs from 10 to 20% of their net income, following a recommendation by the Federal Housing Finance Agency. And the Coalition for Federal Home Loan Bank Reform, a group that I chair and started as a small group of D.C. insiders, has become a true coalition of nine national organizations representing hundreds of thousands of Americans.

Despite billions of dollars in public support, few Americans know about FHLBanks. The Federal Home Loan Bank system is made up of 11 regional banks that pass on discounted loans to their membership of banks, credit unions, and insurance companies. As a government-sponsored enterprise (GSE), the FHLBank system is Congressionally chartered to receive unique subsidies, tax exemptions, and powers, in exchange for providing the public benefits of supporting affordable housing and community development.

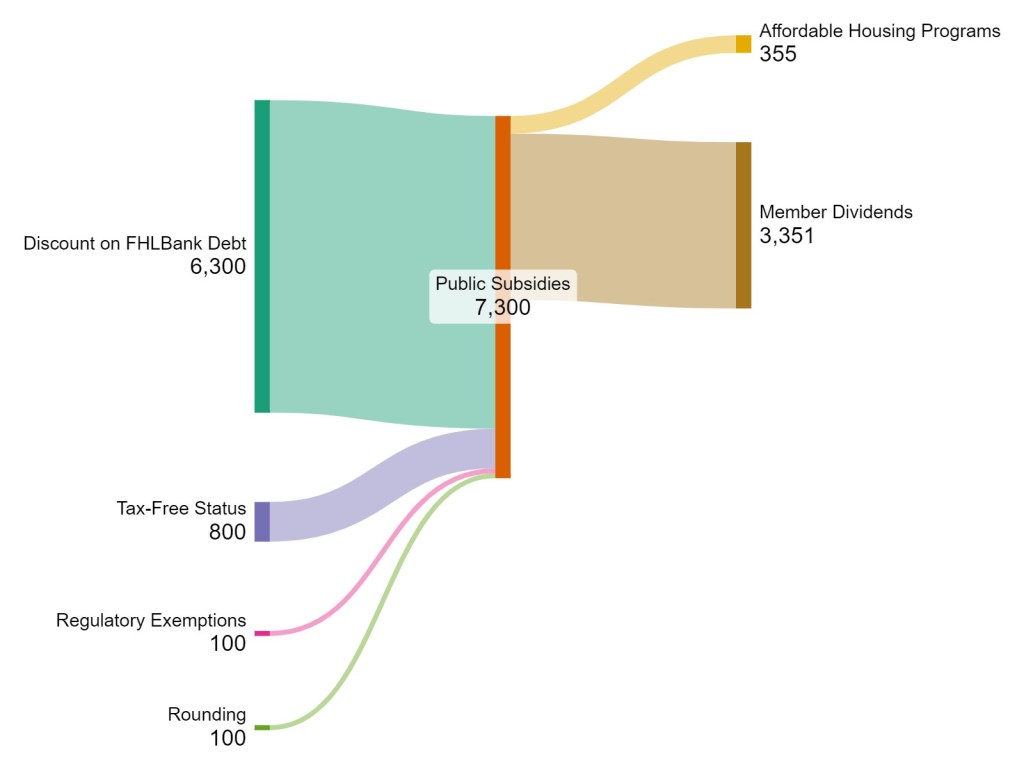

The Congressional Budget Office published a new report, which for the first time in two decades put a dollar amount on the public subsidies that FHLBanks receive, estimating that in 2024 the FHLBank system will receive $7.3 billion dollars(!) in government subsidies.

As I show in Figure 1, this subsidy partly flows from the FHLBanks’ tax-free status and regulatory exemptions. But the bulk of the subsidy comes from the way GSE status confers an “implied federal guarantee” on FHLBank debt: the perception that the federal government will stand for FHLBank debt if the system fails. CBO concluded that GSE status reduced FHLBanks borrowing costs by 0.4% and noted that if the system was “private instead of public” its credit rating would fall to AA or A instead of the current AA+ rating. None of these subsidies require Congressional appropriations but rely on federal guarantees, including the high costs of public bailout, were the FHLBanks to fail.

Source: Numbers from CBO Report (2024) and FHLBanks Annual 2023 Combined Operating Highlights Graphic made with SankeyMATIC.

Under the current system, most of these billions in public subsidies flow on as private profits, rather than support public benefits. Congress mandates that FHLBanks devote 10% of their net income every year to affordable housing programs, which support affordable housing development and downpayment assistance. But that meant that in 2023, FHLBanks only paid $355 million towards Affordable Housing Programs while paying out nearly 10x that amount, or $3.4 billion, as dividends! Through these payouts, FHLBanks are redistributing a public subsidy as a profit to banks and insurance companies.

FHLBanks still believe in trickle-down economics. They claim that their discounted loans and dividends to members may trickle down to consumers in the form of discounted mortgage rates. However, many of their members are not even in the mortgage business anymore: a Bloomberg investigation found that 42% of FHLBank members had not originated a single mortgage over the last five years. It is unclear how cheap loans and big dividend payouts to insurance companies help Americans buy their first house or find an affordable rental.

Even the technocratic, impartial CBO questions this twisted system when it dryly noted in its report: “Other stakeholders of FHLBs, including the executives and owners of banks, might also realize benefits.” That is, parts of today’s public subsidy simply go towards supporting seven-figure executive pay at the 11 FHLBanks.

Whether it is coming from the White House, the FHFA, the Congressional Budget Office, or the Coalition, the status quo at FHLBanks is unacceptable. Wasteful government spending, especially amidst a national housing crisis where both parties are seeking solutions to our housing supply shortage, is a bipartisan issue.

Congress should demand greater accountability on how these public subsidies support public benefits. They can start by passing legislation that greatly improves the Affordable Housing Program contributions that FHLBanks make, from the current meager 10% to at least 30% – a set-aside that FHLBanks have shown they can sustainably make when they paid REFCORP contributions from 1989 to 2011.

I think it is time that the public learned about FHLBanks and how they are skirting their responsibility to help support our nation’s housing troubles. There is so much untapped potential here: imagine having the full leverage of $7.3 billion in public subsidies to truly support imaginative housing solutions.

Sharon Cornelissen is the chair of the Coalition for Federal Home Loan Bank Reform and Director of Housing at the Consumer Federation of America, a national pro-consumer advocacy and research non-profit.