Recently, Intercontinental Exchange (ICE) announced a plan to acquire Black Knight in a reported $13 billion deal that, if approved by federal regulators, would certainly be one of the largest acquisitions ever in the mortgage technology space. The importance of this particular acquisition is one that could have implications for consumers, lenders, vendors and settlement service providers.

More importantly, the acquisition should be a wake-up call about the importance of data in a future world.

Mortgage competition is critical

The mortgage industry to date has not been “Amazoned,” as has the retail sales market, or “Ubered,” as has the transportation market, and still operates in a very decentralized state consisting of a few thousand lenders (banks, community banks, and independent mortgage companies). These all compete for loans in a nation of borrowers who benefit from the resulting competition.

In fact, despite changes in interest rates, it is this competition that drives overall mortgage rates and credit availability to the most advantageous levels for consumers. Thanks to this highly competitive market, it is impossible for any single lender to be a price-maker, as market dominance is, at best, fleeting until the next lender or technology provider comes along and out-competes the last.

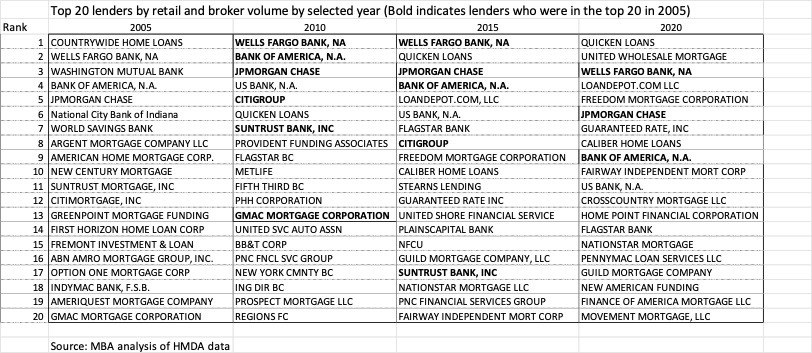

Unlike the comparison to Amazon and Uber, this competition in the mortgage market exists across all sectors. The perceived benefit of competition to consumers is important. The barrier to entry for new platforms and technologies is relatively low, meaning all participants must remain on their toes to ensure they don’t fall behind new companies and new ideas. Just look at the variability of the top lenders in America:

The majority of the top 20 lenders from 2005 were no longer in the top 20 in 2020 — a true testament to the industry’s thriving competition.

There have been periods of time where market dominance became a challenge to competitors, negatively impacting consumer options. However, the market has always adjusted as market conditions change and new technologies and platforms find a better way to reach consumers.

Data monopoly risk

The ICE acquisition of Black Knight is different because of one very important component: data. Historically, no single lender has ever had control of so much consumer information. This is key because if one company exercises majority control of mortgage data and its platforms, there is a future opportunity for a market shift to result in the cutting out of the vast competition.

For example, today’s mortgage servicers have an advantage with their own customers. They already have all the loan information of their customers, and when refinance opportunities arise, they can pinpoint who is “in the money” faster than all others and, if ready, have an advantage of reaching their customers before all the other lenders to offer the refinance, often with a far more streamlined process than a new lender. This, however, is where the advantage generally stops.

Think about it. ICE today already owns Encompass, the Loan Origination System (LOS) platform owned by Ellie Mae and clearly the largest platform used by IMBs (independent mortgage bankers). They own MERS and thus have access to knowing who the servicer of record is for all mortgages and where they are recorded. This is already a significant amount of data to own.

With the acquisition of Black Knight, they would take on MSP’s servicing platform, which is used today for an estimated 65% of all mortgage servicing in the market. This purchase would also include the acquisition of the other mega loan origination platform, Empower, which together, with Encompass, covers nearly 75% of all mortgage loans originated.

The sheer market power coming out of this will be significant. In fact, Black Knight was already defending an antitrust lawsuit prior to this announced sale to ICE. In that 2019 suit, the plaintiff claims that Black Knight “uses its market-dominating LoanSphere MSP mortgage loan servicing system to engage in unfair business tactics that both entrap its licensees and create barriers to entry that stifle competition.”

One must ask: If the sheer power of Black Knight alone, before this transaction, was enough to draw antitrust concerns, what will the collective impact of an acquisition like this do?

If approved, ICE will own or have access to the vast majority of data in the overall mortgage market. Ellie Mae’s Encompass, and Black Knight’s MSP, Empower, not to mention Optimal Blue, would make ICE a formidable price-maker, the likes of which new entrants and even existing players might not have any hope of competing with. To put this clearly, the GSEs respectively would have less access to their own intellectual property from a performance standpoint than would this new conglomerate.

Don’t get me wrong: ICE is very good at what they do. They own some of the world’s largest technology data platforms, including the New York Stock Exchange (NYSE). But it is that exceptionalism that could risk a monopoly for the mortgage market.

Just think about one hypothetical scenario: In the next rate rally when refinances come back, ICE would have access to most of the loan origination data, the servicing performance, the servicer of record and more … more data than any other individual company in the market. And while they are not in the “origination” space today, it would seem like a simple push of a button to take that data and, within minutes, make loan offers to millions of homeowners across the country.

On the other hand, even if they have no intention of competing in the origination space, what happens when the competitive bid on the LOS or servicing platform front goes away, and lenders are stuck with a “take it or leave it” bid? Pricing power, service levels, competitive upgrades and more could succumb to the market power of this one single massive entity.

The most important questions to revisit

We have a few monopolies in our industry. For example, FICO is still the only credit score used in lending and is often accused of being antiquated and not keeping up with minority access and the needs of scoring tens of thousands of Americans. And while new entrants have been trying to break in for years, the sheer market dominance of this scoring model, along with the change-management costs and unknown certainty on new scoring models, has kept that dominance alive.

ICE will argue that they will bring better efficiencies to a fractured mortgage market. But it is precisely this fractured market that results in the most aggressive pricing and service competition, which benefits consumers and permits lenders large and small to compete on a more equal level.

What would stop this new mega conglomerate from giving their largest customers preferred pricing and more attention from a service and support level while eliminating whatever competition exists today just between these two LOSs?

This proposed acquisition should raise, at minimum, these questions among a variety of regulators in D.C. who would directly approve this purchase and among those who oversee consumer access. Beyond that, lenders must think back to when companies with pricing power made them either more or less competitive than their peers. Revisiting that is an important consideration prior to finalizing this acquisition.

ICE is very good at what they do and just like Amazon, which changed how retail lending is done, and Uber, which has revolutionized transportation in the country, resulting in the elimination of thousands of small businesses across the nation — they could become the monopoly you get, whether you wanted it or not.

My advocacy is to simply take a closer look, as this could really matter in the years ahead. The critical question is what will be the long-term impact of such a concentration of market power, and how will that market concentration affect the consumers’ experience over the years to come.

David Stevens has held various positions in real estate finance, including serving as senior vice president of single family at Freddie Mac, executive vice president at Wells Fargo Home Mortgage, assistant secretary of Housing and FHA Commissioner, and CEO of the Mortgage Bankers Association.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Dave Stevens at dave@davidhstevens.com

To contact the editor responsible for this story:

Sarah Wheeler at sarah@hwmedia.com