The real estate market in China, both commercial and residential, have been unwinding over the last few years. Like a slow-motion train wreck at first, it is now definitively off the rails and heading over a cliff. Following a pattern eerily similar to the U.S. in 2008 and 2009. Lax lending standards and cheap credit, plus a popular belief that real estate values never decline, created a massive bubble.

Earlier this summer, the story of Evergrande’s massive default hit the news, followed by Country Garden’s near failure. Now add in the most recent news of outright fraud and embezzlement by Evergrande executives, and there is a chance the sector will drag down an already slowing Chinese economy.

Global economic uncertainty

With the sheer size of China’s economy, as the saying goes, if they sneeze, the rest of the world could get a cold. Chinese real estate investments extend beyond their borders and if those investors suddenly need to liquidate those assets to cover losses at home, many countries real estate markets could be negatively impacted. In the U.S., some luxury residential markets that saw an influx of Chinese buyers could be particularly vulnerable.

Investors who have been burned by events in China may also start seeing ghosts in other markets and decide the risk profile is just too unfavorable. This could make raising capital for new construction projects harder, and more expensive, everywhere.

Despite the risks, there are multiple ways events in China could end up benefitting residential real estate in the US.

Growing demand

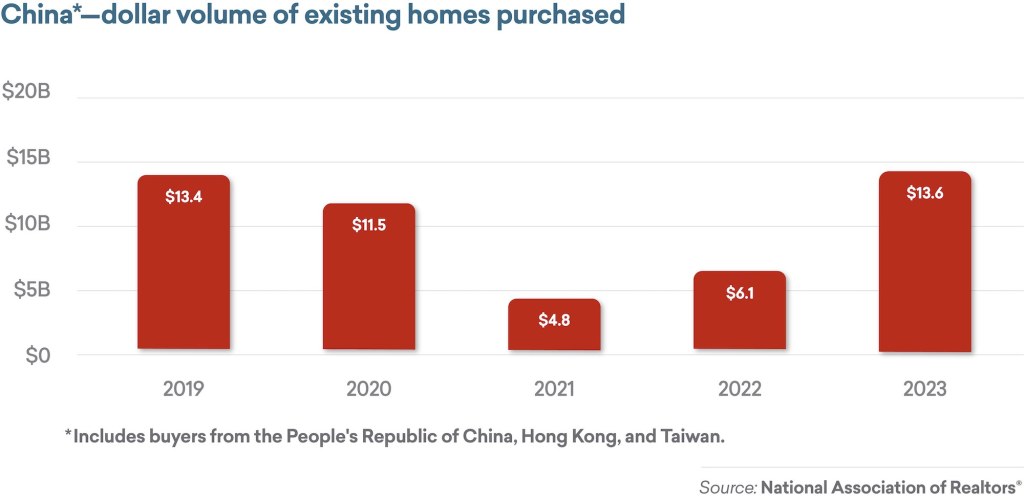

While there is a chance of real estate assets in the U.S. being liquidated by Chinese owners, the data actually points to the opposite trend. In the 12 months leading up to March 2023, Chinese spending on U.S. residential real estate more than doubled, compared to the previous year.

This indicates that the U.S. market is viewed as a safe harbor by those in China with capital. Not only are they seeking safer investments, but the continued devaluation of the yuan makes dollar-denominated assets more attractive.

Real estate investors from other countries are also likely to choose the lower risk profile of the US market. Combined, this will support real estate demand and price levels.

Interest rates

The Fed has already expressed concern about possible ripple effects from China’s economic struggles. If these concerns become serious enough, the Fed could choose to halt, or even reverse rate increases. Regardless of the Fed’s actions, any significant influx of real estate investment from China and other countries will put downward pressure on interest rates.

Given the deeply interconnected nature of global economies, a crisis anywhere is never “good news,” and given the size of China’s economy, current events have the potential to send shock waves abroad.

However, even bad news often has a silver lining. As the Chinese real estate market declines, the U.S. residential market becomes a relatively safer landing spot for investment. In turn, this capital flow will tend to push down mortgage rates, potentially providing some relief from one of the biggest factors holding the US real estate market back from a full recovery.

Vince O’Neill is the chief economist at Plunk.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Vince O’Neill at vince@getplunk.com

To contact the editor responsible for this story:

Tracey Velt at tracey@hwmedia.com