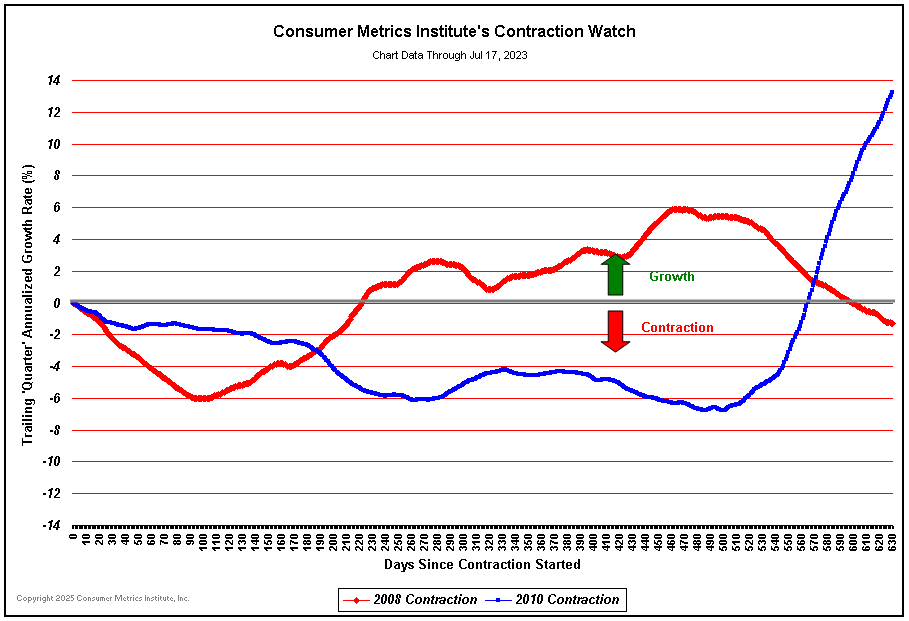

There is no other way to say this: we’re being lied to. Willfully. Anyone who managed to read headlines around the U.S. Treasury‘s latest HAMP report card last week would likely have thought the program a huge success –- with more than one media outlet trumpeting impossibly miniscule re-default rates among permanent HAMP mods. Surprisingly, even a few trade publications –- media outlets that ought to know better – took the “low redefaults!” theme and made screaming headlines out of it last week. At HW, we chose not to run with the HAMP redefault numbers except to note that Treasury officials had added them into the latest report card. And this choice was made with purpose: we knew these numbers were fake. Nobody gets a 1.7% redefault rate 6 months after modification –- not even Uncle Sam — and any media outlet reporting that number with a straight face quite simply doesn’t understand the industry it’s covering. The only way to come up with a 1.7% redefault rate is to change how redefaults are calculated. And that, dear readers, is precisely what our government did. In the report card, buried in a footnote, is the following disclaimer: “a HAMP permanent modification is canceled for non-payment if it is more than 90 days delinquent.” It’s also apparently removed from redefault calculations, which is a great way to smear a pig in a mountain of lipstick and hope nobody notices. The researchers at Barclays Capital were among the few paying attention to this footnote, and took the unprecedented step of issuing a separate research alert on the HAMP numbers last week, highlighting what they called “misleading” reporting by Treasury on HAMP mod performance. I prefer to call it lying. Because if it quacks like a duck and it walks like a duck, it’s a duck. Redefault calculations aren’t exactly a foreign thing, even for our government. A few years back, Uncle Sam began collecting mortgage servicing data for quarterly reporting via the Comptroller of the Currency –- so there is zero excuse to suddenly define a “new” way of calculating redefault rates. I’ve written for months in this column about the need for the Treasury to begin reporting redefault rates on HAMP modifications, and this is what they finally give us? I’m incensed. Because it’s yet another attempt to fool the American public into believing that HAMP, an utterly failed program, is actually working. And because it’s a blatant lie. The Barclays researchers still expect to see actual HAMP redefaults — you know, the kind that may never be reported — to reach somewhere around 60 percent over time. I concur. Before the Treasury decided to offend my statistical sense of justice, I was going to spend today’s column writing about my expectations for second quarter GDP (which will be released Friday morning). So instead I’ll cut to the chase: if the BEA’s inputs for GDP calculation were actually capturing consumer demand (which they are not), the Q2 GDP report would be well off of current consensus estimates and reflecting contracting economic activity. Here’s the latest look at the state of consumer demand, via the Consumer Metrics Institute:  As it stands, who knows what we’ll actually get for GDP? If I had to guess, I’d take the under on current consensus estimates that are calling for real annualized GDP growth of 2.5% in Q2. That said, I’d much rather be wrong on GDP and see the Treasury decide to start being honest with the American people regarding HAMP performance. Something tells me what I’ll get is the exact opposite of that, instead. Paul Jackson is the publisher of HousingWire Magazine and HousingWire.com. Follow him on Twitter: @pjackson

As it stands, who knows what we’ll actually get for GDP? If I had to guess, I’d take the under on current consensus estimates that are calling for real annualized GDP growth of 2.5% in Q2. That said, I’d much rather be wrong on GDP and see the Treasury decide to start being honest with the American people regarding HAMP performance. Something tells me what I’ll get is the exact opposite of that, instead. Paul Jackson is the publisher of HousingWire Magazine and HousingWire.com. Follow him on Twitter: @pjackson

Most Popular Articles

Latest Articles

While the Austin housing market isn’t sizzling, agents say it is still warm

Despite an uptick in inventory, Austin metro area home prices are holding steady and giving agents confidence in the strength of the market