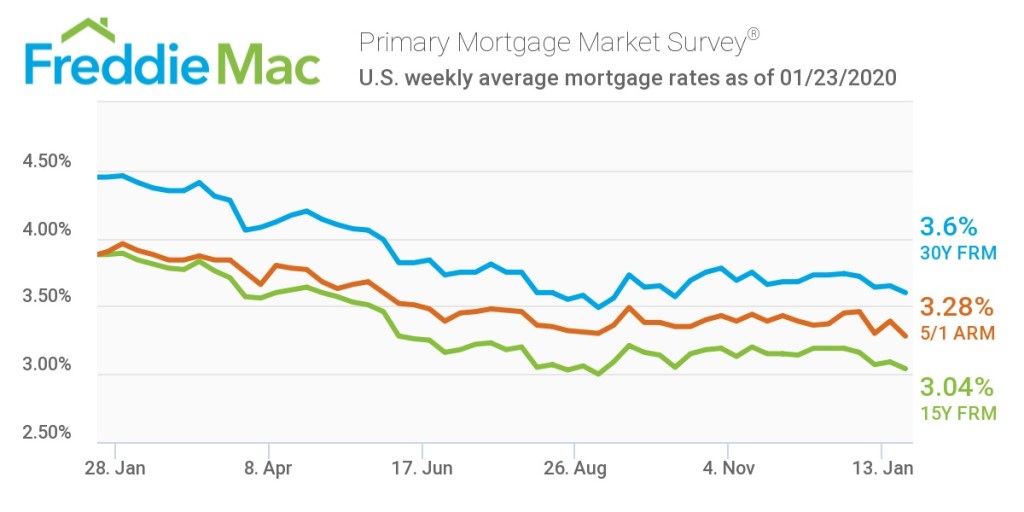

The average U.S. fixed rate for a 30-year mortgage fell to 3.6% this week, a three-month low.

That’s 5 basis points below last week and 85 basis points below the 4.45% of the same week last year, according to the Freddie Mac Primary Mortgage Market Survey.

Sam Khater, Freddie Mac’s chief economist, said mortgage rates now are about a quarter of a percentage point above historic all-time lows. The low financing costs are providing a boost to housing demand, he said.

“The very low rate environment has clearly had an impact on the housing market as both new construction and home sales have surged in response to the decline in rates, the rebound in the economy and improving financial market sentiment,” Khater said.

According to the survey, the 15-year FRM averaged 3.04% this week, falling from last week’s rate of 3.09%. This time last year, the 15-year FRM came in at 3.88%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.28% this week, declining from last week’s rate of 3.39%. Last year, the 5-year ARM averaged 3.9%.

The image below highlights this week’s changes: