Mortgage applications for new-home purchases increased 7.2% year over year in November, according to data from the Mortgage Bankers Association‘s (MBA) builder application survey that was released Tuesday. Applications decreased by 12% from October 2024.

“Applications to purchase newly built homes have seen annual increases since February 2023, as prospective homebuyers continue to favor new homes, given affordability challenges and constrained existing inventory,” Joel Kan, the MBA’s vice president and deputy chief economist, said in a statement.

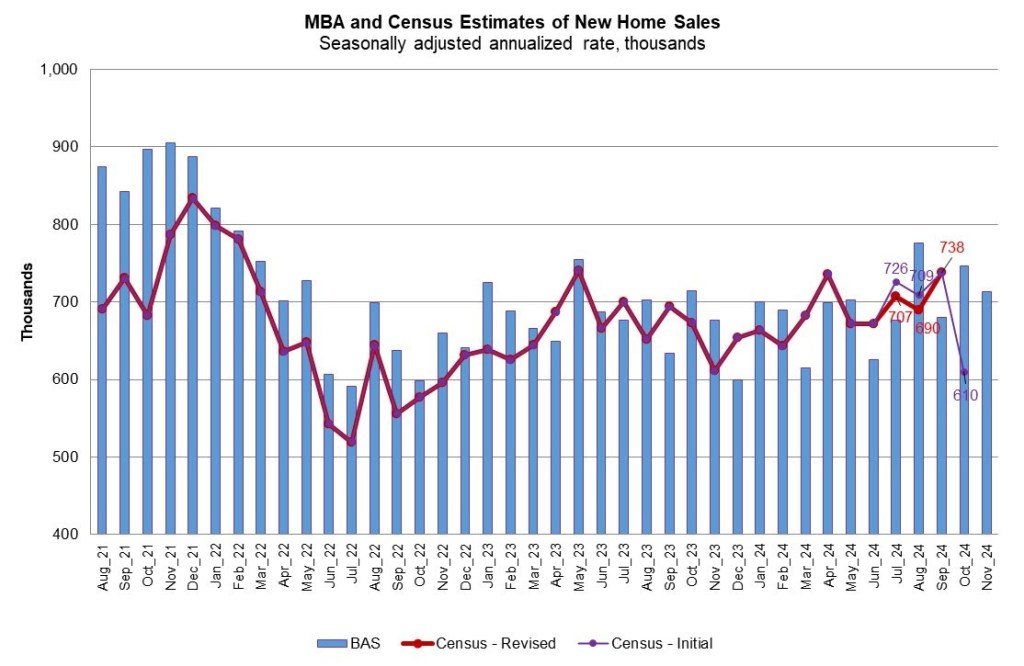

MBA estimates from the builder application survey show that sales of new single-family homes were running at a seasonally adjusted annual rate of 713,000 units in November 2024. That estimate is down 4.6% from the October pace of 747,000 units.

“The decline in applications from the previous month was roughly in-line with typical seasonal patterns at the end of the year,” Kan added. “The FHA share of applications, at 28%, continues to show that first-time homebuyers account for a significant share of new home demand. Additionally, the 713,000 unit seasonally adjusted annual pace of new home sales was the third strongest month of 2024.”

MBA estimates that there were 49,000 new-home sales in November 2024, an unadjusted decrease of 12.5% from the 56,000 sales in October.

Conventional loans accounted for 61.6% of applications, Federal Housing Administration (FHA) loans for 28% and U.S. Department of Veterans Affairs (VA) loans for 9.9% in November. The average loan size for new homes decreased to $402,873, down from $409,942 in October.