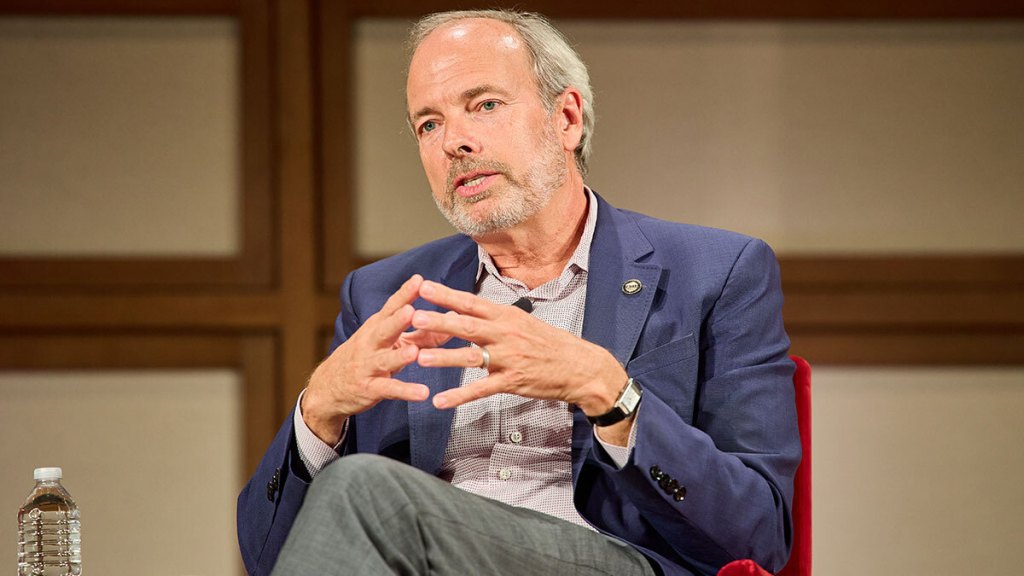

Mortgage Bankers Association President and CEO Bob Broeksmit on Monday called 2025 a “historic year” for the trade group, highlighting major legislative and regulatory victories during his opening address Monday morning at the association’s Annual Convention and Expo in Las Vegas.

Broeksmit shared with the audience that the MBA helped shape roughly 10% of all laws passed by Congress this year, including three significant measures: the Homebuyers Privacy Protection Act, the VA Home Loan Program Reform Act and a broad tax-and-spending bill signed by President Donald Trump in July.

The privacy protection law bans “trigger leads,” a long-criticized practice that allows mortgage applicants’ data to be sold to competing lenders. Broeksmit reflected on the grueling process of working on the trigger leads bill for two years and getting it to pass in bipartisan measures. He officially bid adieu to trigger leads during his remarks.

The VA reform law, Broeksmit shared, averted a potential foreclosure crisis for tens of thousands of veterans after key loan relief programs expired. “We doubled down on our efforts when the VA Servicing Purchase program, or VASP, was canceled earlier this year,” he said.

Finally, the tax legislation made permanent the mortgage interest deduction, mortgage insurance premium deductions and the 20% pass-through deduction, among other provisions benefiting lenders and borrowers, Broeksmit added.

Beyond meeting with members of Congress including House Speaker Mike Johnson, Sen. Mark Warner and other top lawmakers, Broeksmit said the MBA has worked closely with the Trump administration to shape housing and financial regulation, specifically reducing FHA multifamily insurance premiums and pending reforms to the CFPB’s Loan Officer Compensation Rule.

He also pointed to ongoing efforts with the Federal Housing Finance Agency (FHFA) on credit score reform and reporting requirements, including advocacy to end mandatory tri-merge credit reports to lower costs for borrowers.

Looking ahead, Broeksmit said MBA is deeply involved in administration discussions over the future of Fannie Mae and Freddie Mac, pledging to ensure any government-sponsored enterprise reform keeps mortgage credit affordable.

Broeksmit closed his remarks by honoring outgoing MBA Chief Operating Officer Marcia Davies, who is retiring this year. He praised Davies for her three decades of service and for founding mPower, MBA’s network supporting women in the mortgage industry.

“This truly has been a year of historic achievement,” Broeksmit said. “But it’s also historic in another, and sadder, way,” he added, calling Davies’ leadership “courageous” and her impact “a movement.”