As COVID-19 froze the country’s economy for most of March and all of April, it became increasingly more difficult for borrowers to get a mortgage, even if they had the means to take one on.

In fact, a new report shows that in April, the availability of mortgage credit fell to its lowest level since December 2014. That means it hasn’t been this hard to get a mortgage for more than five years.

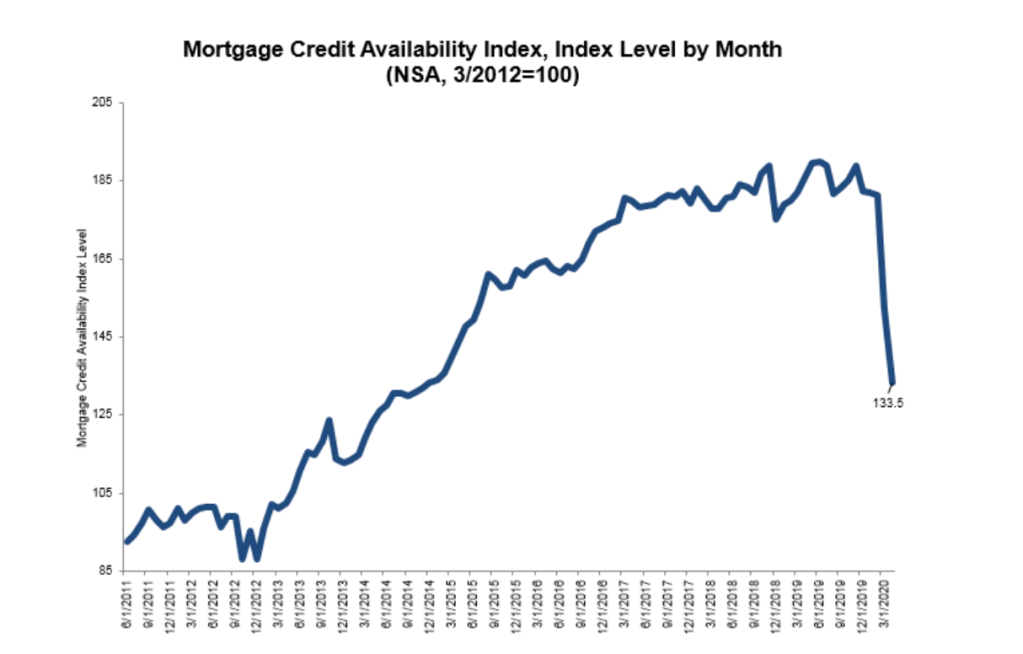

The data comes courtesy of the Mortgage Bankers Association, which reported Thursday that its Mortgage Credit Availability Index fell to 133.5 in April. A decline in the MCAI indicates that lending standards are tightening, meaning it is getting more difficult to get a mortgage.

According to the MBA, the MCAI fell by 12.2% in April, down from 152.1 in March. That figure was down 16.1% from February, showing just how much harder it’s gotten to get a mortgage since the coronavirus first began spreading in the U.S.

The MBA report showed that the decline in credit availability was seen across all segments of the mortgage business, although the decline was the most significant in jumbo loans. According to the MBA report, the jumbo MCAI fell by 22.6% in April, continuing a steep decline that began in March.

Conforming loans, which include loans sold to Fannie Mae and Freddie Mac, also saw a decline in availability, falling by 7.1%. Government loans, meaning those backed by the Federal Housing Administration, Department of Veterans Affairs, or Department of Agriculture also experienced a decline in availability, falling by 9.5%.

“The abrupt weakening of the economy and job market – and the uncertainty in the outlook – drove credit availability down in April for the second consecutive month,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting.

“The overall index fell to its lowest level since December 2014, and the sub-indexes pointed to tightened credit supply for all loan types,” Kan continued. “The decline was largely driven by lenders dropping many low credit score and high-LTV programs, as well as further reduction in jumbo and non-QM products.” [However, as HousingWire reported earlier today, there may be a slight thawing in non-QM lending.]

Kan also noted that there was a “large decline” in loan offerings for cash-out refinances, “given the GSEs’ constraints in purchasing cash-outs that have fallen into forbearance.”