Institutional real estate investors — often mammoth operators with ties to Wall Street — gobbled up record amounts of inventory in almost every corner of the pandemic-induced fever dream that was the 2021 housing market, with one notable exception: distressed properties sold at foreclosure auction.

That these homebuying juggernauts now balk at buying in the market niche that a decade ago provided many of them with their entrée into real estate is somewhat ironic. But it also makes sense given that their large-scale acquisition strategies could buckle under the logistical pressure of performing major renovations on hundreds or thousands of homes simultaneously.

“The Blackstones and the Vinebrooks aren’t going to look at those properties,” said Terry Kerr, a Memphis-based real estate investor, referring to the often vacant and highly distressed properties available at foreclosure auction. “We’re taking a house and gutting it. All new components. … The hedge funds aren’t doing large improvements.”

It’s a different story in the non-distressed retail market, where the large institutional buyers are crowding out both owner-occupant buyers and local real estate investors, according to Kerr, who is president of locally based Mid South Home Buyers.

“Every time we go up against them, we lose,” he said. “It’s the hedge funds who have set the market. Private investors are just following them up.”

Bulk Buyer Bonanza

More than 2 million home sales in 2021 were to all-cash buyers, up 67% from the 1.2 million in 2020 to a new record high, according to an Auction.com analysis of public record data from ATTOM Data Solutions, which is available as far back as 2000.

Those 2 million all-cash sales accounted for 32% of all existing home sales during the year, the highest level since 2014, although still below the peak of 37% in 2012, when home prices finally bottomed out in the wake of the Great Recession. The share of cash sales continued to climb in the first two months of 2022, reaching an eight-year high of 36% in February.

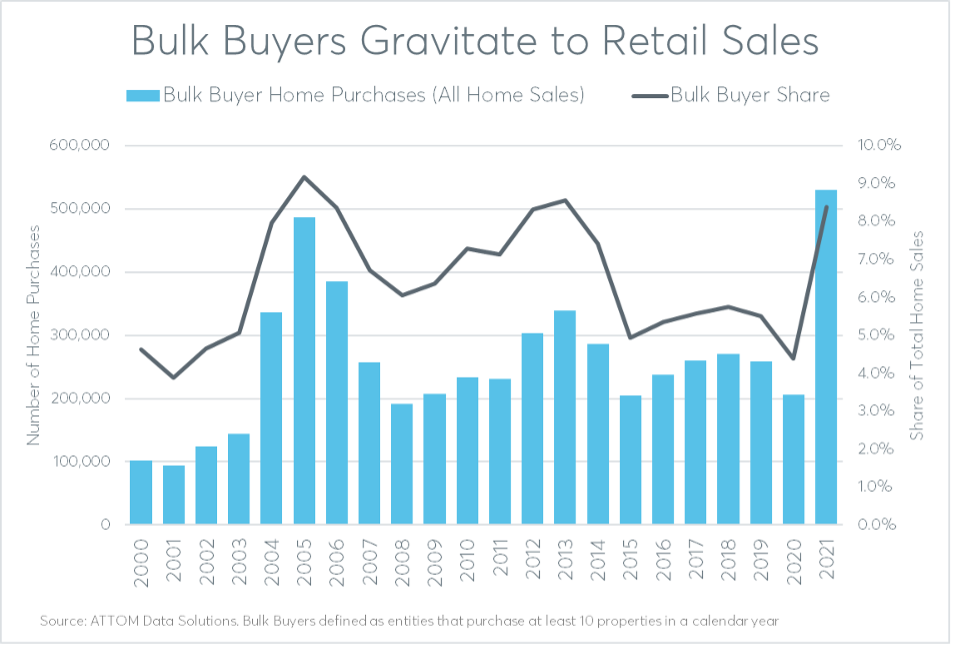

Some of these cash buyers are owner-occupants trying to compete with deep-pocketed institutional investors, but the seemingly insatiable appetite of the institutional investors becomes clearer when looking at the share of purchases going to bulk buyers, which ATTOM defines as entities purchasing at least 10 properties a year.

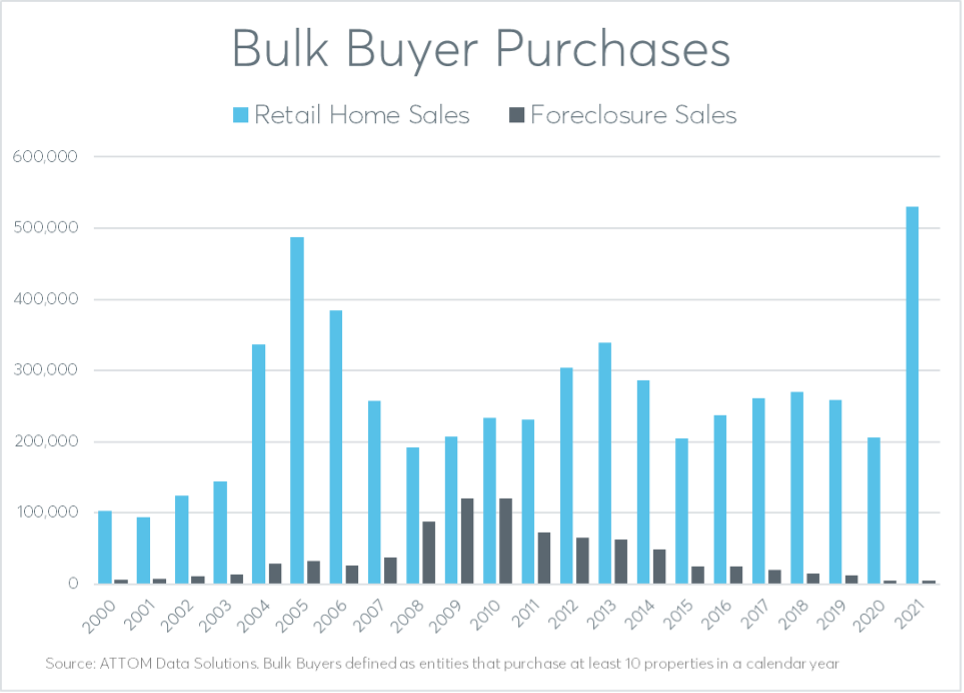

These bulk buyers purchased more than half a million homes in 2021 (530,025), also a new record high and more than twice the number purchased in 2020 (205,934) or in the pre-pandemic market of 2019 (258,780). The bulk buyer purchases accounted for 8.4% of all home sales in 2021, the highest share since 2013.

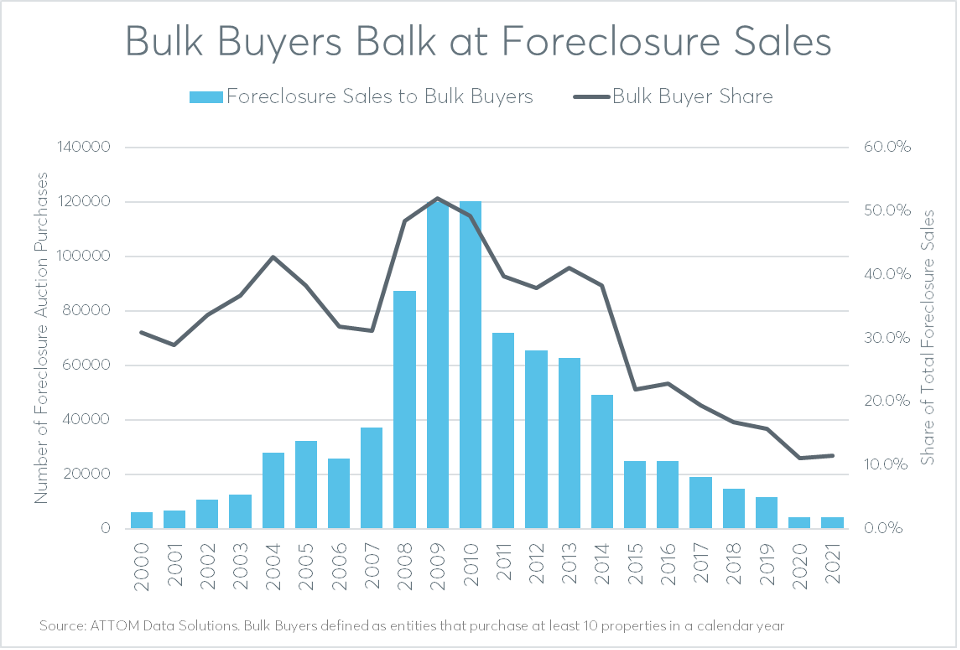

Fewer Foreclosure Purchases

In stark contrast, the number of bulk buyer purchases at foreclosure auction decreased to a new record low of 4,179 in 2021. More importantly, those bulk buyer purchases accounted for just 11.5% of all foreclosure auction sales during the year, up slightly from 11.1% in 2020 but lower than any year before 2020 and well below the peak of 52.0% in 2009. So far in 2022, only 5.4% of foreclosure auction sales were to bulk buyers while 5.6% of retail home sales were to bulk buyers.

Data from the Auction.com platform, which accounted for more than 40% of all foreclosure sales nationwide in the last two years, tells a similar story. Less than 1% of Auction.com buyers purchased more than 10 foreclosure auction properties through the platform during the last two years combined.

Most foreclosure auction buyers using the Auction.com platform were small-volume local buyers purchasing properties within driving distance from where they live. More than 99% of buyers purchased 10 or fewer foreclosure auction properties on the Auction.com platform in 2020 and 2021 combined. The median distance between foreclosure auction buyers and the properties they purchased was 14 miles in 2020 and 16 miles in 2021.

Renovating Right

These are buyers like Tony Tritt, who purchased seven homes on the Auction.com platform in 2020 and 2021 combined. All seven were in the Atlanta area where he lives, an average of 35 miles away. An experienced investor, Tritt has been buying through Auction.com since 2013, but he has never purchased more than seven foreclosure auction properties from the platform in a single year.

“I feel like we’ve played some small role in increasing values in the neighborhoods we’ve been operating in,” said Tritt, noting that he’s willing to take on the major renovations often needed with the highly distressed properties available at foreclosure auction — something that sets him apart from the institutional investors active in the Atlanta retail market. “The ones we pick up on the courthouse steps are the ones the institutional investors steer clear of.”

Tritt sells most of his properties to owner-occupant buyers, many of them first-time homebuyers. Selling a high-quality product to those buyers is a responsibility he takes seriously.

“Our role is not for us to get rich, but to do right. When I renovate a house, if I have to lose money on that house, I lose money, but I renovate it right because I have to sell it to somebody and I have to live with myself,” he said. “My name means everything to me. I see these people at the grocery store and at the ball game. I want them to come up and hug me.”