When prospective clients operate in highly regulated financial markets, enterprise sales don’t come easy. Blend co-founder and CEO Nima Ghamsari knows this perhaps better than anyone.

It wasn’t until 2014 – two years after his cloud banking platform launched – that Movement Mortgage took the leap and digitized its mortgage origination and underwriting process with Blend’s tech stack. It was the first major lender to do so, according to Ghamsari.

“The hard thing about working with banks is they not only need a product and a solution that’s better, they don’t want to be first movers, and they only want to go if there’s a catalyst,” Ghamsari reflected during a fireside chat with Plaid CEO Zach Perret last year. “I remember that 2012, 2013, 2014 were really tough years for us because the product is really good, it was early and there were no proof points, they didn’t want to be the first mover because if it didn’t work out the person who hired us was going to lose their job. And there was no catalyst.”

That catalyst ended up being Rocket Mortgage’s “Push button, get mortgage” campaign in 2015. Suddenly it clicked for bank executives, Ghamsari said. Rocket would eat their lunch if they didn’t shed the inefficient, paper-heavy model.

In the ensuing years, Blend brought on hundreds of clients, including Wells Fargo, First Republic Bank, Mr. Cooper and U.S. Bank. When the mortgage industry generated more than $8.5 trillion in origination volume in 2020 and 2021 and posted record profits, it was Blend’s digital technology that powered about a quarter of those mortgages.

Blend’s clients could originate a mortgage a week faster with Blend’s technology, and they saved hundreds of dollars per loan in operations costs. The platform seamlessly integrated with CoreLogic for credit scores, Plaid for bank account information, Google Maps for location data, as well as popular mortgage programs from Black Knight, ICE Mortgage Technology and others.

Ghamsari, a Stanford grad and former professional poker player who often said he liked to bet on himself, rang the opening bell on Wall Street on July 16, 2021. His company was valued at $4 billion even though it had never before turned a profit.

The IPO gave Blend $360 million, the money needed to grow market share, develop new products and dive deeper into new sectors within fintech — including consumer banking products.

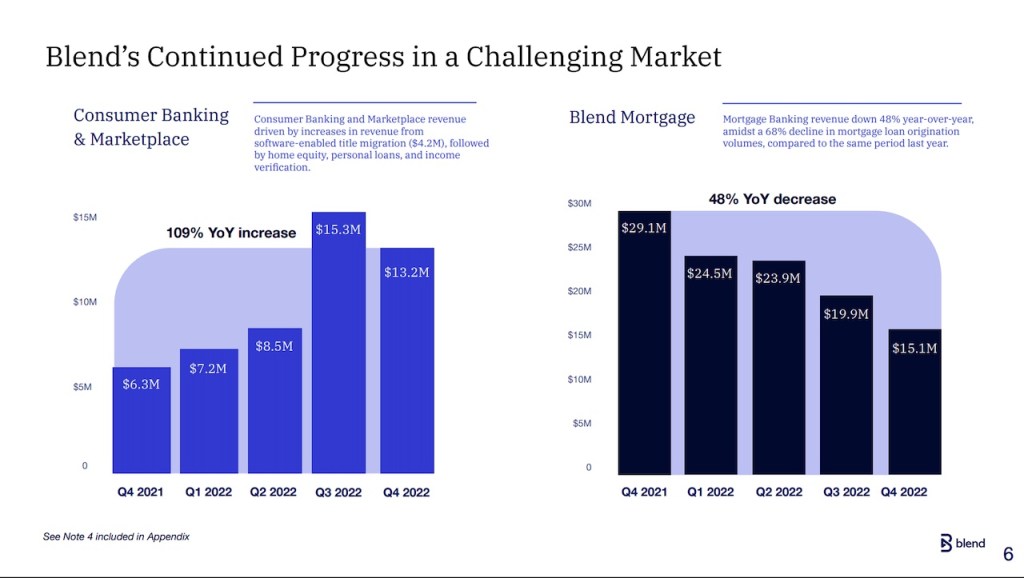

It was smart to diversify from a mortgage industry notorious for its boom-and-bust cyclicality. But nearly two years after going public, with its mortgage-heavy client base reeling from the Federal Reserve’s unprecedented series of interest rate hikes, Blend’s losses have ballooned to over $1 billion.

Ghamsari is now faced with a familiar problem: he needs to convince the marketplace that Blend’s latest evolution—to a platform-as-a-service company—will transform consumer banking, just as it did mortgage a few years ago. He’ll also have to do it before the money runs out: As of Monday, April 3, Blend’s stock is trading at 99 cents a share, its market cap has nosedived to $239 million, the company’s debt load is high relative to its worth, and the runway is shrinking.

Blend’s building blocks

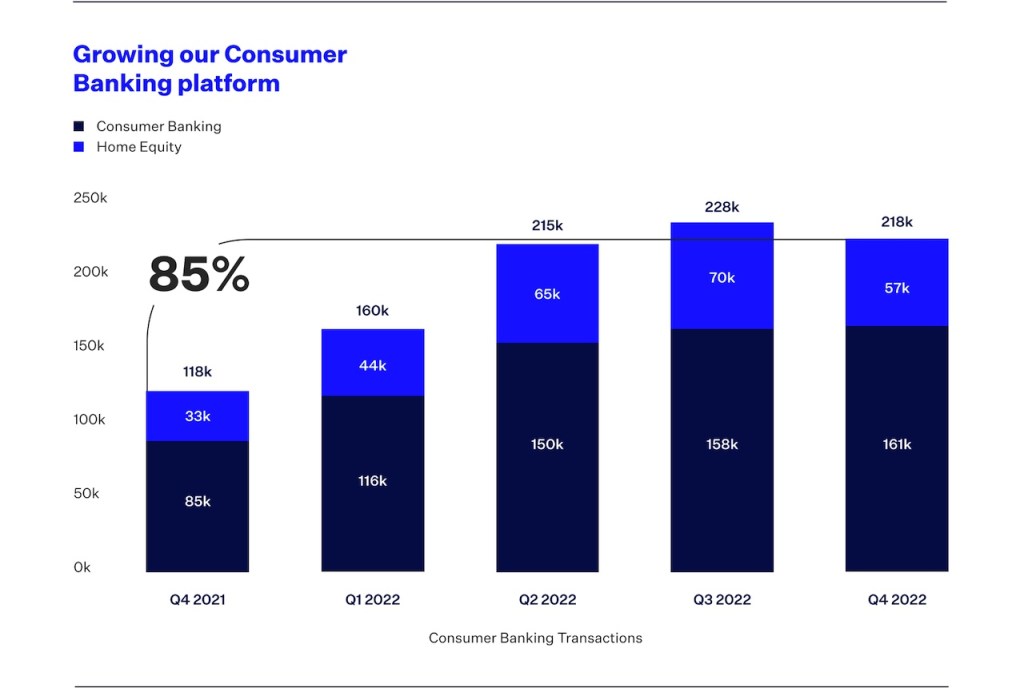

While Blend has been expanding into the consumer lending space since 2019, the majority of its revenue remains tied to the mortgage business.

And Blend’s goal to become a platform-as-a-service company is still in its early stages, analysts and industry observers said in an interview with HousingWire. The firm’s survivability, let alone profitability, will depend on rightsizing the business and accelerating its diversification, analysts and observers said.

In March, Blend launched what it called a “composable tech” platform, known internally as “Blend Builder.” Users can build their own origination products and leverage integrations with modular blocks. These blocks cover the entire end-to-end origination process, including pricing, income verification and closing, as well as an orchestration layer that allows lenders to create custom workflows in a low-code, drag-and-drop environment. Blend offers pre-built solutions, including instant home equity, deposit accounts and credit cards. These products are ready to use, with integration templates available that allow for quick deployment, executives noted.

We are establishing a path towards profitability, even if we do not see a significant macro improvement.

Amir Jafari, Blend’s head of Finance and Administration

“Mortgage loans remain an important segment for us. However, as we build out our Blend Builder Platform and migrate existing customers–or sign new ones–to our consumer banking suite, we will be building a countercyclical buffer for times like these, while expanding our overall total addressable market,” Amir Jafari, head of finance and administration, said in an emailed response to HousingWire.

“We are establishing a path towards profitability, even if we do not see a significant macro improvement,”Jafari said.

(The company did not make executives available for an interview with HousingWire.)

Blend’s evolution into a platform company will allow the firm to be more scalable over the long run, as opposed to being squarely focused on the mortgage category, according to Ryan Tomasello, managing director at Keefe, Bruyette & Woods (KBW).

“But it all comes down to execution,” Tomasello said. “The management’s focus on diversifying the company into other areas like consumer banking is intended to allow the company’s outlook to not be as tied to mortgage but the current mix of the business is still very indexed to mortgage volumes.”

“I think Blend is probably an acquisition target more than anything,” Tammy Richards, CEO of mortgage consulting firm Lendarch, said, noting that Blend suffered $796 million in losses in 2022. “I also think that no company can sustain those kinds of losses and be able to survive.”

The platform pivot

The firm’s pivot to the Blend Builder platform came as the mortgage lending environment really turned sour, a former employee told HousingWire.

“Blend was talking about a pivot to the Blend Builder platform in the summer. Starting [in] the fourth quarter—when the third round of layoffs happened—was when employees realized how much of a pivot was being made,” said the former employee, who requested anonymity.

By the time a fourth round of layoffs was announced in January 2023, a significant amount of resources had been reallocated to Blend Builder, the former employee explained.

The cumulative layoffs at Blend have resulted in major operational changes. Around the third or fourth quarter of 2022, mortgage lenders were reassigned to general portfolios instead of having dedicated representatives on the sales and account servicing team, the former employee said.

“As we announced earlier this year, we’ve allocated an increased portion of operating expenses into Blend Builder as part of our evolution into a platform company,” a Blend spokesperson said in response. “That and other initiatives supporting our path to profitability include various operational realignments, but through it, our commitment to providing our best possible service to our mortgage customers has not changed.”

The overall potential of the platform is huge, observers said.

Blend Builder is the kind of solution that the largest-sized banks are looking for right now — a balance between purchasing leading-edge third-party software combined with a software framework that is highly customizable, an essential attribute for larger banks, Joseph Vafi, an analyst at Canaccord Genuity, wrote in a research note.

“People are always wanting to improve their tech process and it just makes a simplified way of being able to do that,” Richards added.

For independent mortgage banks that don’t have big development teams to be able to build things to connect to Blend, the Builder platform will be especially helpful, Richards explained.

But whether Blend can become the go-to platform for mortgage and consumer banking in the next few years will depend heavily on the company cutting its financial losses.

Coming debts and a shrinking runway

Even if the Blend Builder Platform gets off to a hot start, the company has a slew of financial challenges to overcome.

For starters, its bread-and-butter mortgage customers on average are originating less than half the volume they did a year ago. That means less revenue for Blend, whose revenue model is tied to client volume.

More pressing is rising costs. Operating expenses in 2022 jumped to $835.8 million from $313.2 million in 2021, with $450 million related to the Title 365 acquisition from Mr. Cooper.

To compound that, Mr. Cooper can force Blend to buy its remaining 9.9% ownership interest with a put option, which was valued in December 2022 at $53.2 million.

Blend also has a $225 million term loan that comes due in 2025.

I think Blend is probably an acquisition target more than anything. I also think that no company can sustain those kinds of losses and be able to survive.

Tammy Richards, Head of Mortgage Consultancy Lendarch

While the company has cash, cash equivalents and marketable securities totaling $354.1 million, Blend incurred an operating cash burn of $190.42 million in 2022. (Cash burn for the fourth quarter came down to about $47.3 million.)

“So when you think about the runway, that implies, just based on the fourth quarter loss, that implies, less than two years of runway. That’s if it’s implicitly solely this quarter, and not giving the company credit for losses that should narrow through this year, as they see the benefit of certain cost structure actions that they’ve taken,” Tomasello noted.

While Blend touted new business relationships in its Builder platform with clients including Credit One Bank and Compeer Financial in the fourth quarter, Blend doesn’t expect to post a profit in the first quarter of 2023. It has projected non-GAAP losses of between $37 million and $39 million.

“Continued mortgage and overall lending market volatility impacts our visibility into the revenue recovery. However, we set our longer term path to profitability with an extended downturn in line,” Jafari said.

What’s next for Blend?

As of the first quarter, Blend will re-segment revenues into its consumer suite and the rest of the business in the mortgage sector, which will provide a better sense of how Blend is progressing into a platform company, Tomasello said.

Blend will include all of its consumer banking products — such as deposits, home equity, credit cards, personal loans, and platform subscription access — in a single consumer suite lineup.

For its mortgage business, the firm will consolidate revenues from its marketplaces and add-on products, like income and close, into a single mortgage suite lineup, which reflects its focus on expanding relationships with mortgage customers.

“It’s actually difficult to parse through how successful they are in their consumer banking expansion based on how they currently present their financials and segment their revenues (…) It (consumer banking and marketplace) does include things like e-close solutions on the mortgage side or income verification and also their software and title business,” Tomasello noted.

Blend began charging a recurring platform fee in addition to the existing “success-based” transaction fee in the fourth quarter that will generate regular recurring revenue for all consumer banking deals.

Blend expects to return to sequential growth in the first quarter and each subsequent quarter in 2023.

“Our priority this year is to better serve our customers’ needs as they change, by expanding and deepening our relationships with them through flexible products that best meet their needs at any given point in time,” Jafari told HousingWire.

Jafari noted that growing the mortgage banking business and increasing the user base for Blend Builder are not mutually exclusive and can both be achieved if Blend continues to build the best products on the market.

Of course, the best product doesn’t always win. Time and capital come into play.

“I think they’re at the beginning of their journey,” Richards said. “A lot of companies are trying to be like an Amazon for mortgage banking so that a customer has a one-stop shop for home buying or home selling experience…They’re going to have to be smart with their investments into the tech stack looking to the future to make sure they’re meeting future needs because the industry is really looking for efficiencies and cost savings.”