The great promise of short sales and other distressed pre-foreclosure sales as a foreclosure alternative is most fully realized in a competitive and transparent online auction marketplace, according to recent data from the Auction.com Market Validation Program (MVP) for pre-foreclosure sales. Auctions efficiently ensure the highest and best offer — good for the distressed homeowner, surrounding neighborhood and the mortgage servicer.

Before diving into the recent MVP data, it’s important to look at the historical backdrop of short sales and other pre-foreclosure sales.

Pre-foreclosure sales have long held great promise as an alternative to foreclosure. Pre-foreclosure sales can provide distressed homeowners with a graceful exit that allows them to avoid foreclosure — and avoid the eviction and damaged credit that comes with a foreclosure.

Pre-foreclosure sales as a foreclosure alternative also benefit neighborhoods by limiting the volume of vacant properties, which drag down surrounding home values.

Falling Short

Unfortunately, the reality of pre-foreclosure sales fell well short (no pun intended) of their promise during the wave of housing distress that emerged in the wake of the 2008 recession. Much of the focus in the aftermath of that crisis was, understandably, on loan modifications. Those loan modifications attempted to right-size mortgage payments to help keep distressed borrowers in homes.

When some of those modified mortgages fell back into default — more than 45% in the government-backed Making Home Affordable (MHA) program did so — short sales then became a backburner foreclosure alternative for many distressed homeowners.

This becomes quite evident in data from the MHA program performance results. More than 1.7 million permanent modifications were started through the program, according to a Q4 2017 report from the U.S. Treasury. By comparison, 406,652 short sales were completed through the program, which ran from 2009 to 2016.

More than 45% of the 1.7 million MHA modifications have fallen back into seriously delinquent status (90 days or more delinquent), according to a Q3 2020 MHA report. That leaves close to 800,000 delinquent loans where a short sale (or a pre-foreclosure equity sale if the property has since recovered equity) could help the homeowner avoid foreclosure.

Opportunity Lost

The massive opportunity of pre-foreclosure sales as a foreclosure alternative becomes even more evident when looking through the lens of all completed foreclosures over the last decade. An Auction.com analysis of public record data from ATTOM Data Solutions along with proprietary data from its own foreclosure auction platform estimates that 6.8 million properties foreclosed on between 2009 and 2019 could potentially have qualified for a short sale from a home equity perspective.

The 6.8 million are those properties that fell short of having at least 20% equity at the foreclosure auction, meaning the homeowner and servicer could have opted to list the property as a short sale prior to the foreclosure auction.

The 6.8 million represents 98% of the total 6.9 million properties that completed the foreclosure process — either through a sale to a third-party buyer or return to the foreclosing lender at foreclosure auction — during the 2009 to 2019 period. The remaining 2% also could have potentially avoided foreclosure through a pre-foreclosure equity sale, an even more favorable foreclosure alternative that allows the homeowner to walk away with some of the sale proceeds along with the graceful exit.

Pre-Foreclosure Potential

There are good reasons many potential short sales ended up as completed foreclosures in the last decade. Short sales are complex transactions involving tough compromise and hard-won approvals from several parties, not the least of which are a homeowner whose first choice is likely not to sell, and one or more lenders losing money on the sale.

But while short sales are difficult and less-than-ideal for both the borrower and the lender (or lenders) involved, the alternative — foreclosure — is much worse for those same parties. As mentioned earlier, foreclosure means that distressed borrowers lose the home through a forced sale over which they have no control and then are compelled to leave the house immediately or face harrowing eviction proceedings.

That’s why it’s important to put short sales and other pre-foreclosure sales on the front burner of foreclosure prevention strategy as the mortgage servicing industry works through the millions of mortgages that are delinquent and in forbearance as a result of the 2020 recession.

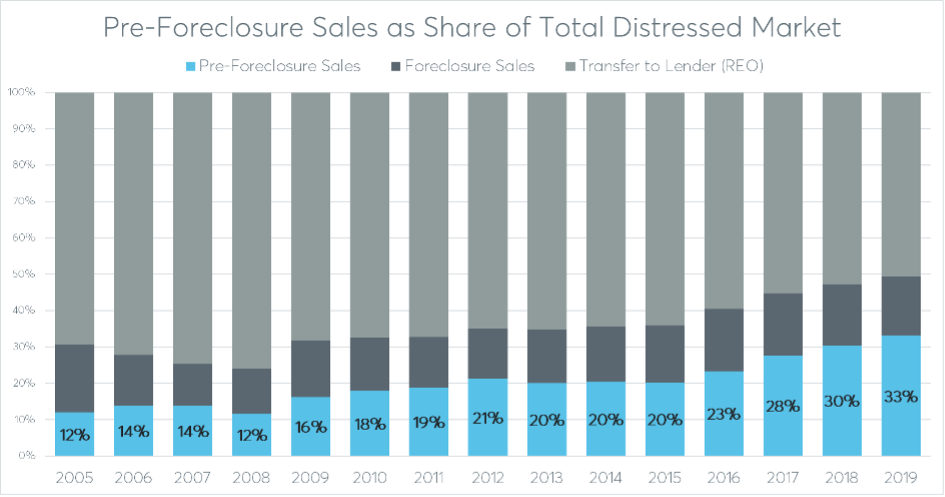

The mortgage servicing industry has come a long way in the last decade when it comes to pre-foreclosure sale adoption, but there is still a long way to go. Pre-foreclosure sales represented one-third of all distressed sales in 2019, up from less than 15% in 2008. That progress is admirable, but there is still a huge upside opportunity to avoid many more foreclosures with a pre-foreclosure sale.

Market Validation

Auction.com has extensive experience with pre-foreclosure sale auctions, pioneering the concept in 2013 and selling more than 4,000 properties via pre-foreclosure sale auction over the last decade. Its Market Validation Program leverages the power of the Auction.com platform and its more than 6 million distressed property buyers to validate — and usually beat — offers received in the traditional market.

Interest in MVP has been surging in recent months as mortgage servicers seek compassionate and responsible disposition alternatives for the growing number of distressed homeowners impacted by the pandemic. This program works to not only validate the market for an existing offer but also to pro-actively help distressed borrowers who haven’t yet listed the property to secure the highest and best offer while avoiding foreclosure.

Four key MVP metrics from August to December demonstrate how the transparent and competitive online marketplace of Auction.com is delivering on the promise of pre-foreclosure sales as a foreclosure alternative.

First, nearly 60% of properties brought to short sale auction on Auction.com received an offer that was above the highest offer received through the traditional short sale listing on the Multiple Listing Service, or MLS.

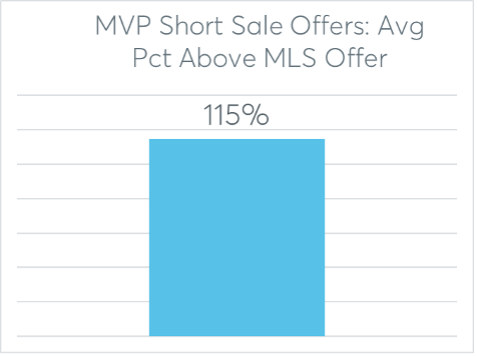

Second, those winning auction offers have been an average of 15% higher than the highest offer received through the MLS. In dollars that is an average of more than $28,000 higher. In some cases, the elevated auction offer was high enough to turn the short sale into an equity sale, an amazing outcome for the distressed homeowner.

Third, the auction environment not only attracted new buyers, it also motivated buyers already interested in the property to submit a higher offer. More than 75% of the winning auction offers came from brand-new buyers who had not submitted the highest offer on the MLS. The remainder of the winning auction offers — which exceeded the highest offer on the MLS — came from the same buyer who had submitted the highest offer on the MLS.

Lastly, the winning auction offers were received quickly — on average during the first auction run. That’s within just 14 days of first being marketed for auction and within just seven days of being available for bidding.

These four metrics clearly show how online auctions, when used in tandem with traditional sale methods, ensure equal opportunity for a broad spectrum of prospective buyers of short sales and other pre-foreclosure sales. This in turn ensures the highest and best offer for these homes — which is good for the distressed homeowner, the surrounding neighborhood and the mortgage servicer.