The modernization of mortgage originations in recent years has made customers expect a smart, push-button experience. Now it’s finally time to deliver this experience in servicing, and the timing has never been more urgent.

The CARES Act policy response to pandemic lockdowns a year ago allowed 12 months of forbearances for millions of homeowners. And while the new Biden Administration policy extended forbearances to 18 months, we still have 2.6 million mortgages in long-term forbearance.

How many of these will default when policy relief expires? How do servicers prepare? And what do regulators expect from servicing now vs. the last crisis? Let’s break it down.

The Latest Housing Policy Updates

The newly passed $1.9 trillion stimulus bill will get cash to Americans in need, aid struggling businesses and jumpstart a post-pandemic economy. And this is just weeks after the Biden Administration updated forbearance and foreclosure relief, including:

- Six more months of forbearance available in two increments of three months, each through June 30

- Foreclosure moratorium extended through June 30

- New forbearance requests allowed through June 30

This — coupled with job market improvements and vaccine acceleration — could point to better months ahead.

This will certainly reduce forbearance-to-default progression, but servicers must still be ready for any eventuality.

Interpreting The Latest Forbearance Data

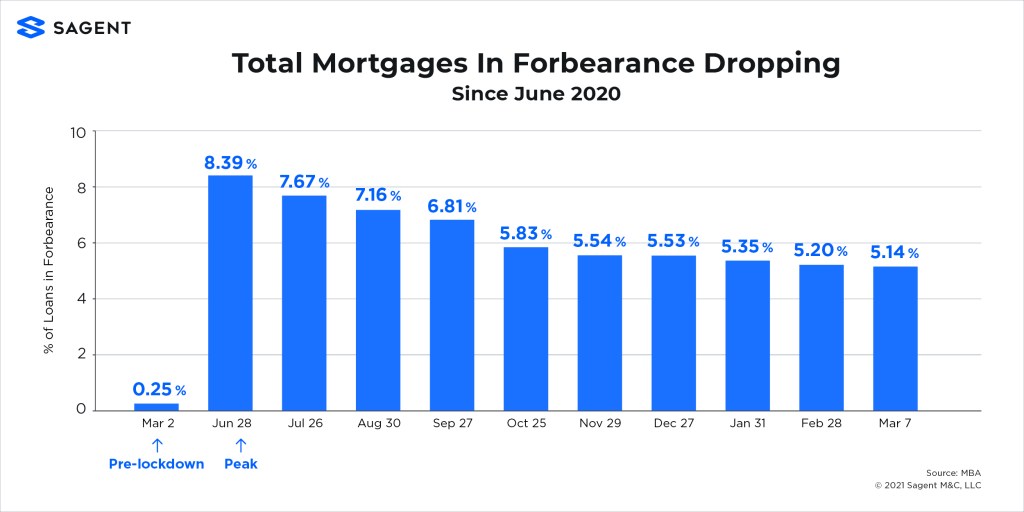

The latest forbearance data shows a steady, albeit minimal, decrease in total forbearance volume (see Figure 1).

Forbearances continue to fall, but at the same tepid pace, we have seen in recent weeks. Yes, people are exiting, but the rate is slow.

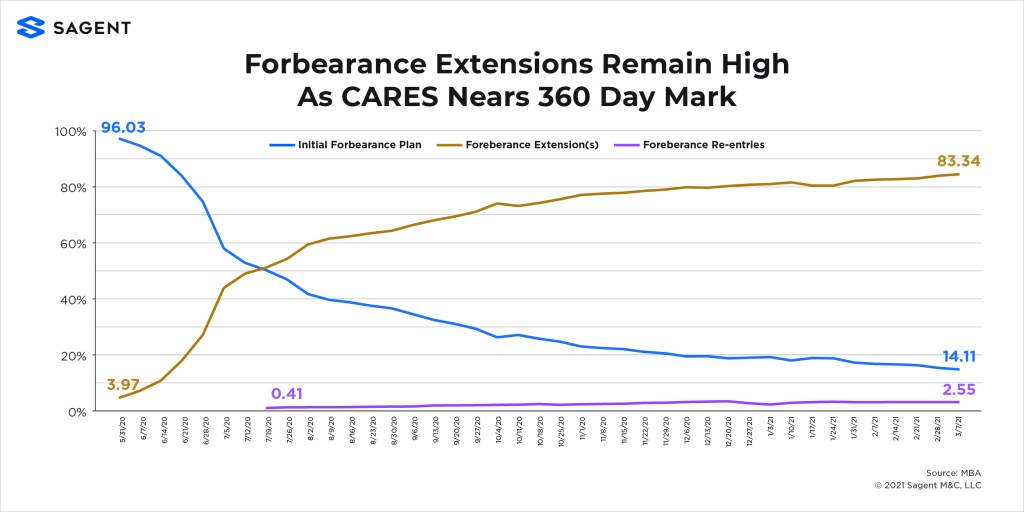

Meanwhile, 83% of borrowers in forbearance have extended their forbearances (see Figure 2).

Forbearance re-entries have not been the problem some initially feared it would be. While some borrowers are re-entering, the rate is low.

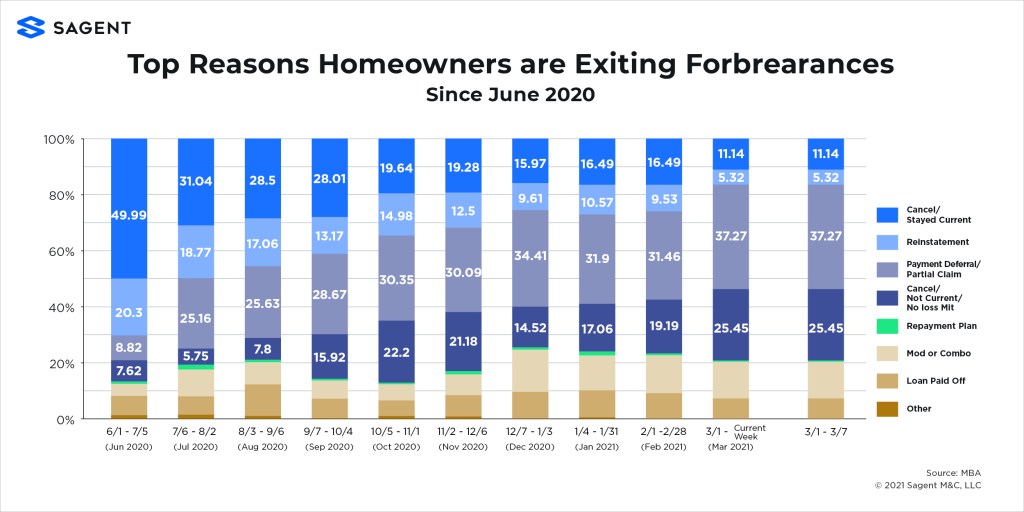

Borrowers are exiting via deferral and modifications (see Figure 3), handled, of course, by smart technology solutions.

Borrowers exiting forbearance without a plan in place (e.g. borrowers who are ‘ghosting’ their servicers) remains a problem.

How Homeowner Hardship Care Works in the COVID Era

COVID has created acute borrower needs in a K-shaped economic recovery where the “haves” thrive and want to capture low (but volatile) rate and home equity opportunities, and the “have nots” struggle and seek compassionate care to help them stay in their homes.

Both client scenarios require speed, clarity, and simplicity for borrowers — while demanding precision and seamless compliance with real-time regulatory changes for servicers.

Here’s how servicers powered by Sagent have cared for borrowers during this time.

As mid-March 2020 COVID lockdowns escalated to 4.3 million forbearances for American homeowners by mid-June, Sagent’s LoanServ was the first scale system of record servicers could tag and track loans with a COVID-specific forbearance designation. This enabled immediate, transparent self-serve forbearances for consumers. And it meant flawless accounting, full loan lifecycle clarity and real-time visibility for lenders and their investors and regulators.

As CARES homeowner relief policies went live and permeated agency and non-agency guidelines during this 2Q20 pandemic spike, Sagent powered seamless real-time lender compliance with the maze of new regs — including CARES-enabled forbearance extensions and Fannie Mae, Freddie Mac and Ginnie Mae interpretations of CARES payment deferral policies.

And while most lender servicing systems scrambled to code pandemic methodology into their ancient infrastructure, Sagent was powering fast homeowner hardship self-serve and real-time configurability to ensure servicer compliance with real-time policy changes.

How? Because Sagent’s modern platform lets lenders simply configure (rather than re-code) for real-time compliance changes.

As forbearances mature in 2021, Sagent’s TEMPO (default management) and CARE (customer care and retention) systems deliver real-time, fully compliant loss mitigation decisioning for lenders, and clear, compassionate presentation and implementation of options to strained homeowners.

What Regulators Expect From Servicers Right Now

We’re a year into the pandemic, and while smart policy has delayed a default wave, the threat still looms large. Servicers must be powered by nimble technology to be heroes to borrowers, stalwarts to investors, and stewards of consumer protection to regulators.

This last point is absolutely critical, as the CFPB has signaled they’ll be watching servicers extremely close as this plays out. We all know technology shortcomings in the post-2008 years led to weak servicer practices.

Not this time.

In this cycle, smart technology can finally power a modern consumer loss mitigation lifecycle with agency/non-agency decisioning and digital management of every detail for borrowers, investors, vendors, and regulators throughout all default phases.

It’s taken time to modernize servicing because it’s the last, most complex frontier of consumer finance.

But our industry is ready now. This is our opportunity to show consumers and regulators that servicing is where lifetime customer care is managed and grown. And Sagent fully understands the gravity of this responsibility.