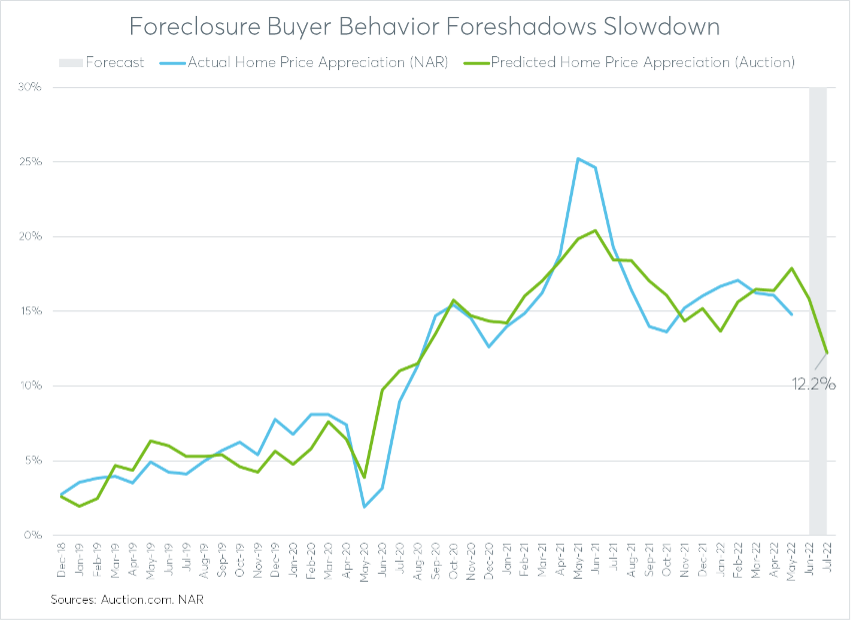

Retail housing market data from June showing early signs of a real estate slowdown was foreshadowed three months earlier in buyer behavior at foreclosure auctions.

The retail housing market data, released by Redfin at the end of June, shows the median asking price for newly listed homes for sale in the four weeks ending June 26 dropped 1.5% from an all-time high in the previous month even while a record share of all homes for sale saw price drops.

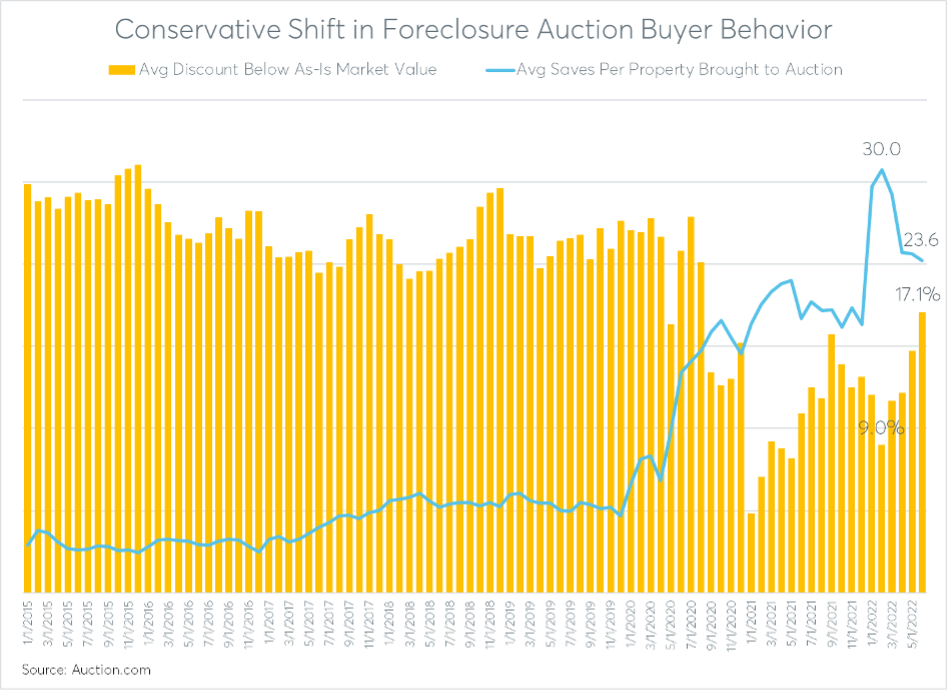

This data shows early signs of a slowdown in the retail housing market in June that was anticipated by real estate investors buying properties at foreclosure auction in March. After purchasing properties at an average discount of 9% below estimated “as-is” market value in February — a 13-month low — investors built in a bigger discount cushion of 12% in March, according to proprietary data from Auction.com. The as-is market value is typically based on a drive-by broker price opinion or external-only appraisal given the properties are usually still occupied.

The average number of online saves per property brought to foreclosure auction in March also pulled back from an all-time high in February. The online saves indicate how many potential buyers are interested in bidding on properties available for auction, providing a reliable measurement of real estate investor demand for those properties.

More Conservative Offers & Buy Box

These two key foreclosure auction metrics show a clear shift in March toward more conservative bidding behavior, both in terms of max offers and buy box for investors. Both trends have continued since, through at least June (more on that later). This shift in foreclosure auction buyer behavior was likely the result of rising mortgage rates, which increased above the 4% threshold in March and have since risen well above 5%, approaching 6%.

The downshift in buyer behavior at the foreclosure auction came two months before the downshift showed up in retail housing market data. That’s because buyers at foreclosure auction are on the frontlines of the local housing markets where they operate, often the first to identify and react to coming market changes. Behavioral buyer data from the foreclosure auction, therefore, acts as an early warning system for imminent market shifts.

“We’re transitioning from a super red-hot market, and it’s cooling off a bit, mostly interest-rate driven,” said Paul Lizell, a Florida-based real estate investor who buys distressed properties at auction in several states and coaches other real estate investors to do the same. “We’re telling them to back off of some of the higher-end properties and stay under the $350,000 (price point based on after-repair value). That’s a safer range.”

Rising mortgage rates were the catalyst for a market slowdown that many investors believed would be coming at some point given a decade-long housing boom capped by the pandemic-triggered buying frenzy of the last two years. More than half of Auction.com buyers (55%) described their market as “overvalued with a correction possible” according to a March 2022 buyer survey. That was up from 40% a year ago.

Lizell said he’s building an extra 10% haircut into his calculations for “maximum allowable offer” at auction. The extra margin will give him and his students a cushion in case of a retail market correction, which would impact the price at which they’re able to sell renovated homes to owner-occupant buyers.

“Up through May our sale price (on the properties we sell post-renovation) was still going up. I think we’ll see the end of that. Next month you’ll see a plateau. If rates continue to go up that’s where you’ll see that 10% shift,” said Lizell, who has been investing since 2001 and noted that a correction is already taking place in non-real estate markets. “If you look at equity markets, real estate is the last man standing.”

From Real Estate’s Frontlines

On the frontlines of the housing market, investors like Lizell are often the first to know about and react to shifts in the real estate market. They’re constantly monitoring the market, using their own proprietary data as well as external data to help them adjust ahead of market shifts that could impact their bottom lines.

“I get big into the macroeconomic stuff to keep ahead of the curve as much as possible,” Lizell said, noting he learned the importance of staying ahead of market shifts in the wake of the 2008 recession. “I went through that crisis, and it was a bad one, and it hit quick. … (You’ve) got to be nimble in this market. Super important, otherwise we’ll be out of business.”

Atlanta-area Auction.com buyer Tony Tritt also survived the housing crash following the 2008 recession. Like Lizell, he isn’t expecting a housing market correction anywhere close to the scale of that event in the coming months or years, but he is starting to see signs of a changing market.

“It’s a cyclical industry. We might see some pain again. A slowdown in price appreciation does not make a crash,” said Tritt, who said he renovates and resells between 35 and 50 properties a year, mostly reselling to owner-occupants. “I view our houses like a 180-day business cycle. When I acquire a property, I look out six months from now. That six-month cycle causes me a little more anxiety in 2022 than it did in 2019.

“I’m not concerned, I just give more pause,” he added. “We are still undersupplied.”

Foreshadowing a Continued Slowdown

What is the latest foreclosure auction behavior from forward-looking buyers like Tritt and Lizell predicting about the retail housing market in the second half of 2022 and into 2023?

Investors have continued to increase their average discount cushion below estimated “as-is” property value. That discount rose to a 22-month high of 17.1% in June, the highest since August 2020 although still below the average of 21% in the pre-pandemic market of 2019.

Demand in the form of saves per property brought to auction has also continued to recede in each month since March, falling to a six-month low of 23.6 saves per property in June. That’s still strong demand by historical standards, a function in part of the low inventory of properties available at foreclosure auction.

The shrinking buy box and more conservative offers by real estate investors at foreclosure auction is starting to impact the sales rate — the percentage of properties brought to auction that end up sold to investors. That rate pulled back to a 23-month low in June, although also well above pre-pandemic levels.

Combined, these three metrics — sales rate, saves and average discount — are highly correlated to retail home price appreciation in the following month (0.94 correlation). That means auction data from June can provide a reliable early indicator of retail home price appreciation in July, as measured by the National Association of Realtors (NAR).

Since the NAR data is typically not released until around the 20th of the next month, this means the June auction data available on July 1 provides an early indicator of data not available until more than 45 days later, around August 20.

Using a regression analysis based on this correlation, May and June foreclosure auction buyer behavior indicates that home price appreciation will continue to slow in June and July, dropping to a 23-month low in July while remaining in double-digit territory. While far from a crash, or even correction, the trajectory of the last year — if it continues — would put home price appreciation on pace to fall to single digits in the second half of 2023.

This fits with the slowdown-not-crash scenario that both Tritt and Lizell say is likely. But both are also keeping powder dry for a more severe correction, particularly in some local markets.

“It’s more shifting to get cash quicker,” said Lizell. “So, if it does shift, we are more in the position to take advantage of falling prices.”