Owning a starter home is now $1,000+ per month more expensive than renting one. While the metric has decelerated from a $1,188 peak in October 2022, it remains far above historic levels, according to John Burns Research & Consulting.

Factors such as high mortgage rates — currently hovering around the 7% mark — and elevated resale prices continue to challenge for-sale housing affordability. This results in a higher-than-usual number of home renters staying in place as they can’t make the numbers work in such a challenging housing market.

The monthly premium to own versus rent in April hit $1,030 per month, compared to $884 per month at the time last year, a 15% increase, the housing research consultancy found.

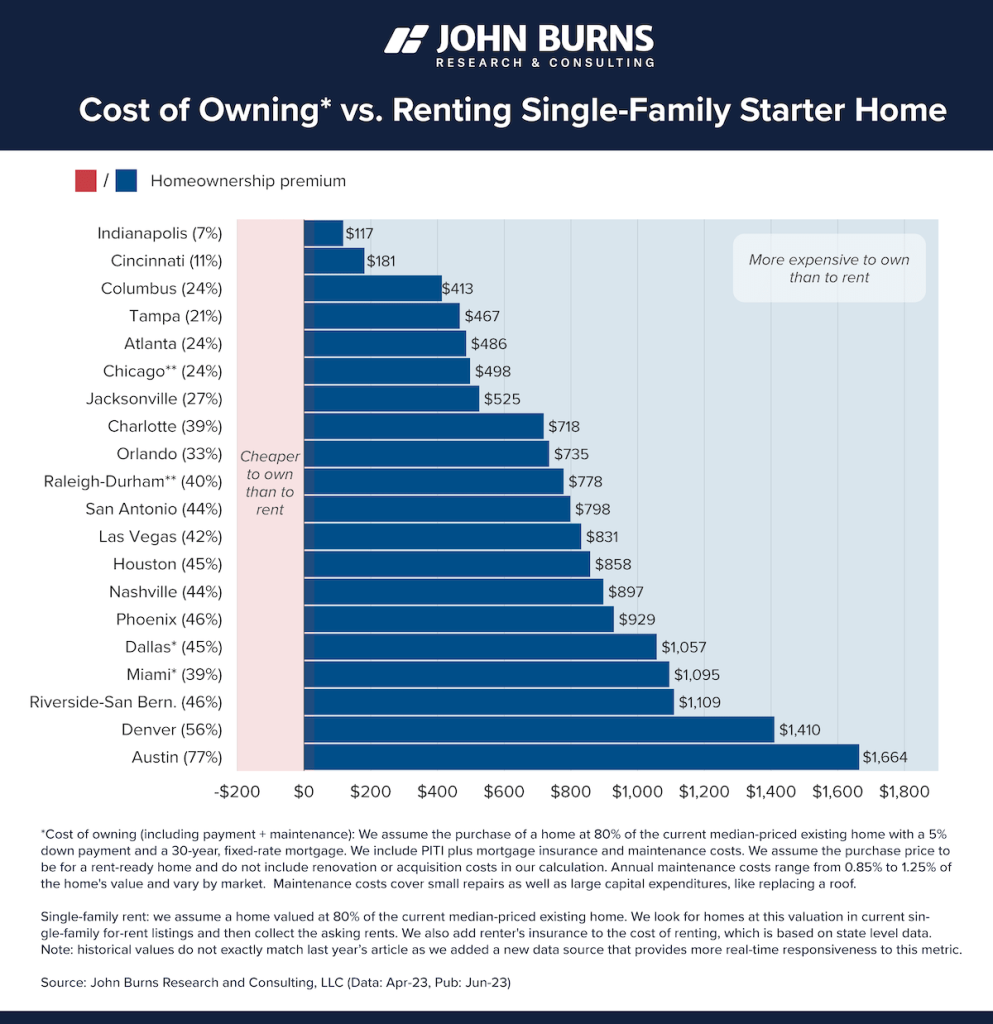

Premiums vary greatly by market, but the cheaper markets in the Midwest are more obtainable.

The homeownership premium is cheapest in Indianapolis (7% – $117), Cincinnati (11% – $181), Columbus (24% – $413), Tampa (21% – $467) and Atlanta (24% – $486). Meanwhile, the homeownership premium is highest in Austin (77% – $1,664), Denver (56% – $1,410), Riverside-San Bernardino (46% – $1,109), Miami (39% – $1,095) and Dallas (45% – $1,057), the research shows.

Interestingly, the homeownership premium is below the national average of $1,030 in 15 of the 20 most popular markets for single-family rental investment, according to JBREC. This can be explained by the fact that “homes in these markets can be purchased at prices where the rents achieve a good yield for the landlord,” the report says.

(Most single-family rental investors target the $300,000 to $500,000 range, and many have targeted the Southeast, Midwest and Southwest in recent years.)