The U.S. housing market has reached its least affordable point in decades and housing agencies have increasingly rolled out homebuyer assistance programs to tackle this issue.

A total of 135 new homebuyer assistance programs were introduced in 2023, a 6% increase over the previous year. This brought the nationwide tally up to 2,294, according to Down Payment Resource’s fourth-quarter Homeownership Program Index (HPI) report.

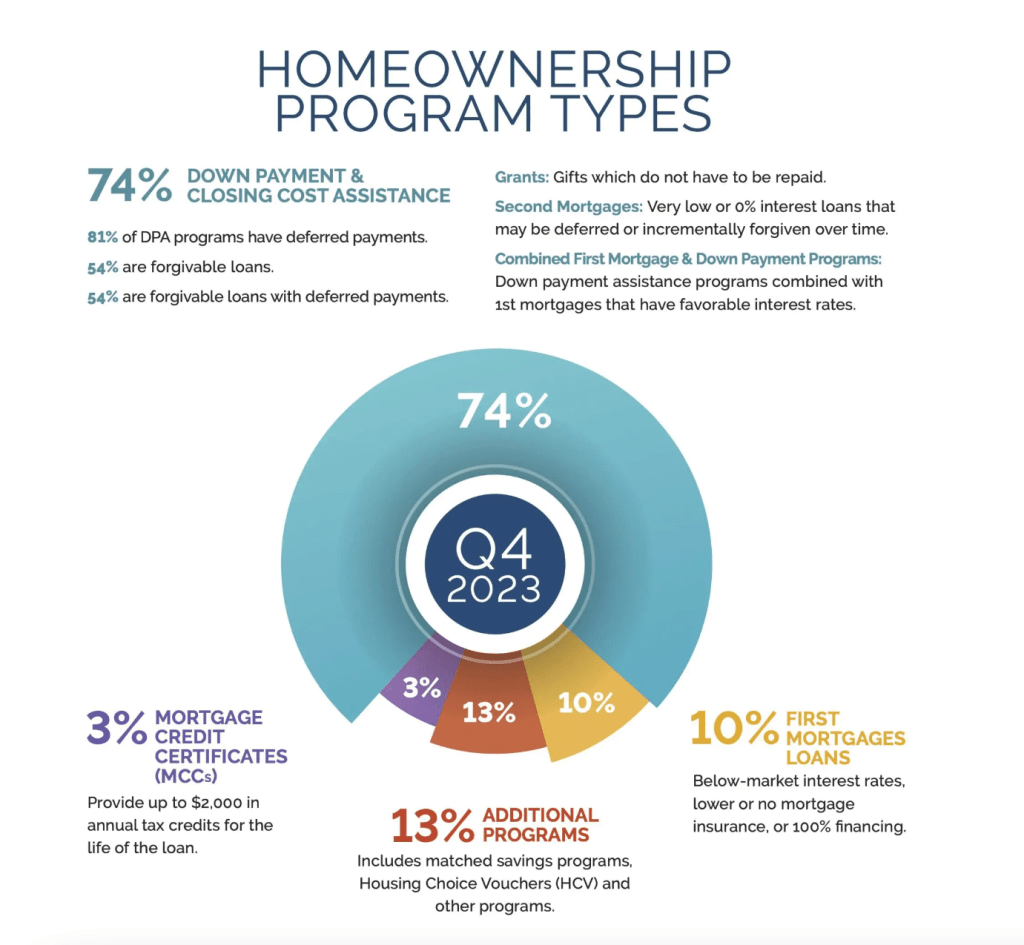

Of the homeownership program types, 74% consisted of down payment and closing cost assistance programs; 13% were additional programs including matched savings programs and Housing Choice Vouchers (HCVs); 10% were first-lien mortgages with below-market interest rates, lower or no mortgage insurance; and 3% came from mortgage credit certificates (MCCs) that provide up to $2,000 in annual tax credits for the life of the loan.

A growing number of nonbank mortgage lenders have recently rolled out down payment assistance (DPA) programs to increase their origination share in a challenging mortgage environment.

Most recently, loanDepot rolled out a new DPA program for Federal Housing Administration borrowers that enables them to put no money down upfront.

Other lenders that have introduced DPA programs or DPA-oriented programs of late include Rocket Mortgage, United Wholesale Mortgage, Guild Mortgage and Guaranteed Rate.

Among the nearly 2,300 homebuyer assistance programs available last year, 804 were designed to assist with the purchase of a manufactured home — up 20% from the previous year, according to the report.

“With a significant increase in programs for manufactured homes, multifamily properties, and specific buyer demographics like service members and Native Americans, this year’s report underscores a growing commitment to diversify housing solutions and empower a broader spectrum of aspiring homeowners,” said Rob Chrane, founder and CEO of Down Payment Resource.

Manufactured housing has a lower entry point than other types of homes and is helping many buyers to get their foot in the door, the report noted. Going forward, Down Payment Resource expects to see the number of programs that allow for manufactured housing to continue to grow.

Housing agencies are expanding program eligibility guidelines to include more property types. For example, some 686 programs are now available for the purchase of a multifamily property (defined as those with two to four units) — up 8% from the previous year.

Using DPA to purchase a multifamily property has become increasingly popular. This allows people to become homebuyers as well as investors, a more common strategy in recent years that is known as “house hacking,” the report stated.

In addition to completing a homebuyer education class, borrowers purchasing a multifamily home with homebuyer assistance typically have to go through classes on being a landlord to ensure long-term sustainability.