The new Home Mortgage Disclosure Act (HMDA) data report released late last week by the Consumer Financial Protection Bureau (CFPB) includes origination volume data for proprietary reverse mortgage products during the 2019 calendar year. This is according to the report itself and independent verification by sources with knowledge of private product originations.

The data offers a figure that is attributed to “niche non-HECM reverse mortgage products,” while also specifying that non-HECM originations in the same category increased by 58% between calendar year 2018 and 2019, respectively.

Additionally, lenders who offer proprietary products have responded to the publication of the data, saying that raw numbers from the data are not wholly representative of the proprietary market.

The data

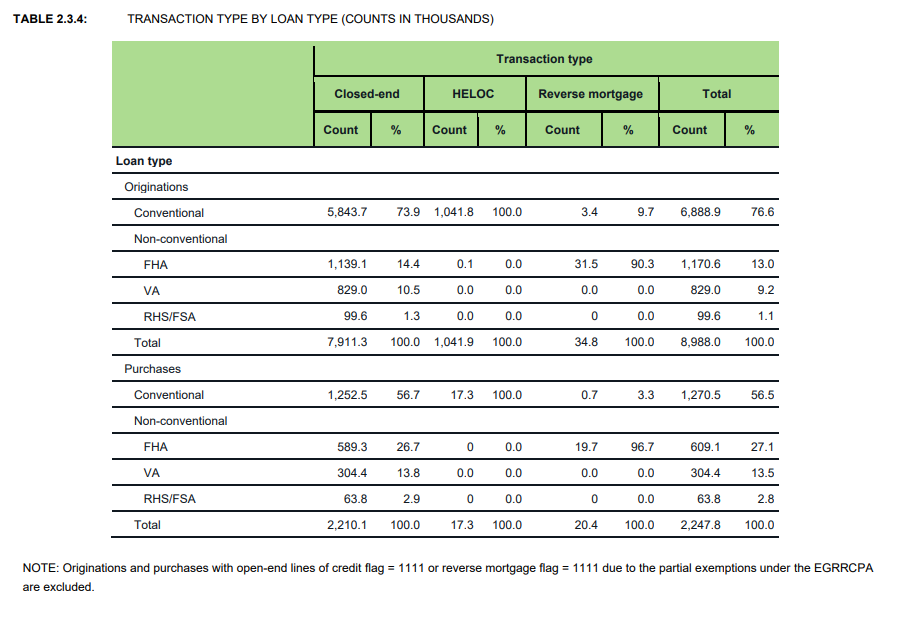

“An overwhelming majority of reverse mortgage originations (90.3%) and purchased loans (96.7%) reported their loan type as Federal Housing Administration (FHA) insured, because the Home Equity Conversion Mortgage (HECM) insured by FHA is the dominant product in the reverse mortgage market,” the relevant section of the report reads. “There are about 3,400 conventional reverse mortgage originations (up from about 2,000 in the 2018 data) and 676 conventional reverse mortgage purchased loans reported, representing the niche non-HECM reverse mortgage products.”

The word “conventional” as used in the data is in reference to loans which are not sponsored, offered or secured by a government entity. Data from the report detailing the calendar year origination of HECM loans previously placed the 2019 origination figure at 34,800, indicating that proprietary originations make up 9.7% of the total figure of HECM originations in calendar 2019, based on the HMDA data.

Proprietary reverse mortgage products have largely been perceived by industry stakeholders as a potential pathway toward future reverse mortgage industry prosperity, particularly in light of the reduced volume that followed the influential product changes that were handed down by the federal government which went into effect in October of 2017.

Over the past few years, many of the major lenders have become involved in the proprietary marketplace, adding loan products that feature lending limits which are much higher than the limits governing HECM products and which are typically geared toward more affluent borrowers with much higher home values.

Lender responses: context is king

The data on its own cannot of give a full picture of the state of the proprietary reverse mortgage market, but is still encouraging. This is according to Chris Mayer, CEO of Longbridge Financial, responding to the publicly-available origination figure as presented in the HMDA report.

“The HMDA data don’t give a perfect picture of the impact of proprietary reverse mortgages, but the data are promising,” Mayer tells RMD in an email. “Only about 10% of all homes had a value greater than the FHA limit in 2019 according to data from Zillow. Of course, there are also some condos where the borrower could not use a HECM, so the 10% is a bit of an underestimate, but these data suggest that proprietary reverse mortgages represent a meaningful share of the market.”

There are other factors at play that may give additional context to the raw origination figure of proprietary products making up less than 10% of the figure for HECM originations, including the ways in which the typically higher home values that the proprietary market typically serves interacts with the share of borrowing, he says.

“If you looked at average balances, almost surely proprietary reverse mortgages represent much larger than a 9.7% share of total borrowing, since most prop loans are on higher value homes,” Mayer says. “For reverse mortgages, it is impossible to determine the balance of the loan from HMDA data, because lenders typically report the size of the principal limit for HECMs, not the actual loan balance.”

Data on its own is incapable of giving as robust a perspective on the proprietary market as some of the other factors in play, adds David Peskin, President of RMF. In fact, the size of the market may indicate a larger presence for proprietary products.

“It’s really still at the early stage, but I think the growth [of the proprietary market] itself lets you have a good understanding of where we are,” Peskin told RMD founder John Yedinak in a panel during RMD’s HEQ event on Tuesday.

Making estimates based off of other relevant metrics paints a different picture of the share of the market that is reflected by proprietary product volume, Peskin shared.

“Unlike the HECM market, where the information is readily available, we can only go off of what we believe is estimated,” he said. “But, we think in 2020 the estimated volume is somewhere between $2-2.25 billion, which would be up from around $1-1.25 billion in 2019 and then up from around $500 million in 2018. So, in less than a few years, the industry is up four-fold in terms of proprietary products. That would put the market somewhere around 25% of overall reverse mortgages.”

This estimate of the market is sizable, especially considering that it’s been only a few years since multiple product providers have been active in the proprietary reverse mortgage space, Peskin said.

“When you think about the product itself, it really wasn’t initially meant, in my view, to replace the HECM,” Peskin explained. “It was really there to address the void where FHA falls short.”

Recent history

2018 saw a notable influx of newer proprietary reverse mortgage products including from RMF and One Reverse Mortgage, while that year also saw FAR roll out a ‘Flex’ version of its HomeSafe reverse mortgage. FAR also announced a partnership with American Advisors Group (AAG) in 2018 to offer HomeSafe products through AAG’s retail and correspondent channels under the name “AAG Advantage” for retail, and “AAG HomeSafe” for wholesale, and Longbridge announced its “Platinum” proprietary product late in the summer of 2018.

Liberty Reverse Mortgage introduced its ‘EquityIQ’ proprietary product last year, and other major lenders including RMF and Longbridge have been adding additional products to its respective “Equity Elite” and “Platinum” product lines. Earlier this year, Nationwide Equities announced the launch of its own proprietary offering, “EquityPower.”

Mass proliferation of proprietary products is currently restricted by the fact that only a handful of states can offer them, but lenders have been working to get their proprietary offerings approved and active across a wider number of territories. Lenders offering proprietary reverse mortgages have made strides in getting their products approved in new states, and have separately indicated that getting proprietary products approved in additional states remains a priority.

Read the CFPB HMDA report, and RMD’s original coverage about its other reverse mortgage-relevant contents.