A secondary school teacher in Colorado makes on average just under $63,000, according to the Bureau of Labor Statistics. If a Colorado teacher making the average salary had $20,000 to put towards a down payment and were willing to spend 30% of their pre-tax salary on their mortgage payment, she could afford a house that cost about $225,000.

That’s a problem when a typical Colorado home – as defined by Zillow‘s Home Value Index – costs more than $528,000.

When teachers can’t afford to buy homes, school districts can’t hire teachers. As a result, districts across the country, including in Colorado, have decided to partner with – or even become – homebuilders and landlords.

With forecasters not expecting home prices to crash anytime soon and essential jobs across the country needing to be filled, will this become a model for the future?

Housing teachers

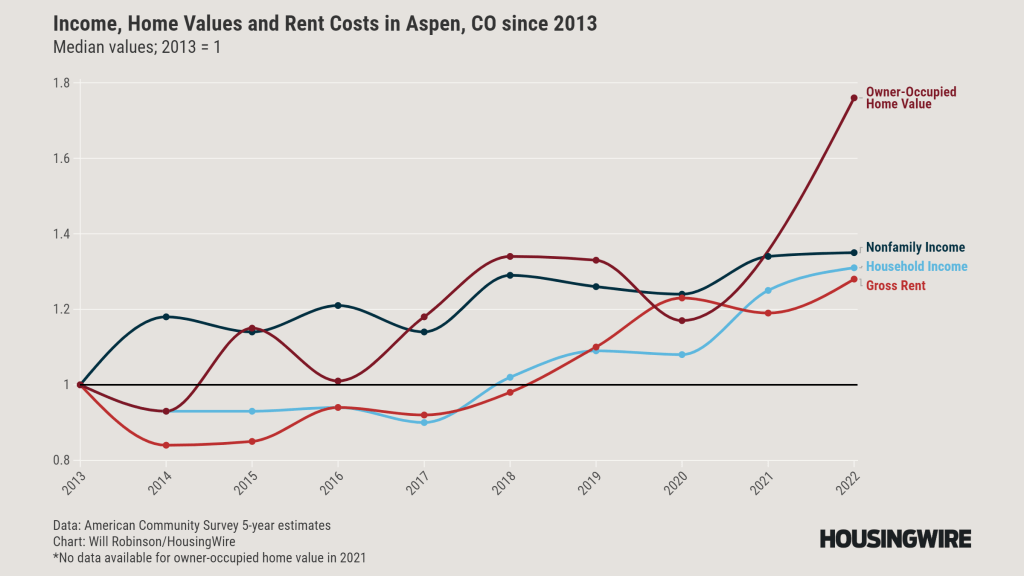

Aspen is famous for ski slopes and luxury housing. In 2022, the median home was worth about $843,000, and the median renter paid $1,738 per month, according to American Community Survey five-year estimates.

Like nearly every city in America, affordability worsened during the pandemic.

With housing generally unaffordable compared to its neighbors, Aspen has provided some housing for teachers for decades, but it doubled down on this effort in the last two years – spending $40.8 million over that period to acquire 52 units and renovate several of its 50 existing units.

All in, the district now has more than $50 million in housing assets, the bulk being apartments and condominiums, although it also has single-family homes. It has shown a willingness to absorb operational losses as a landlord, losing almost $2 million last year and almost $5 million since 2015.

For those teachers who get a unit – there is a wait list – the benefit is substantial. Last year, the average rent in a district-owned unit was about $900, roughly 15% of the district’s average teacher salary.

Other districts have adopted the same approach. In addition to other districts in Colorado, the idea has spread to Texas.

Pecos-Barstow-Toyah ISD in West Texas is spent $16.6 million in 2021 to add an apartment complex to its stock of housing units, trailer homes, duplexes and triplexes, and Pflugerville ISD, near Austin, will use proceeds from a $43.9 million bond to purchase property to construct affordable housing for teachers and staff.

And while Aspen and Austin are pricey housing markets, their need for housing that the general workforce can afford is universal. In fact, both markets have a lower percentage of renters who spend 35% or more of their household income on rent than the national average.

Housing workers

Cities across the country are seeing shortages of various essential jobs, not just teachers, and many of these jobholders face the same affordability dilemma teachers face. Unlike teachers, however, these roles do not have school district authorities with significant spending power to alleviate their housing burdens.

The Labor Market Institute identifies 473 job classifications as “critical occupations,” totaling more than 100 million workers or roughly 70% of U.S. workers. The Bureau of Labor Statistics highlights 10 that are essential for public health and safety.

Half the list of these essential workers make less than the average Aspen teacher’s salary, though of course not all contend with Aspen home prices. Nonetheless, with home values breaking records multiple times last year nationwide, it is hardly a stretch to imagine that many of these workers face an affordability crunch.

So who is solving housing affordability for these workers?

Homebuilders, for one, are building at a faster rate than pre-pandemic and offering buydowns and price decreases, but economists don’t expect this to lower home prices next year and expect new home sale prices to remain above existing home sale prices. Homebuilders also tend to build where it’s most cost-effective and faster, which means new construction tends to be concentrated in the Sun Belt.

Mortgage rates, too, ended 2023 on a downward move in response to expectations of federal funds rate cuts, giving a boost to buyers’ purchasing power. But there again, economists do not expect a material impact on prices next year.

Various federal, state and local housing agencies focus on providing affordable housing, and many have been helped in recent years by funds created by a slew of tech and healthcare companies, including Amazon, Apple, Facebook, Google, Microsoft, United Healthcare and others.

However, any pricing impact the billions spent by these agencies and companies may have had on affordability seems to have been outweighed by the pandemic-prompted surge in prices and mortgage rates.

With affordability slipping and home prices steady, school districts becoming landlords may just be the canary in the coal mine. Affordability will likely be a central focus throughout 2024 as local economies seek to attract and retain essential workers.

It’s about time. We pay teachers poorly to educate our children. Then they can’t afford to live in the cities where they work. We are great at capitalism but terrible at taking care of those really in need. And we throw away billions on subsidies for entities and industries that ask the most but don’t really need it.

American Exceptionalism!