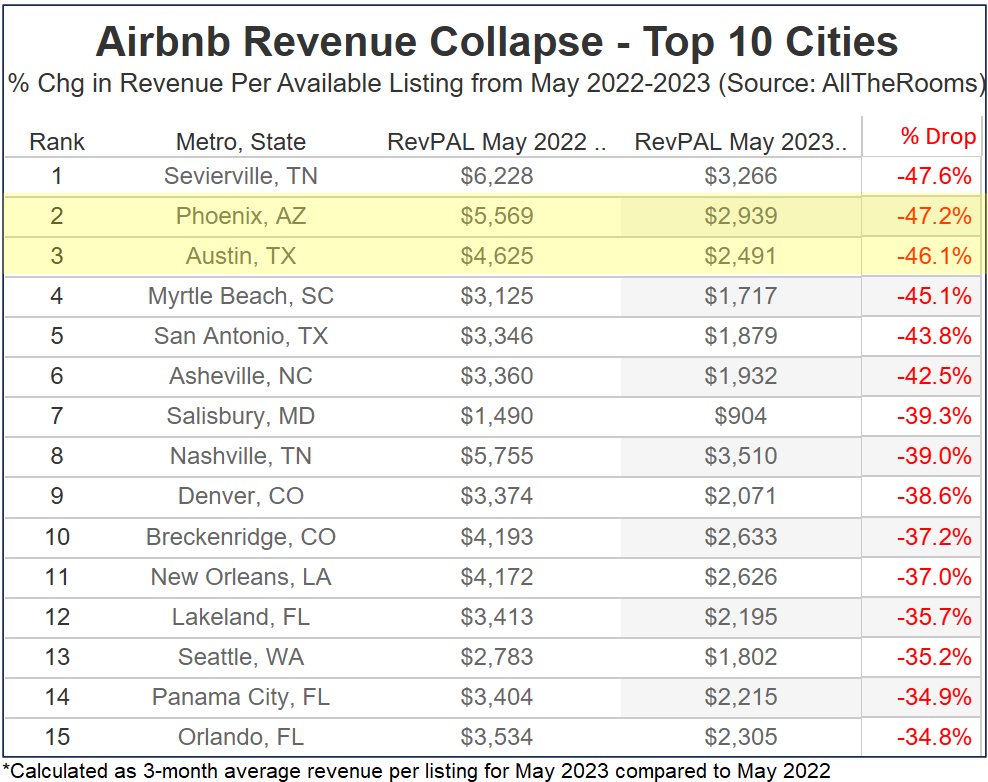

There was a viral tweet going around from YouTube housing influencer Nick Gerli. You’ve probably seen it. Gerli cites data from a company called AllTheRooms to make the case that the Airbnb/short-term rental market is “crashing” and it will have a big impact on inventory.

Indeed, the chart he shared is alarming.

A nearly 50% drop in revenue in some markets!

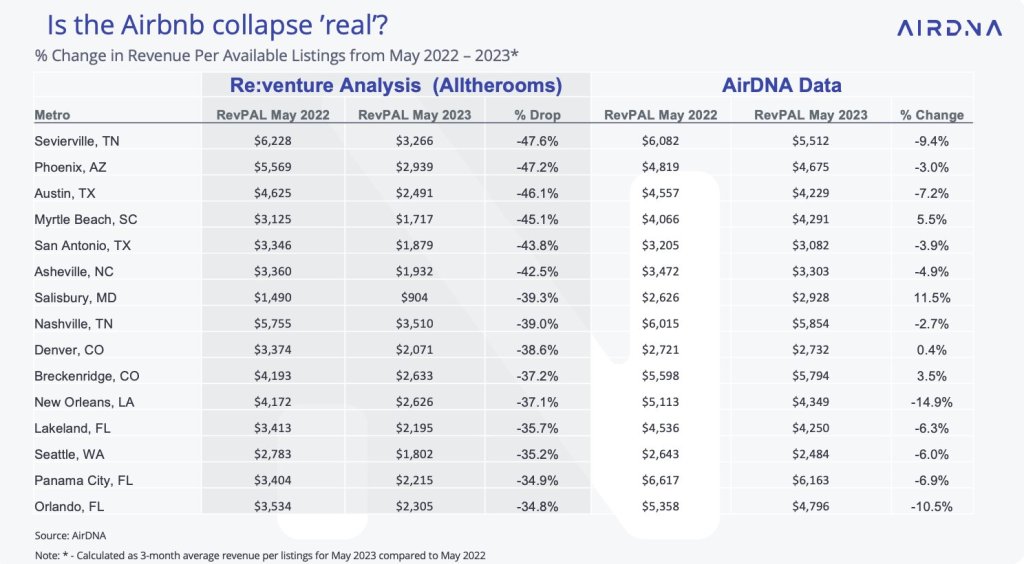

But the data looks dubious. I interviewed Jamie Lane, the chief economist and head of analytics at AirDNA. He looked at the AllTheRooms data and ran a mirror analysis with AirDNA’s data and, well, just look.

Revenue per listing is down, but it’s not down by a third or more in those markets, according to AirDNA.

AllTheRooms didn’t respond to my requests for comment, but Gerli, who runs Reventure Consulting, said he was aware of the discrepancies in the data and had reached out to Airbnb “to provide their own data for these cities so we can get the most accurate figures.” (Airbnb itself said in a statement that the data was “not consistent with its own” and added that “more guests are traveling on Airbnb than ever before.”)

Gerli, however, did offer high level thoughts on the situation. His outlook remains bearish.

“Both data sources agree that the Airbnb supply in America has surged over the last 2-3 years since the pandemic started, particularly in cities like Phoenix. In some markets there are now 2-3x more homes listed on Airbnb than for sale, a situation that has robbed the housing market for inventory,” Gerli wrote in an email. “However, now that the Airbnb correction has started, we will likely see struggling Airbnb owners look to sell their properties. Look for the downturn to be worse in cities where 1) the revenues declined the most and 2) there’s the highest surplus of Airbnb inventory relative to homes for sale.”

Lane at AirDNA doesn’t see a ‘crash’ happening, even though revenue is trending down from last year and it is a relatively saturated marketplace in some metros (the number of listings was up 18% over the same period last year).

“I see that as an entirely false narrative,” he said. “The short-term rental industry has very healthy performance right now. If you look at overall occupancies for 2023, the industry is going to run 57%. That compares to a pre-COVID [level] of 55%. So we’re well above pre COVID occupancy levels. We are down from the 2021 highs, but that was a COVID anomaly in terms of industry performance.”

AirDNA expects modest Airbnb revenue declines throughout the rest of the year – a 1% drop for the rest of the year and no growth in 2024.

Let’s dive in a little further. Lane maintains that the fundamentals in STR remain strong – we see lower churn today than we saw pre-pandemic, the travel desire is absolutely real, a large segment of the population is more mobile than ever (thanks, remote work!), and about 20% of listings are private or shared rooms, not entire houses.

More importantly, revenue for most hosts across the country is still strong nationally, reducing the likelihood of forced sellers, Lane said.

“If you look at revenue today, average revenue per listing compared to pre-pandemic, we are 30% higher, and that has barely come down off the highs in 2022. The earnings of short term rental operators have not collapsed by any means.”

But let’s say demand nosedives due to a recession and the numbers no longer pencil out for some operators. What impact would that have on the market?

It’s hard to say, but an STR crash like the one Gerli describes already did happen, back in 2020.

“In 2020, listings fell by 25%, we saw many markets essentially decline by half, with no disruption to the broader housing market,” Lane said.

Inventory, as ever, is key to all this. Currently, there are about 1.4 million short-term rental listings in the U.S. while there are about 600,000 active for-sale listings. Even if all the 1.4 million STR listings hit the market at the same time, I don’t think that would result in a crash.

“Active listings in a normal period would be between 2 to 2.5 million,” said HousingWire’s Lead Analyst Logan Mohtashami. “Even if all those homes came to market overnight, they would need to not get a bid over 60 days to allow the active inventory to return to historical norms.”

Not that such an Airbnb inventory shock would even occur.

Said Lane: “When you look at major cities, let’s say the 50 largest metros, most of that [Airbnb] inventory is not available full time. Over 50% was available for rent less than 180 days over the previous year. So it’s not full time short term rental investments.”

Lane argued that a flood of Airbnb’s wouldn’t even crash heavily saturated markets either.

“So you look at a market like Phoenix and how many new homes are being built any given year, that’s larger than the entire short term rental industry,” Lane said.

The broader housing market needs more inventory any which way it can get it, but I don’t see much coming from non-viable Airbnbs. What do you think? Share your thoughts with me at james@hwmedia.com.

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at james@hwmedia.com.