Large single-family rental investors didn’t have much of an appetite in the fourth quarter of 2022 and the first quarter of 2023. Or, rather, perhaps I should say that they didn’t have much food to choose from. Purchases among the biggest SFR operators were down roughly 80% year-over-year, according to some estimates, and it wasn’t because they couldn’t make the rental prices work. Those have remained strong.

“But rather, it’s that there are a lot less people selling [homes]” L.D. Salmanson, CEO of real estate data platform Cherre, told HW’s Bill Conroy in a feature we published Tuesday.

The slowdown in institutional investor SFR purchases? “That’s temporary,” he said. “That’s not going to last.”

Indeed, so-called Wall Street SFR firms are back, baby! Industry sources and housing number-crunchers tell HousingWire that institutional SFR firms that target the $300,000 to $500,000 price point have been buying up more homes since March, with recent headlines including Pretium Partners’ $1.5 billion purchase of 4,000 build-for-rent homes concentrated in the South and Southwest.

This tracks, as the largest percentages of single-family home sales to institutional investors in the first quarter of 2023 included Georgia (8.4% of all sales), Tennessee (7.7%), Alabama (7.5%), Texas (7.5%) and Arizona (7.3%), according to ATTOM Research.

This uptick is a sign that more housing inventory is available for sale as more potential homebuyers are priced out of the market due to high interest rates and soaring housing prices.

“It’s been extremely expensive and unaffordable for a lot of families to purchase a home, so they’re going to have to find alternative housing through the rental side,” Brandon Lwowski, director of research at valuations firm HouseCanary, told Conroy. “Homebuyers have been sitting on the sidelines.”

According to Lwowski, a rise in the volume of homes available for sale in certain areas is already happening. In fact, he said, some parts of the country are experiencing “excess inventory right now,” primarily the Southeast and Southwest. Those are the traditional SFR hunting grounds.

“It might sound crazy, but there’s a lot of areas in Texas, Florida and the Carolinas where we’re seeing this increase in [homes for-sale] inventory,” Lwowski said. “One market that was surprising to me when I was looking at this data was the Austin/Round Rock [Texas] area, which has the largest year-over-year increase in inventory.”

Even in San Antonio, where homes are more moderately priced, Lwowski said home inventory is up 53% year over year.

For now, institutional investors only control about 3% to 5% of the SFR market, which counts an estimated 17 million homes. But they’re making inroads, observers said. The SFR sector has grown about 20% in the last three or four years and demographics remain favorable. We’re short an estimated 7 million housing units in America, the stigmatization of renting has waned, and the “lock-in effect” caused by 62% of mortgaged homeowners having a rate under 4% will loom large for years. Plus, these institutional investors at the end of 2022 had allocated about $110 billion in cash to make SFR purchases, according to a report by Zelman & Associates. The money’s there.

“We’re expecting another 13 million or so [SFR homes to be added to that total] by the end of the decade,” Cherre’s Salmonson said. “[The SFR market is] about a $4.5 trillion to $5 trillion addressable market … and 18% of the market is build-for-rent.”

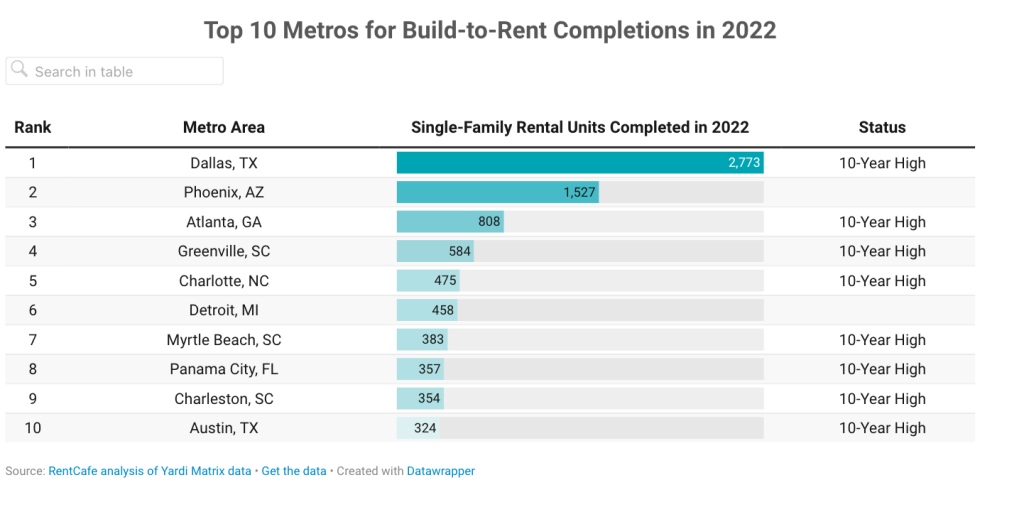

The construction of new build-to-rent homes hit a record in 2022, with more than 14,500 houses completed, according to RentCafe. Phoenix, Dallas and Detroit are the top three metros that added the most single-family homes for rent in the last five years. Currently, there are 44,700 build-to-rent houses under construction — triple the number of new homes completed in 2022.

New construction homes now represent more than one-third of the sales market overall, far higher than historical norms.

I expect we’ll see a lot more deals like the $1.5 billion portfolio exchange between Pretium and D.R. Horton, which is the nation’s largest homebuilder and has prioritized build-to-rent over the last year or so. There are huge synergies to be found when large institutional SFR investors buy directly from scaled enterprises like a national homebuilder. It just makes too much sense. Whether it ultimately proves yet another obstacle for first-time homebuyers to overcome or merely takes a bite out of the multifamily rental market remains to be seen.

What do you make of the growing presence of institutional investors in single-family real estate? Share your thoughts with me at james@hwmedia.com.

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at james@hwmedia.com.