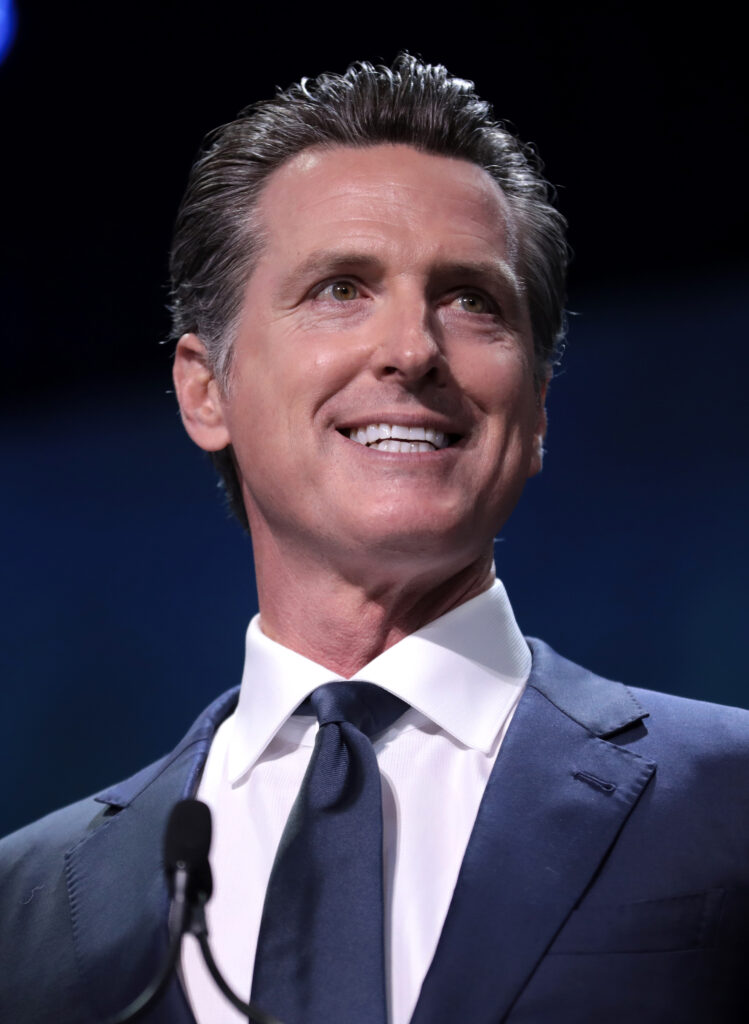

The state of California’s desire to create a watchdog agency akin to the federal Consumer Financial Protection Bureau (CFPB) is moving ahead, after Governor Gavin Newsom (D) signed a package of bills into law to reform the state’s Department of Business Oversight (DBO) into a new entity.

The new consumer watchdog, which will be called the Department of Financial Protection and Innovation (DFPI), is a powerful new state organization which will require licenses for debt collectors operating within the state, while imposing new requirements on student loan servicers among other provisions. The law as signed by Governor Newsom will take effect in the state on January 1, 2021, according to original reporting at Reuters.

The new law aims to take on several new tasks related to business oversight and consumer protection, including the addition of dozens of investigators and attorneys to supervise financial institutions; establishing a team to monitor markets and identify emerging risks to consumers; and creating a team dedicated to consumer education and outreach while listening to those in specific communities. The bill will also allow the state to create a new “Office of Financial Technology and Innovation,” which will cultivate financial technology to serve consumers.

“While the federal government is getting out of the financial protection business, California is leaning into it,” said Governor Newsom in a press release announcing the bills’ signings. “It’s at this moment especially – when so many Californians are strapped for cash and struggling to pay their bills – that families are likely to fall victim to predatory and abusive financial products. These bills ensure that financial predators are subjected to alert oversight and agile enforcement.”

It is as-yet unknown what specific impact the creation of the new agency will have on the reverse mortgage industry, though given the modeling of the state agency on the template of the CFPB as envisioned by architect Elizabeth Warren and inaugural director Richard Cordray, the new bureaucracy is likely to interact with it. Cordray reportedly consulted on the creation of the bill introducing the concept of the more powerful state agency, according to reporting at NPR.

“The law also expands the state’s power to target unfair, deceptive and abusive acts and practices by financial service providers – such as debt collectors and emerging financial technology products,” the governor’s office said in a press release. “The creation of the department was a key idea in the governor’s January 2020-2021 budget proposal.”