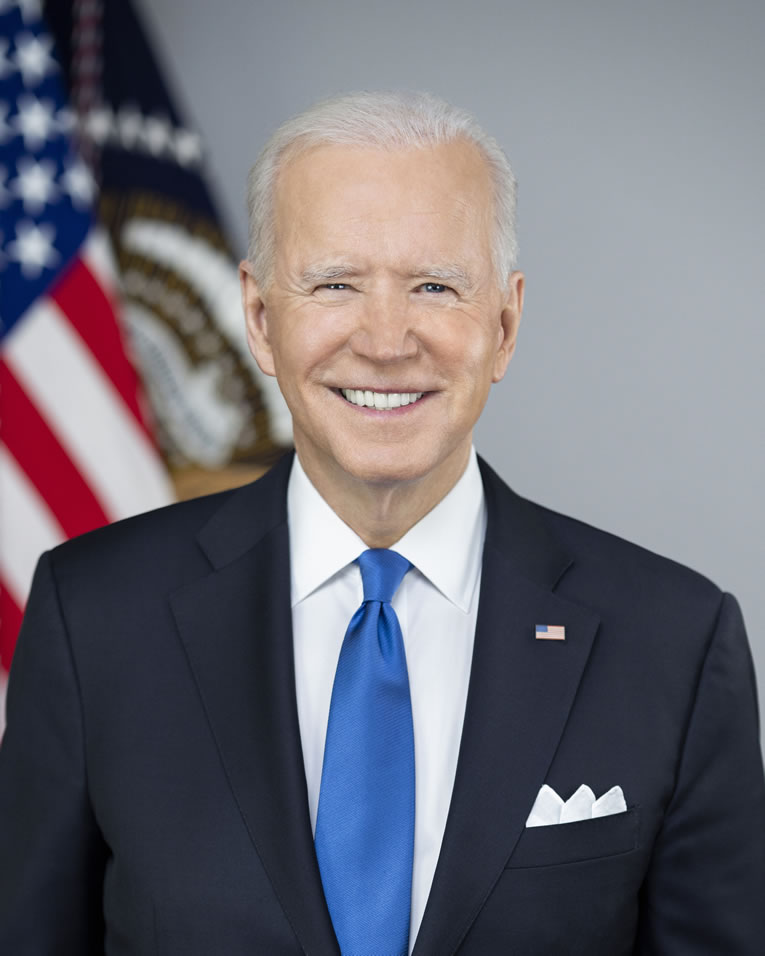

The White House announced that President Joe Biden will call on lawmakers in the House of Representatives and the Senate to address a series of housing issues in his State of the Union address, which will be delivered to a joint session of Congress and televised nationally on Thursday night.

In the address, the president will call for a $10,000 tax credit for both first-time homebuyers and people who sell their starter homes; the construction and renovation of more than 2 million additional homes; and cost reductions for renters.

Biden will also call for “lower homebuying and refinancing closing costs and crack down on corporate actions that rip off renters,” according to the White House announcement.

The mortgage relief credit would provide “middle-class first-time homebuyers with an annual tax credit of $5,000 a year for two years,” according to the announcement. This would act as an equivalent to reducing the mortgage rate by more than 1.5% on a median-priced home for two years, and it is estimated to “help more than 3.5 million middle-class families purchase their first home over the next two years,” the White House said.

The president will also call for a new credit to “unlock inventory of affordable starter homes, while helping middle-class families move up the housing ladder and empty nesters right size,” the White House said.

Addressing rate lock-ins

Homeowners who benefited from the post-pandemic, low-rate environment are typically more reluctant to sell and give up their rate, even if their circumstances may not fit their needs. The White House is looking to incentivize those who would benefit from a new home to sell.

“The president is calling on Congress to provide a one-year tax credit of up to $10,000 to middle-class families who sell their starter home, defined as homes below the area median home price in the county, to another owner-occupant,” the announcement explained. “This proposal is estimated to help nearly 3 million families.”

The president will also reiterate a call to provide $25,000 in down payment assistance for first-generation homebuyers “whose families haven’t benefited from the generational wealth building associated with homeownership,” which is estimated to assist 400,000 families, according to the White House.

The White House also pointed out last year’s reduction to the mortgage insurance premium (MIP) for Federal Housing Administration (FHA) mortgages, which save “an estimated 850,000 homebuyers and homeowners an estimated $800 per year.”

In Thursday’s State of the Union address, the president is expected to announce “new actions to lower the closing costs associated with buying a home or refinancing a mortgage,” including a Federal Housing Finance Agency (FHFA) pilot program that would “waive the requirement for lender’s title insurance on certain refinances.”

The White House says that, if enacted, this would save thousands of homeowners up to $1,500 — or an average of $750.

Supply and rental challenges

Housing supply continues to be an issue for the broader housing market, and the president will call on Congress to pass legislation “to build and renovate more than 2 million homes, which would close the housing supply gap and lower housing costs for renters and homeowners,” the White House said.

This would be accomplished by an expansion of the Low-Income Housing Tax Credit (LIHTC) to build or preserve 1.2 million affordable rental units, as well as a new Neighborhood Homes Tax Credit that would “build or renovate affordable homes for homeownership, which would lead to the construction or preservation of over 400,000 starter homes.”

A new $20 billion, competitive grant program the president is expected to unveil during the speech would also “support the construction of affordable multifamily rental units; incentivize local actions to remove unnecessary barriers to housing development; pilot innovative models to increase the production of affordable and workforce rental housing; and spur the construction of new starter homes for middle-class families,” the White House said.

Biden will also propose that each Federal Home Loan Bank double its annual contribution to the Affordable Housing Program, raising it from 10% of prior year net income to 20%. The White House estimates that this “will raise an additional $3.79 billion for affordable housing over the next decade and assist nearly 380,000 households.”

Biden will propose several new provisions designed to control costs for renters, including the targeting of corporate landlords and private equity firms, which have been “accused of illegal information sharing, price fixing, and inflating rents,” the White House said.

The president will also reference the administration’s “war on junk fees,” targeting those that withstand added costs in the rental application process and throughout the duration of a lease under the guise of “convenience fees,” the White House said.

And Biden is expected to call on Congress to further expand rental assistance to more than 500,000 households, “including by providing a voucher guarantee for low-income veterans and youth aging out of foster care.”

Housing association responses

Housing associations such as the Mortgage Bankers Association (MBA) and the National Housing Conference (NHC) quickly responded to the news. The NHC lauded the development.

“This is the most consequential State of the Union address on housing in more than 50 years,” NHC President and CEO David Dworkin said. “President Biden’s call for Congress to tackle the urgent matter of housing affordability through tax credits, down payment assistance initiatives, and other measures is warranted and represents a crucial step in easing the burden of high rents and home prices.”

MBA President and CEO Bob Broeksmit explained that while the association will review all of the proposals in-depth, it welcomes the Biden administration’s focus on reforms that can expand single-family and multifamily housing supply. It is also wary of some of the proposals.

“MBA has significant concerns that some of the proposals on closing costs and title insurance could undermine consumer protections, increase risk, and reduce competition,” Broeksmit said. “Suggestions that another revamp of these rules is needed depart from the legal regime created by Congress in the Dodd-Frank Act and will only increase regulatory costs and make it untenable for smaller lenders to compete.”