A Q3 2020 rise in vacant foreclosures signals a possible re-escalation in a hard-fought battle against neighborhood blight in which many cities have just recently gained the upper hand.

“We still have vacancy and blight issues but they are not crippling as they were a decade ago,” said Ian Beniston, executive director at the Youngstown Neighborhood Development Corporation (YNDC), a nonprofit community development corporation in Youngstown, Ohio. “When we began a decade ago there was much more blight. There were more than 5,000 vacant properties. Last count there were 1,800 – which is still 1,800 too many.”

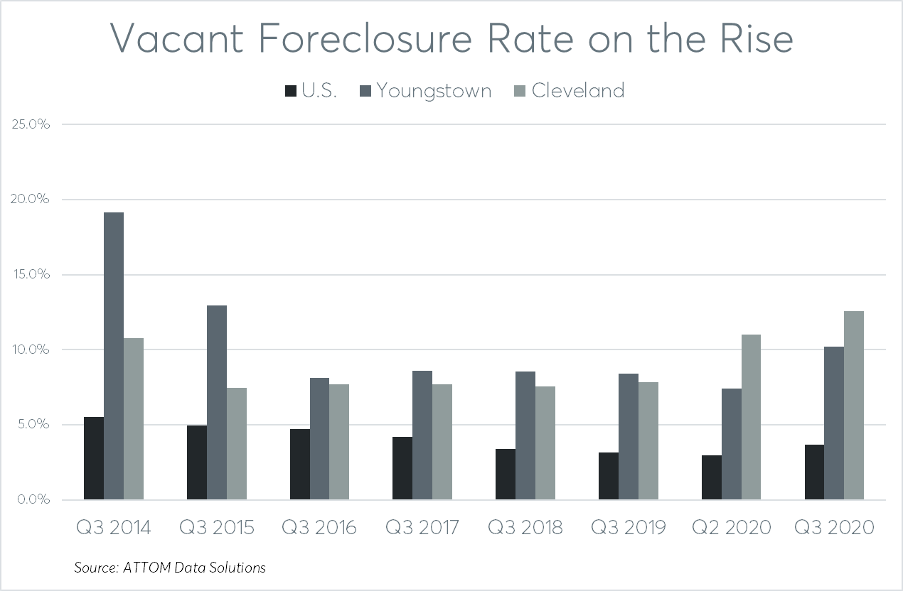

The rate of vacant foreclosures, also known as “zombie” foreclosures, dropped to an all-time low of 7.4% in Youngstown in the second quarter of 2020, according to data from ATTOM Data Solutions, which also shows the zombie foreclosure rate dropping to an all-time low of 3.0% nationwide in the second quarter.

Zombie resurrection

But the zombie foreclosure rate in the third quarter increased to a three-year high of 3.7% nationwide while the zombie foreclosure rate in Youngstown increased to a more than four-year high of 10.2%, according to the Q3 2020 Vacant Property and Zombie Foreclosure Report from ATTOM.

“It appears that an increased number of vacant foreclosure properties may be an unintended consequence of the foreclosure moratoria put in place by federal, state and local governments,” said Rick Sharga, executive vice president at RealtyTrac, a subsidiary of ATTOM Data Solutions, in the report.

Not like wine

That unintended consequence of foreclosure moratoria could be bad news for the neighborhood stabilization efforts spearheaded by YNDC and other organizations like it.

“We care about managing the level of vacant properties … [because] every property that is vacant provides an opportunity for vandalism,” said Chris Alvarado, executive director of the Slavic Village Development (SVD), a Cleveland, Ohio-based nonprofit community development corporation that promotes neighborhood stabilization through housing development, local business development and community organizing.

“Vacant properties are not like wine; they do not get better with age,” Alvarado continued. “That right there causes an immediate blighting influence. And the more of these vacant properties that proliferate, the lower the confidence in the neighborhood.”

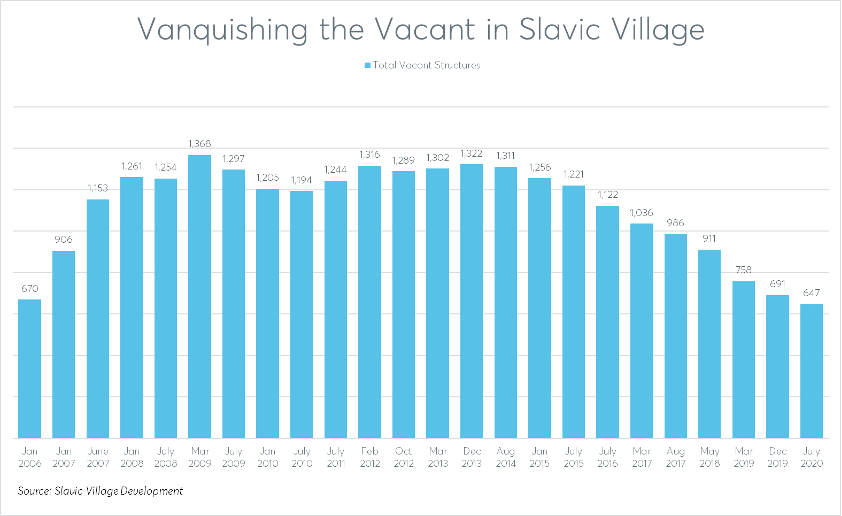

Alvarado noted that the number of vacant homes in Cleveland had been steadily declining in recent years, a sign that the neighborhood stabilization programs employed by SVD are working. There were a total of 647 vacant structures in the Slavic Village neighborhood in July 2020, down 15% from March 2019 and down 53% from a peak of 1,368 vacant structures in March 2009, according to a biannual survey conducted by SVD of all parcels in the neighborhood.

“It’s not solved, but the vacant property issue is much more manageable,” Alvarado said. “In 2008, 2009, it was triage. We were struggling to get control of blocks.”

Rising demand for vacant distress

The recent rise in zombie foreclosures may mean community development organizations like SVD and YNDC will need to shift some focus back to the vanquishing of vacant homes. The good news is that there is plenty of demand for vacant properties, from both nonprofit and for-profit buyers.

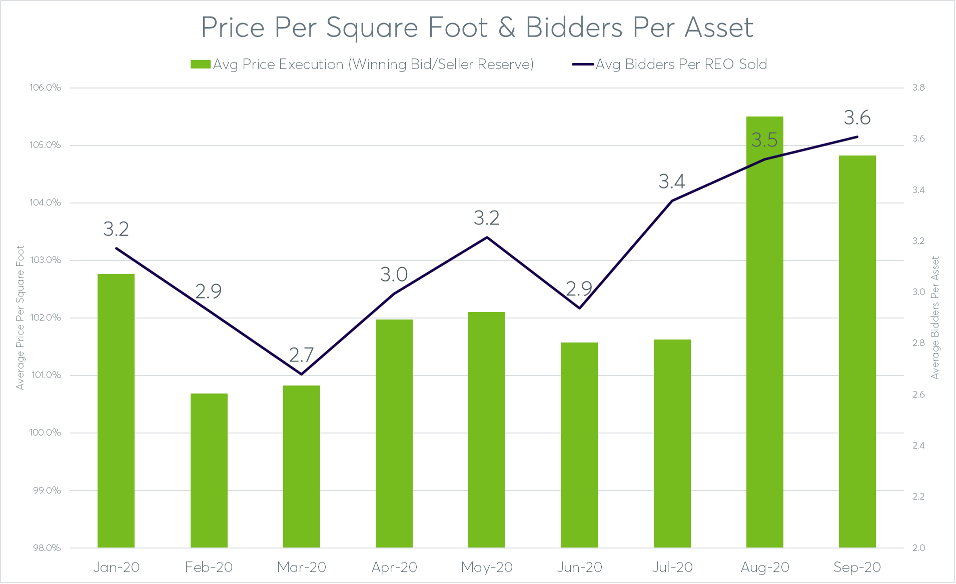

Demand for REO properties sold on the Auction.com platform has been rising since a short-lived dip in March and April, as evidenced by five consecutive months of year-over-year increases in sales rate (percentage of REOs available for auction that sold) and average price per square foot through September. The rising sales rate and price per square foot are driven by more competition from bidders: the average number of bidders per REO sold on the Auction.com platform hit a year-to-date high of 3.6 in September.

Competition for vacant REOs specifically was just as strong, with average bidders per asset also increasing to a new year-to-date high of 3.6 in September, according to the Auction.com data. That competition helped lift average price execution (winning bid as percentage of seller reserve) for vacant REOs to 104.8% in September, just slightly below the year-to-date high of 105.5% in August.

“Our 6 million registered website users have enough liquidity to weather a storm, and are ready and able to quickly absorb the recent uptick in vacant foreclosures,” said Ali Haralson, chief business development officer at Auction.com. “They have proven that they can efficiently return these distressed vacant properties to occupancy.”

Seeking new inventory sources

Once rehabbed, previously vacant distressed properties are attracting scores of retail buyers, according to Jeff Crum, chief investment officer at New Jersey Community Capital (NJCC), a nonprofit, socially motivated lender that also buys and rehabs vacant distressed properties.

“We’ll put a home on the market, and we’ll have 30 offers in a week, and most of them are above list,” said Crum, noting that the combination of strong demand and low supply is driving up prices, creating an affordability challenge for some communities where NJCC operates. “If you had asked me about gentrification in Newark in 2012 and 2013, I would have told you I’m not worried about gentrification; we just need to get properties re-occupied. But now gentrification is an issue.”

Beniston noted demand is also strong for rentals that YNDC has renovated after purchasing in distress.

“All of our rentals rent immediately,” he said, giving as an example 500 inquiries that YNDC received for two rentals it put on the market in April. “We do aim to increase homeownership overall, but we also know that we have to maintain and increase the quality of rental stock because not everyone is a homeowner and not everyone wants to be a homeowner.”

Rather than continuing to rely solely on its primary acquisition channel — the local land bank — Beniston said YNDC has turned to new acquisition channels such as Auction.com to find vacant distressed properties it can purchase and rehab as part of a strategic plan to revitalize neighborhoods, block by block.

Beniston provided as an example a property YNDC rehabbed and resold to an owner-occupant after purchasing it on Auction.com. That home was on a street where YNDC had purchased several other existing homes, built three brand new homes and had renovated the sole apartment building on the street — “an awesome historic structure built in 1910,” Beniston said.

“[Improving neighborhood housing quality] needs to be done as part of a strategy,” he said. “Our approach as an organization is very incremental. We have a plan for every parcel.”