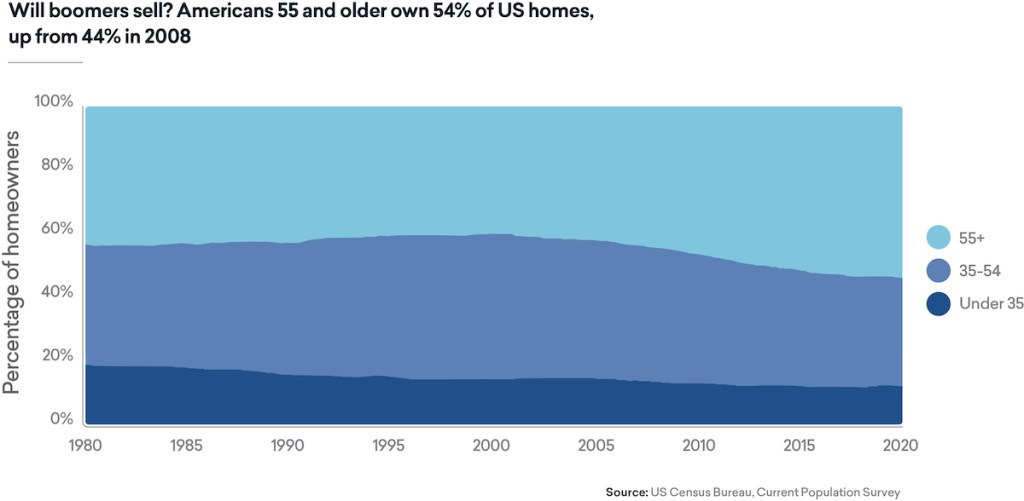

Just the term ‘baby boomer’ is sure to elicit a reaction, particularly from those in younger generations. Jealousy? Maybe because those born from 1946 to 1964 hold over half of all wealth in the U.S., and they own a comparable share of residential real estate. Contrast those trends with millennials, who hold less than 5% of the wealth in the U.S. There is also the inescapable fact that all Boomers will soon be over 60 and either retired or close to it.

Boomer behaivor

This, by itself, offers hope for easing the real estate inventory crunch that continues to dampen velocity in the market, along with high interest rates. If baby boomers follow the pattern of past generations, retirement means downsizing to condos or small homes, or moving to some type of retirement community. This could put a significant number of homes, particularly single-family properties, on the market over the next decade.

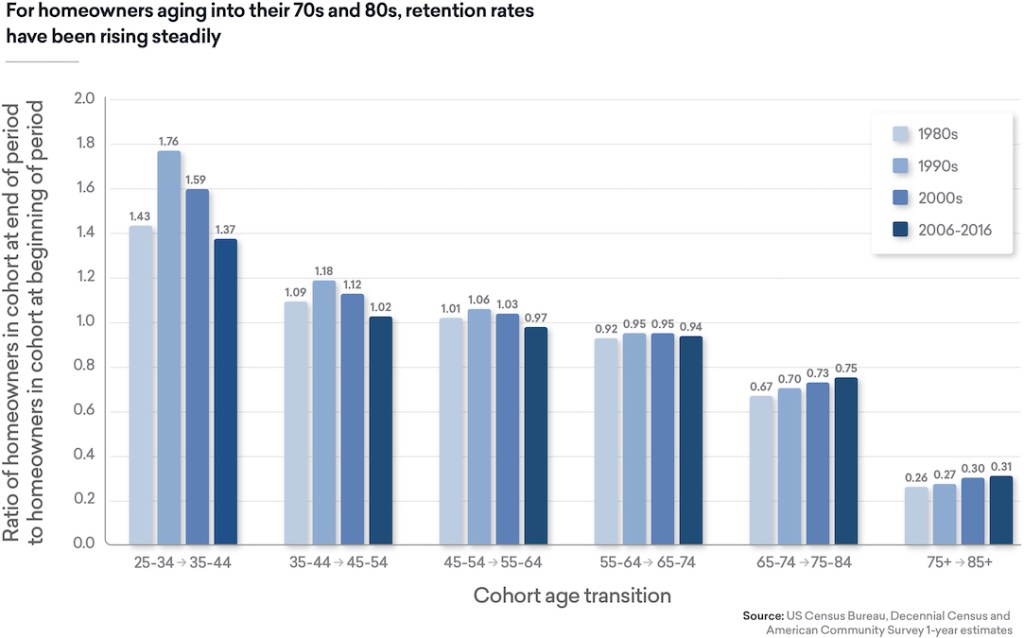

The multi-billion-dollar question, however, is: will they sell? Some data indicates that boomers will age in place longer than past generations because they have the health and wealth to do so. Census Bureau analysis, in fact, shows that the proportion of homeowners staying put after 65 and into their 70s and 80s has been increasing steadily over the past few decades. This trend is expected to continue as the last of the baby boomer generation moves into those age ranges.

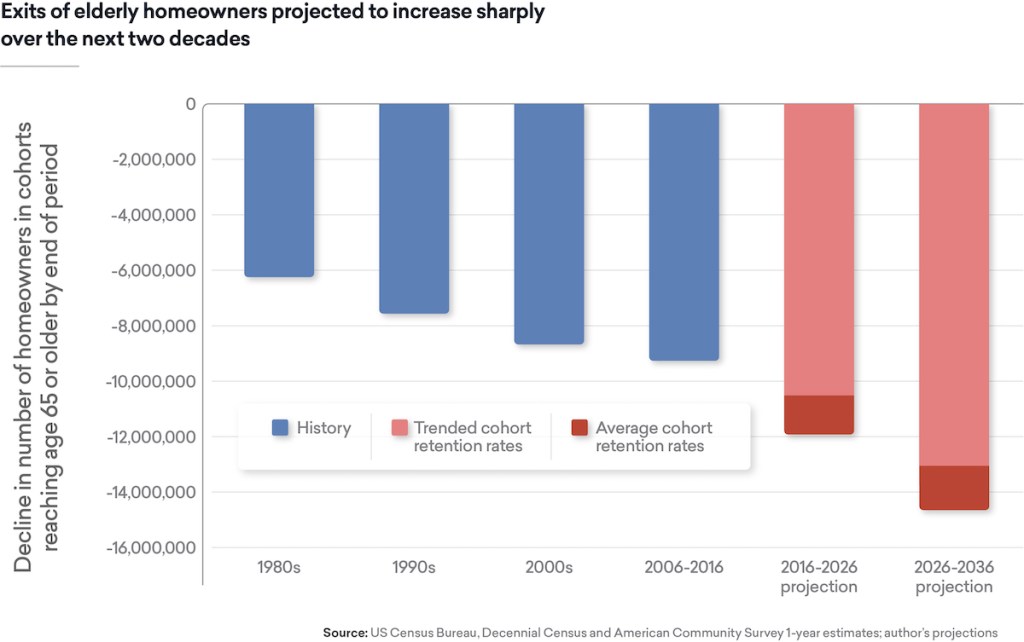

On the other hand, 2016 research by NAR showed that baby boomers comprised the largest proportion of homebuyers amongst all generations. Since this survey included purchases of all types of primary residences, this likely demonstrates that a significant number of boomers are moving out of their family residences and downsizing. A 2018 article published by FannieMae pointed out that while the proportion of boomer homeowners choosing to move out may be less than previous generations, the sheer scale of baby boomer homeownership will mean a huge increase in the number of properties that will be sold. The Census Bureau estimates that homeownership by those 65 and older in 2026 will drop by 12 million, with a further drop of 15 million in the subsequent decade. This could mean an additional 27 million properties available to the market over that period.

Generational Impact

Due to their wealth and property holdings, the lifestyle choices of the baby boomer generation will continue to shape the real estate market — and the economy — for years to come. As a generation that prizes activity and independence, more of them will hang on to their homes longer than the generations before, but even with this dynamic, the large number of homeowners entering their 60s and beyond will dictate a significant increase in real estate inventory over the next decade.

Vince O’Neill is the Chief Economist for Plunk.