A new study of distressed property dispositions between 2003 and 2017 by Fannie Mae and academic researchers finds loss severity on nonperforming loans is lower when properties are disposed of early, before a lender takes ownership.

“Losses tend to be lower when the lender does not take ownership of the property,” according to early findings from the study provided by Hamilton Fout, director of Economics for Economic and Strategic Research at Fannie Mae. “The earlier the creditor is able to dispose of the property the less they lose because of better maintenance of the property, for example.”

Fout and study co-authors Arnab Biswas with the University of Wisconsin Stout and Anthony Pennington-Cross with Marquette are also working on publishing a paper that will provide a more in-depth treatment of findings from the study to shed light on an area of loan servicing that has not been well-explored in academic literature, according to Fout.

“There is not a great understanding about what’s driving severity,” he said. “Loss mitigation strategy matters.”

REOs experience biggest losses

The specific distressed property disposition strategies analyzed in the study were short sales (SS), deeds-in-lieu of foreclosure in which the distressed owner deeds the property directly to the lender (DIL), third-party sales at foreclosure auction (TPS), and sales of real estate owned by the lender (REO).

To measure loss severity, Fout and his co-authors looked at record-level default data from Fannie Mae between 2003 and 2017 for which a disposition outcome was available. The loss severity calculation accounted for all disposition-related costs incurred by Fannie such as foreclosure costs, property maintenance costs, sales costs and interest carrying costs. These combined costs were subtracted from the property sale proceeds and then divided by the outstanding mortgage balance at the time of default.

This initial loss severity calculation found that loss severity was highest for REO dispositions (63 percent) followed by deeds-in-lieu (60 percent), short sales (46 percent), and finally third-party sales at foreclosure auction (32 percent). Fout and his co-authors dug beyond those initial findings, however, taking steps to control for factors that may have influenced the results. These factors included loan type, loan-to-value ratio, borrower credit score and debt-to-income ratio, as well as a property’s owner-occupancy status.

“Controlling for borrower, loan and market characteristics, as well as sample selection, we find that REO loans experience the greatest losses followed by TPS, SS and DIL,” the study concluded.

Foreclosure sales recover more

The findings from Fout and his co-authors align with proprietary foreclosure sale and REO sale data from the Auction.com platform, which accounted for close to 50 percent of all third-party foreclosure sales nationwide in 2018.

The Auction.com analysis — which looked at the final disposition outcome for more than 23,000 properties brought to the foreclosure sale in Q2 2018 using Auction.com data matched to public record and MLS data from Collateral Analytics — shows that even without factoring in the costs that come with taking possession and maintaining a property, lenders are recovering more of their losses with properties sold at the foreclosure sale than they are with properties sold as REO.

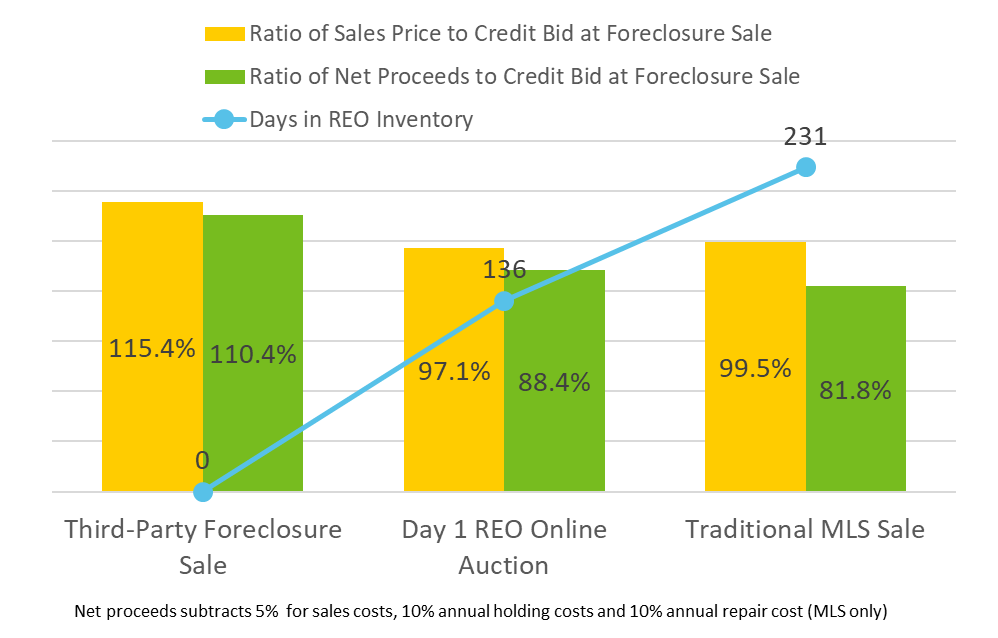

Properties purchased by third parties at the foreclosure sale (what the Fout study refers to as TPS) sold for 115.4 percent of the credit bid (also known as reserve) set at the foreclosure sale, while properties that sold as REO after being listed on the Multiple Listing Service (MLS) sold for 99.5 percent of the foreclosure sale credit bid — an average of 231 days after the foreclosure sale. Meanwhile, REOs that sold through an online auction with the “Day 1” Auction.com program sold an average of 136 days after the foreclosure sale for 97.1 percent of the credit bid at foreclosure sale.

The advantages of the earlier disposition options are even more clear when accounting for holding and repair costs associated with selling an REO. Using the same cohort of 23,000 properties brought to foreclosure auction in Q2 2018, the net proceeds after estimated holding and repair costs were 81.8 percent of the foreclosure sale credit bid on average for REOs sold on the MLS, compared to 88.4 percent for REOs sold via the Day 1 online auction program and 110.4 percent for properties sold to third parties at the foreclosure sale.

Research continues

Fout and his co-authors are continuing to investigate how self-selection at the foreclosure sale could be influencing the results. Although they’ve taken steps to account for this, Fout acknowledged that this controlling process is difficult because properties are not “randomly assigned” to the third-party sale or REO buckets.

“Research continues on controlling for selection and understanding the mechanisms behind the better outcomes for non-REO disposals to more fully inform policy decisions related to loss mitigation strategies,” Fout and his co-authors write in the early findings.