This article is part of our HousingWire 2022 forecast series. After the series wraps, join us on February 8 for the HW+ Virtual 2022 Forecast Event. Bringing together some of the top economists and researchers in housing, the event will provide an in-depth look at the top predictions for this year, along with a roundtable discussion on how these insights apply to your business. The event is exclusively for HW+ members, and you can go here to register.

2021 was an extraordinary year for the housing market: mortgage rates at an all-time low, record high annual growth in single-family prices and rents, lowest foreclosure rates in a generation and the largest number of home sales in 15 years. Sellers saw a market where their homes sold quickly and often above list price as multiple buyers competed to have the winning bid.

2022 Forecast series

Interest rates on 30-year fixed-rate loans averaged 2.96% in 2021, a record low annual average, and are expected to rise this year. The Federal Reserve has announced plans to gradually “taper” its supportive monetary policy: Net acquisitions of agency mortgage-backed securities are expected to cease by the end of March and the Federal Open Market Committee has signaled possibly three 25-basis point increases in the federal funds target by yearend 2022.

Long-term fixed-rate mortgage rates should slowly rise in the coming year: look for interest rates on fixed-rate loans for single-family and multifamily mortgages to average about one-half of a percentage point higher in 2022 than they were in 2021, or about 3.5%. Even with this increase, fixed-rate loans will still be cheaper than they were before the pandemic: In the 2010-2019 decade the interest rate averaged 4.1% for 30-year fixed-rate loans. And if three hikes in the federal funds target come to pass, initial rates on ARMs, HELOCs and construction loans (often linked to the bank prime) will likely increase from one-half to three-quarters of a percentage point.

Higher mortgage rates and home prices are expected to moderate buyer demand as the erosion of affordability takes a toll. In addition, more for-sale inventory will likely be available on the market. More inventory is expected from three sources: new single-family construction, ‘pent up’ sellers who had delayed selling during the pandemic and will be ready to move in the spring and borrowers who had exited from forbearance but continue to struggle to remain current. With more supply from new construction and existing owners relocating, new and existing home sales are expected to rise about 1% to 7 million sales, the largest number since 2006.

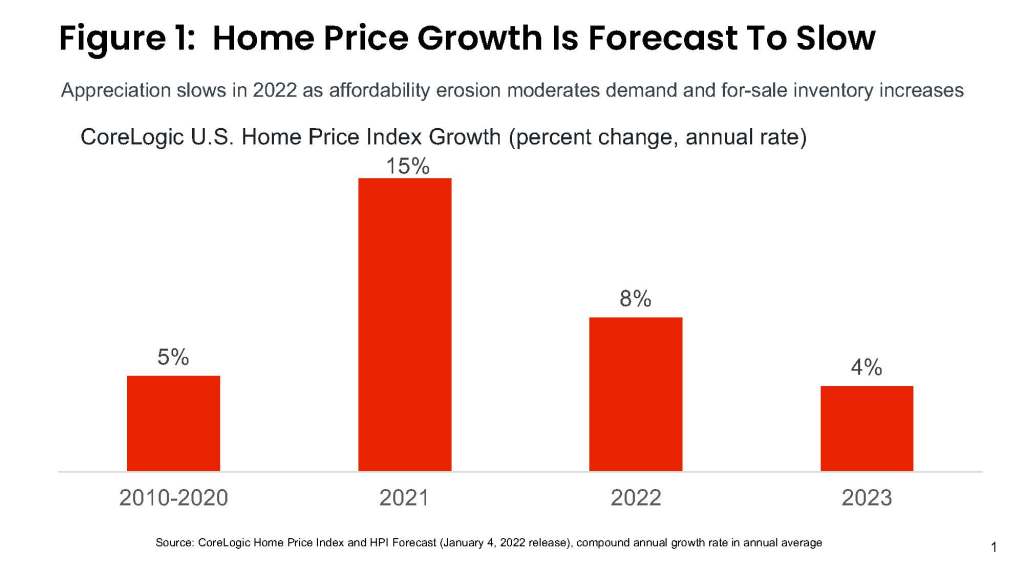

With fewer buyers able to afford homes, we expect homes listed for sale will be on the market a bit longer with fewer competing bidders, which should moderate price growth. The CoreLogic Home Price Index Forecast has the annual average rise in the national index slowing from 15% in 2021 to 8% in 2022.

Rent growth on single-family homes reached the highest ever recorded in the CoreLogic Single-Family Rent Index in 2021, up 11% in the national index over the latest 12-month period. Single-family investors stepped-up their acquisitions of homes during 2021 and multifamily rental starts will likely inch up; rent growth should moderate as additional rental homes enter the market.

More home sales and higher prices will lead to a rise in home-purchase originations in 2022. However, higher mortgage rates will reduce refinance originations this year, perhaps by 50% or more from last year, and alter its composition. During the refinance boom of the past two years, borrowers looking for a “rate-and-term” refinance dominated the market.

Today homeowners have a record amount of home equity wealth, and refinance originations will likely have a much larger cash-out share in 2022 than last year. In addition, refinance borrowers will likely have slightly lower average credit scores (as borrowers with FHA loans refinance into conventional loans with LTV or 80% or less to eliminate the mortgage insurance premium) and a longer average loan term (to keep the monthly payment low in a market where interest rates have risen).

Employment and income growth should continue to keep new delinquencies at a very low level. The 30-day delinquency rate and the foreclosure rate were at their lowest in a generation last year, although the percent of borrowers who had missed six or more payments remained more than one percentage point higher than immediately prior to the pandemic.

The end of foreclosure moratoria and the CARES Act forbearance program will likely result in a rise in distressed sales — foreclosures and short sales — in 2022, but this increase will be small given the record amount of home equity that homeowners have gained through home-price growth. 2022 should be a strong year for housing. Look for mortgage rates to rise but remain historically very low, home sales to increase to a 16-year high, price and rent growth to slow, refinance to shift toward cash-out and delinquency rates to remain low albeit with an uptick in distressed sales.

Summary:

- Interest rate on 30-year fixed-rate loans projected to average 3.5% in 2022.

- Home sales rise to a 16-year high.

- Single-family price growth slows to an annual average of 8% in 2022.

- Less refinance, but with a larger cash-out share.

- Loan delinquency remains low but with an uptick in distressed sales.