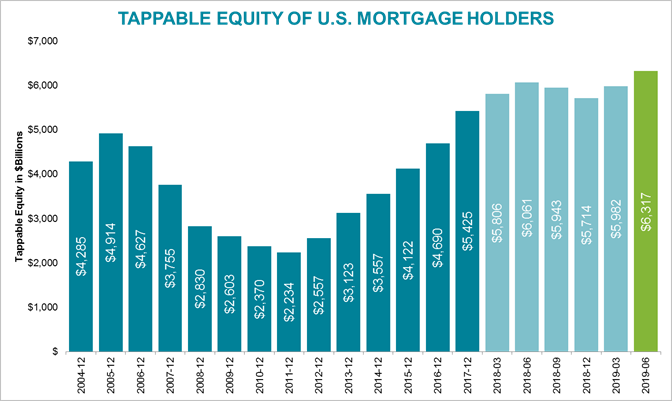

Tappable equity reached an all-time high of $6.3 trillion in the second quarter as home-price gains made real estate more valuable.

The amount of equity homeowners could borrow against before hitting the 80% loan-to-value limit imposed by most lenders rose by $335 billion during the three-month period, according to Black Knight. The new record high is 26% above the 2006 peak in the midst of the housing bubble.

The average owner with tappable equity has $140,000 available to borrow against, Black Knight said. About 55% have interest rates that are at least 0.75% higher than current rates and have credit scores at or above 760, the mortgage data firm said.

“Nearly half of the 45 million homeowners with tappable equity have 1st lien interest rates at or above 4.25%, making refi an attractive option,” Black Knight said in a statement.

The increase in tappable equity slowed in 2018 as higher mortgage rates chilled the pace of home-price gains. Higher financing costs typically reduce the size of mortgages borrowers can get because they’re qualified based on their ability to make the monthly payments, which go up as financing becomes more expensive.

When mortgage rates fall, as they have in recent months, borrowers typically can get bigger mortgages. That means they can either bid higher for a home they want or shop for properties in a higher price bracket.

When homes prices rise, the value of properties that aren't on the market also increase because a home's worth is based on "comparable sales," meaning what similar homes sell for in its neighborhood.

The average U.S. rate for a 30-year fixed mortgage fell to a three-year low of 3.55% last week, according to Freddie Mac. While there have been some signs in the bond markets that home-loan rates may tick a few basis points higher, they’re likely to remain far below 2018's annual average of 4.8%, as measured by Mortgage Bankers Association.

The rate probably will average 3.7% for the remainder of 2019 and through the first quarter of 2020, according to the MBA forecast released Aug. 15. The rate for 2020’s second quarter probably will average 3.8%, the group said.

The annual average rate for a 30-year fixed mortgage this year probably will be 3.7%, MBA said. Next year, it probably will average 4%, the group said.