Citigroup Global Markets Realty is entering the non-Qualified Mortgage space by issuing its first non-QM mortgage backed security.

The company issued its first deal at $362.58 million worth of loans originated by Impac Mortgage Holdings. The group is acquiring non-QM loans from lenders to re-sell in the secondary market, according to a report from DBRS, a credit reporting agency.

The loans in the new MBS have been held for an average of six months.

In its report, DBRS stated that representations and warranties on the deal are “far stronger” than its ratings on other non-QM MBS. The reason for this strength is the firm’s investment-grade rating and a lack of sunset provisions, according to DBRS’ report.

Back in 2018, DBRS predicted that a comeback for non-QM mortgage loans would be near.

The company explained increasing home prices and the shortage of housing inventory, alongside rising interest rates, will result in more lenders expanding their loan offerings to include products outside the QM space, according to the DBRS’ U.S. Residential Mortgage Review and 2018 Outlook.

The report showed reduced compliance concerns, standardized representations and warranties and more confidence surrounding their loan underwriting processes are some of the reasons lenders are less concerned about originating non-QM loans.

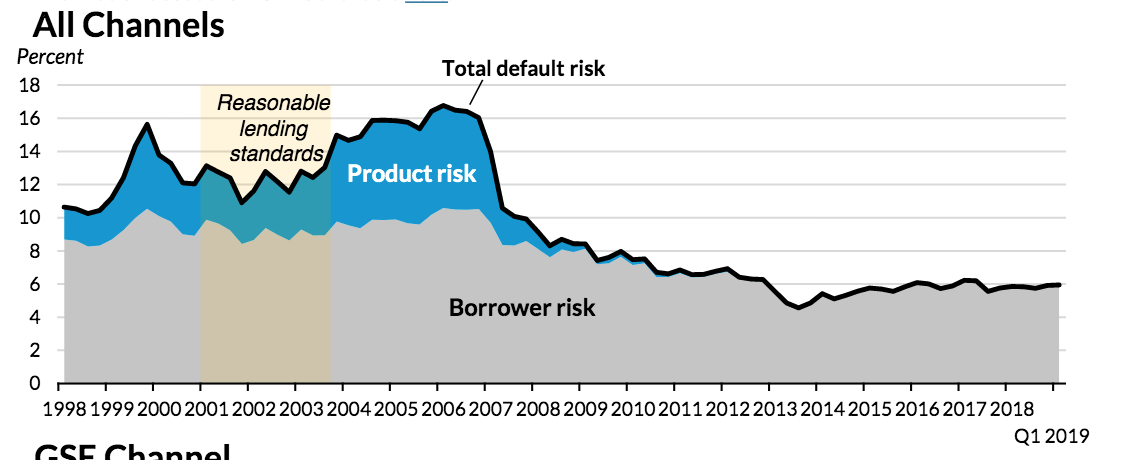

Of course, even with an increase in non-QM activity, it would be nowhere near pre-crisis levels. The Monthly Chartbook July 2019 from Urban Institute shows mortgage credit availability increased from 5.75% in the fourth quarter of 2018 to 5.95% in the first quarter of 2019 due to an increase in risk taken in the portfolio and private-label securities channel.

And while this is the highest level it has been since 2013, the chart below shows it is down significantly from pre-crisis years, showing lenders still have plenty of room to increase their risk.

Click to Enlarge

(Source: Urban Institute)

Fay Servicing will handle the servicing for the loans in Citi’s first non-QM MBS.