Sweeping changes periodically realign the mortgage industry in part or as a whole. They may come after a seismic economic shift, a spate of new regulatory requirements resulting from a financial crisis, or, on the positive side, a groundbreaking technological innovation.

In the case of innovation, the financial services professionals who are willing to embrace a new technology – and the new thinking that it may demand – stand to grow their companies in ways that increase market share and profitability.

We have seen this reality borne out time and time again over the past decades of revolutionary innovation and now accept the fact that, as digital technology and the Internet have become the drivers of change for lenders and real estate professionals, no program or practice is static. Even tried and true methodologies are not immune to technological evolution and becoming out of date.

In 2017, I helped design and develop a new valuation solution with the logic within its decisioning engine to solve a previously unsolvable riddle. I then began an industry-wide campaign to introduce this new solution to lenders and providers of valuation services.

When HousingWire invited me to write an article covering the evolution of valuations, I decided to share the logic that went into developing this latest step in that evolution and hopefully show the logic of regularly using it.

The fundamental value of automated valuation

I started in our industry in the early 1990s when AVMs were first being introduced. At that time, innovators who recognized the value of emerging AVM technology were investing time and energy to promote it to lenders across the country and pave the way for its greater acceptance.

Then, just over a decade ago, our industry experienced all three of the change agents I mentioned above: a financial crisis of historic proportion, a significant regulatory response and the ongoing introduction of new technology. Since then we have rebounded to a point where regulations are slowly being relaxed and interest rates slowly rising under the Federal Reserve’s control.

Rising interest rates and prices caused by limited housing supplies are having the effect of prompting many homeowners to think twice about selling and  moving into a new home. Instead, they are reinvesting in their current properties with the help of a new HELOC to pay for renovations.

moving into a new home. Instead, they are reinvesting in their current properties with the help of a new HELOC to pay for renovations.

As a result, originations are down and home equity applications are rising. In 2017, TransUnion forecasted that the number of consumers opening HELOCs could double between 2018 and 2022, and backed it up in a subsequent company-sponsored report that said as of April 2018, household home equity was at “its highest level – $14.87 trillion – since at least 2000.”

If these trends continue, alternative forms of valuation will be pressed into greater service because of their speed and reduced cost, and of these, the automated valuation model is the most affordable. AVMs are relied upon throughout the loan cycle, but particularly in home equity lending.

When AVMs were gaining popularity as a property evaluation tool back in the 1990s, the technology got another boost in 1994 from the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System and the Federal Deposit Insurance Corporation. At that time, the agencies set a $250,000 value threshold below which a property would not require an appraisal conducted by a licensed or state certified appraiser. Last November, the agencies proposed raising this limit – called the de minimus threshold – for the first time in 25 years to $400,000.

Introducing cascade logic

As the new century began, an important new advance in AVM technology was introduced to address a potential AVM deficiency. AVM dependence on local public records made them suffer in areas where those records were missing or unreliable. Cascades now offered a solution, using an automated process that guarded against this issue yet still provided results. Cascades would run as many AVMs as were needed in order to deliver widespread geographic coverage to the lender.

By the time I joined Veros Real Estate Solutions as its vice president of analytics in April 2017, I had become aware of some tears in the logic behind the AVM cascades. Since 2010, hit rates and coverage for the top-tier AVMs had increased markedly, with current nationwide hit rates averaging as much as 90 percent for leading brands.

As a result, the cascade’s original advantage over stand-alone AVMs was largely mitigated, as both accuracy and hit-rates for leading models had increased significantly since inception. In other words, cascades became less necessary due to the improved data quality and analytics available to all the top AVMs.

In a January white paper issued in support of the agencies’ proposal to raise the de minimus threshold to $400,000, the Mortgage Bankers Association gave its assessment of the current value of AVM technology, which now has vastly better underlying data to “fuel the models and their confidence scores.”

As the MBA explained it, real property data “has significantly improved in terms of geographic coverage, depth and granularity, availability of new information, currency of information and the overall integrity and accuracy of available data sources.”

Gone are the days, as the white paper also points out, when AVMs depended entirely on public records data, which are generally comprised of purchase transactions, title transfers from country recorders or tax data from the local assessor’s office. Today, access to public records is not only much easier and more dependable it can be obtained from regional or national aggregators as quickly as from the traditional local sources. And, beyond the better access is the fact that – in just the past decade – the public records themselves have become far superior in their coverage, currency and integrity. Similarly, MLS and other detailed property data, which were historically extremely hard to come by, is now readily available and regularly incorporated within AVM models.

Another issue with cascades is that they had been designed to determine the most accurate AVMs based on available county look-up tables. This produced another fundamental problem in that cascade logic was therefore built on automatically running sequential AVMs. This means that after the first AVM fails to get a hit, the second is now running either on a property that the first AVM deemed unsuitable or on one that is appropriate for AVM use, but for which the first model didn’t render a high-confidence value. That means that any result it generates is very likely to be inaccurate and, therefore, unusable. The bottom line is there is a reason the first AVM did not return a successful valuation.

Cascades could be excused, since they had never been designed to ask what should have been the first question posed when doing an AVM valuation: Is an AVM the best valuation choice for this property?

In good company to ask a fundamental question

In a recent article entitled “The Wild, Wild West of Automated Valuations,” AVMetrics Owner Lee Kennedy stated, “We…believe in using the right tool for the job, and we believe there is a place for automated valuations in prudent lending practices.”

In recent years, I had begun to wonder if the industry was ready to take AVMetrics’ thinking to the next logical step, and ask the question, “Is this subject property even appropriate for an AVM?”

It was clear that not all properties are good candidates.

The benefits seemed obvious: If lenders were able to determine in advance that an AVM was suitable to use for property valuation on a specific property it would save them time and expense, as well as reduce the risk of proceeding with potentially inaccurate information.

The benefits seemed obvious: If lenders were able to determine in advance that an AVM was suitable to use for property valuation on a specific property it would save them time and expense, as well as reduce the risk of proceeding with potentially inaccurate information.

This “suitability scoring” would allow an AVM to score a hit when a property is consistent with neighborhood norms and there is sufficient data available on the property, its neighborhood and recent sales of other comparable, nearby properties.

Scoring a win for suitability

After confirming that an AVM is the suitable tool for valuing a property, lenders and other valuation service providers receive a suitability score based on an analytics-driven formula and case-based reasoning to assess the subject property’s fitness for AVM utilization. If the property is a good candidate for an AVM, the system determines the most accurate and appropriate AVM for that specific property.

In addition, complete, transparent, and easy-to-understand due diligence data is provided to the customer up front and on an ongoing basis. When the subject property is not a good AVM candidate, several valuation options are afforded to the user as part of the complete and fully automated valuation solution.

This led us to wrestle with the old question about the reliability of the cascade logic.

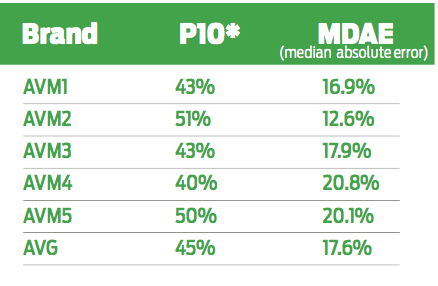

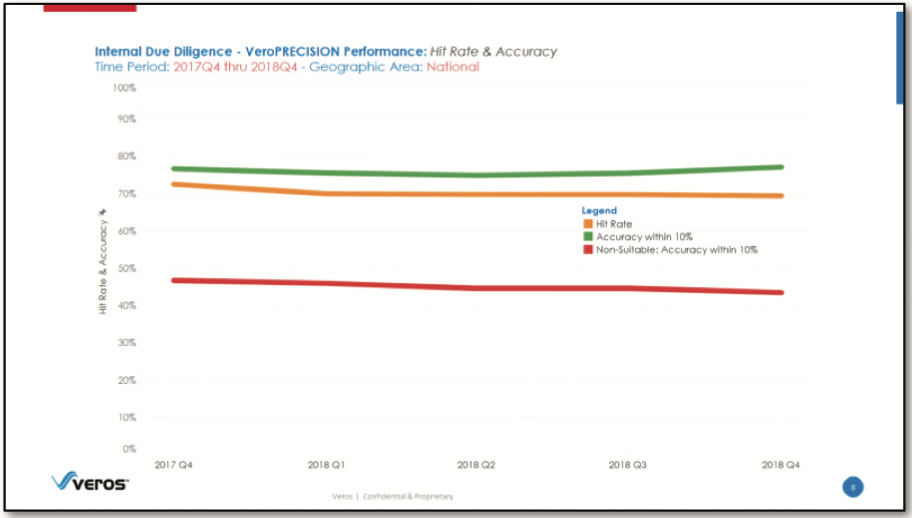

Once a property’s AVM-suitability was determined, we saw that the accuracy level for what would have been the second AVM in a cascade dropped well below the plus-or-minus ten percent an effective AVM registers. See chart below:

This poses a problem for banks and credit unions because, in addition to the inaccuracy, there is greater outlier risk, which affects those returned values that are at least 25% above or below the appraised value. We found the outlier level could be four or five times greater for AVMs attempting to value non-suitable properties.

It makes sense, therefore, that properties deemed unsuitable for AVM use should have a much lower accuracy level. To test that proposition we ran five independent AVMs on 107 properties that had been deemed unsuitable. Note that the valuation accuracy level, within 10% of the appraised value, is less than 50%.

When a high-quality AMC sees large and repeating valuation errors from an appraiser, what does it do? If the appraiser’s incorrect valuation approaches aren’t corrected, the AMC immediately stops sending orders to the appraiser. That’s exactly what this process does. It halts the unsuitable AVMs from being returned. Unfortunately, in today’s AVM cascading approaches, lenders are getting values on both suitable and unsuitable properties and, when an AVM in the second cascade position is ordered, do not know which properties fall into each category.

When compared to the recent non-purchase appraisal benchmark values, here are the results for properties deemed non-suitable for AVM use:

AMCs: The partnership that completes the end-to-end solution

Once the suitability engine determines that the property is a good candidate for an AVM, it can immediately run the appropriate AVM for that specific property from predetermined top-performing providers. It then delivers to the lender a clear and easy-to-understand report that can be shared with a customer.

By contrast, at the lender’s direction, unsuitable properties can be automatically routed to a predetermined traditional valuation method. This provides a great opportunity for Appraisal Management Companies to provide their valuation customers with a complete end-to-end solution.

Lenders have been putting faith in AMCs for some time because AMCs are required to understand the nuances of collateral valuation on a national scale. They act as the prudent risk manager on matters related to collateral valuation.

Their recommendations are always subject-property based. If the subject property is a small rural home with massive acreage, then the indicated appraiser is one with rural property experience. If the subject property is an apartment complex with ten units, then an appraiser with income property experience is the right person for the assignment.

The same analogy can be applied to appraisal or valuation products. Based on the underwriting risk, lenders and AMCs work to select the relevant valuation  product for the lending assignment. For many years, the drive-by appraisal was the product of choice for home equity lenders. In 2019, the preferred product may be an evaluation or a desktop appraisal.

product for the lending assignment. For many years, the drive-by appraisal was the product of choice for home equity lenders. In 2019, the preferred product may be an evaluation or a desktop appraisal.

This innovative approach to AVM use was developed specifically for distribution by AMCs for the home equity application and equips them with a valuation alternative to AVM cascades. It gives lenders a reliable, efficient and compliant tool that is complemented by the expertise and valuation acumen of the AMC.

Sharing the logic of logic-based VeroPRECISION

I spent 2018 promoting both the benefits and efficiencies that this process can offer. In industry presentations and white papers, which were made available to HousingWire readers, I explained how this suitability decisioning leverages robust analytics, artificial intelligence, and machine learning to determine if an individual subject property is best served by AVM valuation or if it should be routed to an appraisal or other traditional valuation process. It is currently tested on more than 30,000 properties each month and the results are compelling.

In conclusion, when using AVMs – and with the proven accuracy and efficiencies provided by today’s AVMs, there is no reason lenders shouldn’t be using them – it is imperative to ask and answer the most basic question. Is the subject property a suitable candidate for AVM analysis? Your credit policy folks will love you for it.