America’s young adults are seriously debt-burdened. After all, the nation’s students have accumulated roughly $1.5 trillion worth of student loan debt.

With such a balance, it’s no surprise that many struggle to enter the housing market as first-time buyers.

However, a new proposal introduced by Sen. Elizabeth Warren, D-MA, could eliminate up to $50,000 worth of student loan debt for the average American.

This means that the typical aspiring first-time homebuyer burdened with student debt could save for a down payment in just nine years, according to a new analysis from Redfin.

In order to calculate this total, Redfin assumes the typical potential homebuyer with the average amount of student debt spends 10% of their income on debt repayment at the average 5.8% interest rate.

So, if they paid off their student debt, then put up 10% of their income toward a 20% down payment, it would take them 12 years to save enough to buy the average home, which is priced at $308,000.

However, Under Warren’s plan, they could make a down payment three years faster.

“The idea of taking on a mortgage when you’re still paying off tens of thousands of dollars in student loans is a non-starter for many people,” Redfin Chief Economist Daryl Fairweather said. “If student debt were eliminated, college grads would be able to start building wealth through homeownership, laying down roots and contributing to their communities’ years earlier in their lives.”

And while first-time buyers across the country could benefit from Warren’s forgiveness plan, Redfin indicates housing markets in the south will reap the most rewards.

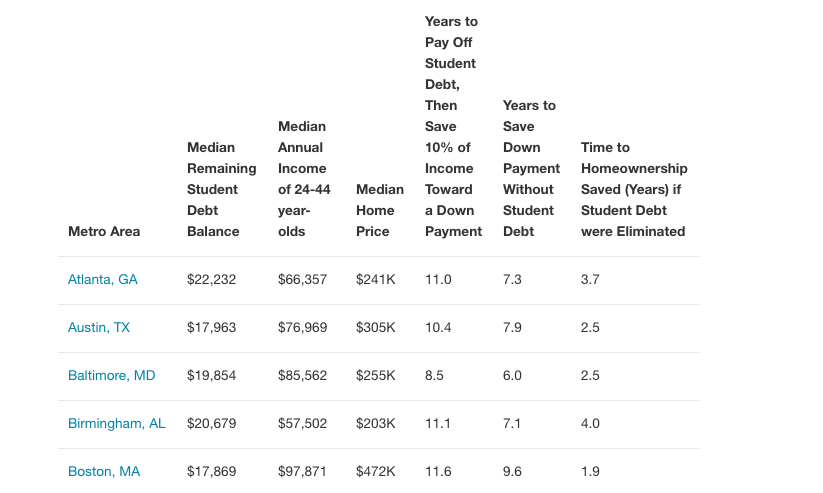

According to Redfin’s data, these five housing markets could see some of the biggest decrease in the time it takes to save for a down payment:

(Click to enlarge; Courtesy of Redfin)

Note: For this analysis, Redfin utilized statistical data from LendingTree and the Bureau of Labor and Statistics.