With a population of nearly 84 million, it’s safe to say Millennials are destined to make waves in the housing market. However, a recent analysis from First American suggests the industry isn’t harnessing their full potential.

“Millennials are the largest generational group the U.S. has ever seen, and the largest segment of Millennials will turn 30 in 2020, the prime age for buying a first home,” First American writes. “In 2018, we’ve already started to see how this demographic wave of home-buying demand is already re-shaping the housing market.”

“Yet, despite the fact that Millennial demand for homes is set to increase, traditional measures of affordability are skewed toward people that already own homes, offering a somewhat misleading perspective for potential first-time buyers.”

According to First American’s report, instead of focusing on Millennial buying power, attention needs to be shifted towards housing supply.

“As the surge of Millennial demand begins to hit shore, Millennial first-time home buyers may want to consider cities that offer a greater supply of affordable homes for median renters,” First American Chief Economist Mark Fleming said.

This is because the company discovered that nominal house price appreciation in 2018 applied unrelenting upward pressure on house prices.

In fact, according to the company’s data, nominal house prices grew 6% between the fourth quarters of 2017 and 2018. During that same period, household income for renters slightly increased 3.3%.

And since housing supply is unlikely to increase dramatically in 2019, First American says it’s reasonable to expect house prices to continue to rise, discouraging many first-time buyers.

In order to prevent Millennials from rejecting homeownership, potential first-time home buyers can benefit from a more targeted examination of affordability, according to First American.

“Since first-time home buyers are nearly certain to be currently renting, our estimate of a first-time buyer’s house-buying power is based on the median renter’s income,” First American writes. “The renter house-buying power estimate also takes into account the prevailing 30-year, fixed mortgage rate, and assumes one-third of the first-time home buyer’s pre-tax income is used for the mortgage.”

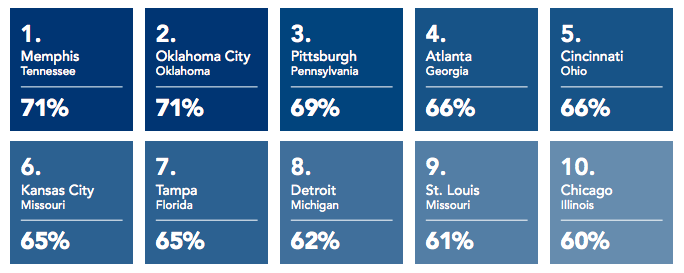

According to First American, these cities have the largest supply of affordable homes for first-time home buyers:

(Courtesy of First American)

Note: First American’s First-Time Home Buyer Outlook Report utilized mortgage rates, renter income levels, PMI and property taxes influence to calculate market affordability for first-time homebuyers.