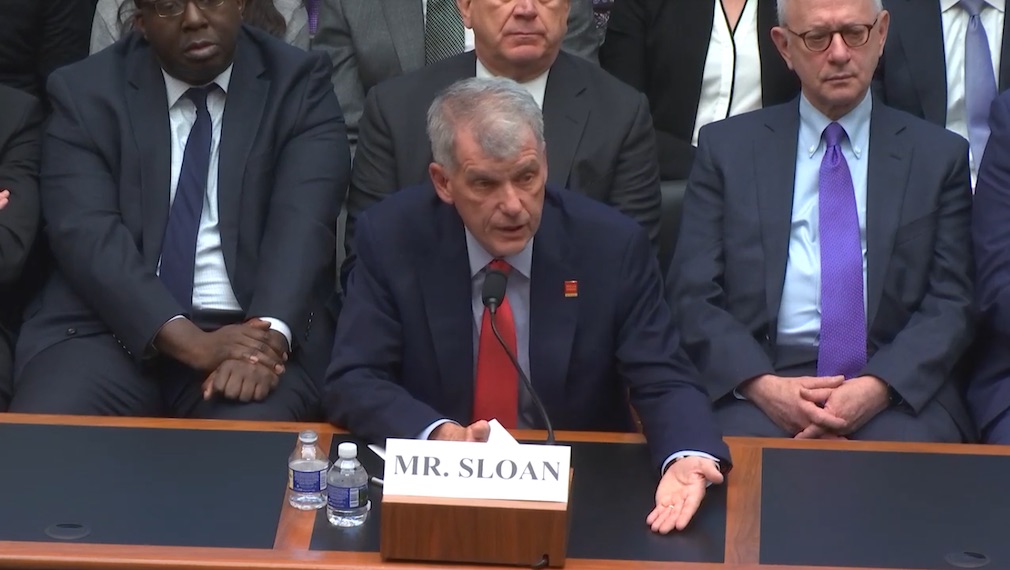

Wells Fargo CEO Tim Sloan appeared before the House Financial Services Committee on Tuesday to address questions regarding the bank’s overhaul after a series of scandals rocked the big bank in recent years.

In a tense four-hour hearing, Sloan was grilled about the steps he has taken during his two-year tenure as CEO to improve the bank’s culture, enhance its cybersecurity measures and pay restitution to the millions of customers it has wronged since numerous misdeeds were brought to light.

In 2016, it was revealed that Wells Fargo employees opened 3.5 million fake accounts to meet sales goals, and since then numerous other scandals have emerged, including forcing customers to buy auto insurance they didn’t need; charging service members illegal fees and unlawfully repossessing their cars; and charging improper mortgage fees in a rate-lock scheme.

As a result, the bank has been slapped with more than $4 billion in fines and the Federal Reserve made an unprecedented move by banning the bank from growing its assets beyond 2017 levels until it cleaned up its act to the satisfaction of regulators.

Tuesday’s hearing, titled “Holding Megabanks Accountable: An Examination of Wells Fargo's Pattern of Consumer Abuses,” was intended to determine the progress the bank has made on improving its infrastructure to prevent future abuses.

Committee Chairwoman Maxine Waters opened the hearing by listing Wells Fargo’s wrongdoings. Not mincing words, she called the bank “a recidivist financial institution that creates widespread harm with a broad range of offenses.”

Waters alleged that the fines and punishments have not altered the bank’s behavior, insisting several times that the bank is too big to adequately operate.

“Wells Fargo’s ongoing lawlessness and failure to right the ship suggest the bank, with approximately $1.9 trillion in assets and serving one in three U.S. households, is simply too big to manage,” Waters said.

Representatives from nearly every state then proceeded to launch questions at Sloan, which were mostly hostile in nature and amounted to an airing of grievances against the big bank as Sloan was often left with little time to respond.

Among the topics discussed were Wells Fargo’s investment in the gun manufacturer that made the gun used in the Parkland school shooting; the firing of employees as the company opened operations overseas; its misdeeds against servicemembers; its investment in oil pipelines that have harmed the environment; and the status of reparations to the millions of customers it has wronged.

For his part, Sloan insisted that the bank’s problems have been fixed and that proper measures have been put into place to prevent future abuses.

The CEO said that the bank’s problems were the result of poor corporate organization and that steps have been taken to restructure the bank.

“Our past problems were the product of an old, decentralized structure, so we have centralized enterprise controls, including risk, finance and human resources and hired impressive new leaders, many of them from outside the company, to oversee them,” Sloan said.

He also stressed a change to the corporate culture that no longer incentivizes the sale of products but instead focuses on customer service and risk control.

When asked by Rep. Patrick McHenry, R-NC, if he could personally assure the committee that its customers would no longer be harmed, Sloan said the bank has done the best that it can.

“I can’t promise you perfection, but what I can promise you is that…the substantive changes that we’ve implemented since I became as CEO are going to prevent them from occurring as best we can.”

Rep. Sean Duffy, R-WI, said, judging from the hostile air in the room, he was surprised that Sloan was not testifying in an orange jumpsuit.

Duffy asked Sloan to enumerate the steps the bank has taken to right its wrongs, acknowledging that Sloan was not being given time to answer many of the questions asked of him.

Sloan said the bank has refreshed its board of directors by bringing in seven new members; made changes to its leadership team; reorganized the company to create a better set of checks and balances; hired 3,000 new risk professionals; invested billions of dollars in new technology; raised the minimum wage of its workers to $15 per hour; made its team members shareholders; and changes its sales incentives.

But many representatives remained skeptical of the bank’s progress in improving the predatory culture at the heart of its scandals.

A number of representatives referenced a New York Times article published last week that suggested the bank has done nothing to change the aggressive sales culture that led to past abuses.

The Times quoted Wells Fargo employees who said they still remain under pressure to “squeeze extra money out of customers” and that they operate under “ambitious sales goals.”

Sloan repeatedly insisted that its assertions were false.

“We disagree with almost every statement made in that New York Times article," he said. “It is fundamentally not true.”

The big question of the day was whether or not Wells Fargo is simply too big to function, with the suggestion that the bank should be dissolved to protect consumers from further harm.

While Waters made it clear that she stands firmly in this camp, Sloan insisted that breaking up the big bank doesn’t serve consumers.

“I think the value that larger banks bring today is that because of our economies of scale, we can invest billions in technologies and innovation and services that our medium-size and smaller competitors can’t,” he said. “There are a number of products and services that we’ve been able to introduce because of our economies of scale.”