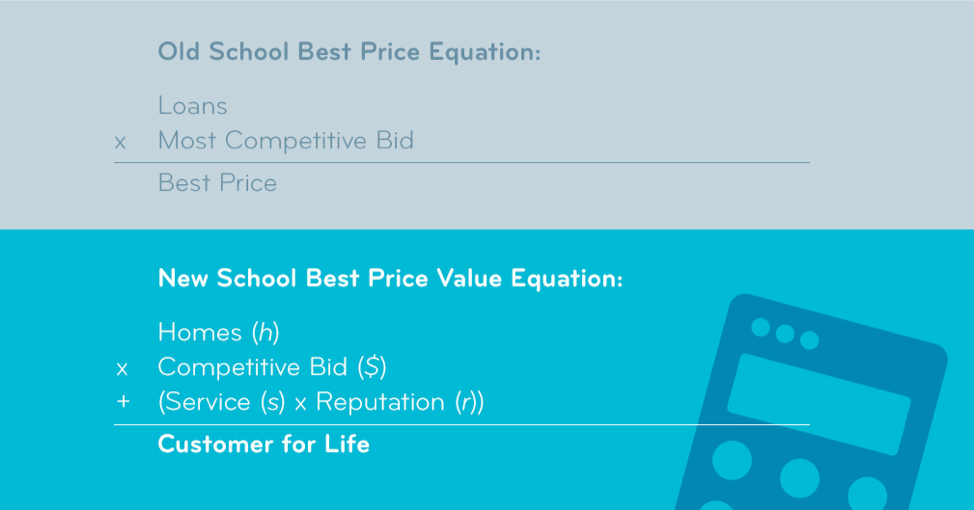

If you ask what matters most when selling loans off, the knee jerk answer is “best price.” Sure, sharpen the pencil, squeeze an extra 2 bps, and look like a hero because you opened up your warehouse lines. Here’s the bad news: That’s old school and affects the long-term growth of your company.

Price is important, and you want a competitive price, but that’s table stakes in today’s competitive environment. The new school of thinking is a best price equation that includes future customer value: Homes(h) x Competitive Bid($) + (Service(s) x Reputation (r)) = Customers for Life. How the customer is treated post-sale affects your profitability and growth long term. Do you ever wonder why the average mortgage company lasts less than 10 years?

You’re probably thinking, they’re not our customer anymore. Well, think again.

A recent TMS Correspondent Lending study found that customers rarely remember who their loan was sold to (even though they make a payment to the new servicer each month!). They attribute their customer service experience to the lender who originated the loan. A bad experience more often than not reflects back to the originator, and is 14 times more long-lasting than a positive experience. Positive experiences tend to be immediate, present tense and are attributed to the new servicer, unless the original lender is kept top of mind.

Think about it. You worked so hard to woo that customer, lock them in and get them to the closing table (Courting is expensive.) With a quick hand shake and a smile, you turn around and sell them off to some investor they’ve never heard of who may not deliver the same level of woo as you. They fell in love with you, they think of you first…and you dumped them for an extra 2 bps.

Yeah, this is a business of buying and selling loans. We get that. But you invested a lot to win over those customers, and why have to win them over again in the future – which is unlikely to happen because you dumped them to someone who doesn’t really care.

There’s a new school of thinking that can keep the love alive. That is, if you choose a Correspondent investor (or as we like to call it CAREspondent Investor) who takes care of your customer for you, and keeps them thinking about you. (This is new school!)

Studies show that the customer is going to refi or purchase again in the next 3-4 years. Why can’t that be with you? This takes best price equation to a whole new level: Customer Lifetime Value. So, you can be a hero not just for moving loans off your books; you’ll be heroic for making sure customers come back!

Let’s take a closer look at how to think of the Best Price Value Equation

h x $ + (s x r) = Customer For Life

h = Home: Let’s get one thing straight, you’re not dumping a loan, you’re placing someone’s home with a correspondent investor who is going to take care of that customer for you. That home, or that customer, is going to realize their dream of homeownership. And when they’re ready to remodel, refi or buy another home, you want to be top of mind for them.

$ = Competitive Bid Price: 5-25 bps more per loan is great, but not at the expense of the other factors below. You want to pay a competitive rate so that you are making money, but don’t be short-sighted to think that quick $20 is better than $2000 on a future refi or even more for a future purchase.

s = Superior Customer Service: It may not have been love at first sight, but you got them into the home and they love you for that. And it cost you an average of $3,000 to acquire that new customer. Why let that burn out? At investors like TMS, servicing technology allows highly trained agents to monitor borrower payment habits in real time and proactively reach out to them to make sure they can handle any life circumstance or crisis. TMS created its award-winning subservicing technology SIME, Servicing Intelligence Made Easy, because the company was a correspondent lender before it became an investor. If a customer’s new servicer doesn’t treat them with the same level of care, it will come back to haunt the lender. The recent TMS survey discovered that 77% of customers who were sold off to a servicer attribute any bad service post-sale to the originator. On the flip side, approximately 70% of customers would be more loyal if they had good customer service and 65% would recommend the company to others. Partner with a correspondent investor who will take care of your customer so they will come back for more romance on the next loan.

r = Reputation: Who says you can’t stay top of mind once you sell the loan? The new school way is to partner up with your investor on this customer and give them extra love. Correspondent investors like TMS offer you co-branded billing statements so your customer will be reminded of the romance for the next 360 months…or at least until they refi or purchase with you again. They know they love you, let’s make sure they remember your name when it’s time to refi or purchase another home.

Stop thinking about the best price equation as the investor with the most competitive bid. That’s the quickest way to let love die. The new school way involves much more service and care for your customer, fueling their lifetime value. Be the hero for your company and your customers by capturing long-term growth and providing superior customer service.