Gross Domestic Product was championed by consumer spending in the third quarter of 2018, according to the advanced estimate from the Bureau of Economic Analysis.

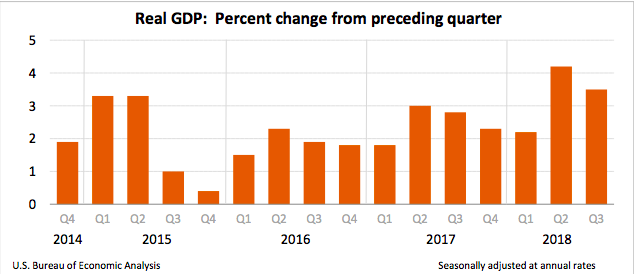

Real GDP increased to an annual rate of 3.5% in the third quarter, according to the advanced estimate. This is down slightly from the 4.2% growth seen in the second quarter.

Today’s third-quarter advance estimate is based on incomplete source data that is subject to further revision and will be followed by a second estimate, due to be released in November.

The chart below shows that GDP fell nearly one percentage point from the second quarter but is up more than two percentage points from the third quarter of 2017.

(Source: BEA)

Mortgage Bankers Association Chief Economist Mike Fratantoni said GDP growth for the third quarter met forecast expectations.

“This strong, above trend growth is being driven by stronger consumer spending – fueled by the incredibly healthy job market and rising wages,” Fratantoni said. “Stimulative fiscal policy is also clearly spurring faster expansion, with the third quarter data showing gains in defense spending.”

“We expect the pace of economic expansion to step down a notch in 2019, but it will still be above the long-run trend,” Fratantoni continued. “This in turn should push down the unemployment rate even lower – keeping housing demand up even in the face of somewhat higher mortgage rates.”

The increase in real GDP in the third quarter reflected positive contributions from non-residential fixed investment, personal consumption expenditures, private inventory investment and state and local government spending.

These were partly offset by negative contributions from exports and residential fixed investment. Notably, imports increased in percentage.

Current-dollar GDP increased 4.9%, or $247.1 billion, in the third quarter to a level of $20.6 trillion. This is down from the second quarter’s 7.6%, or $370.9 billion.

The gross domestic price purchase index increased 1.7% in the third quarter, down from an increase of 2.4% in the second quarter. Personal consumption expenditures increased 4%, up from 3.8% last quarter.

However, Capital Economics notes that higher interest rates are beginning to take their toll.

According to its analysis, at 3.5% annualized, GDP growth remained unusually strong in the third quarter, thanks partly to this year’s fiscal stimulus, but there are clear signs that higher interest rates are beginning to have a bigger restraining effect.

Capital Economics insinuates that once the boost from fiscal stimulus fades next year, they expect economic growth to slow below its potential rate, forcing the Federal Reserve's plans for another rate hike to the sidelines.

Fiscal stimulus is keeping headline GDP growth strong for now. But the third quarter GDP figures add weight to our view that the cumulative tightening in monetary conditions already seen is beginning to bite.

Next year, as the boost from fiscal stimulus is fading and the lagged impact of higher interest rates begins to weigh more heavily, we expect GDP growth to slow below its 2% potential pace. That is why we expect the Fed to stop raising rates by the middle of next year, sooner than markets or Fed officials themselves anticipate.