Although some in the mortgage industry have been advocating for the Federal Housing Administration to reduce the cost of its mortgage insurance premiums, as long as current trends persist any reduction in pricing isn’t likely anytime soon. Two of the primary drivers that will likely force FHA to retain current MIP pricing levels are: 1) deteriorating credit quality in FHA forward mortgage originations, and 2) the ongoing impact of legacy Home Equity Conversion Mortgage loans.

Declining Credit Quality

As has been well documented, in the immediate aftermath of the recession, the credit box for FHA loans tightened substantially. For a period of time, FHA’s average borrower credit score reached 700 – something unheard of prior to the recession. So it was natural that over time credit standards for FHA loans would ease back into a more normal range. And, indeed, we have seen this happen in recent years. But as lenders’ credit standards for FHA loans have been dialed back, some troubling signs have emerged that may give FHA leaders pause when they consider the health of the Mutual Mortgage Insurance Fund.

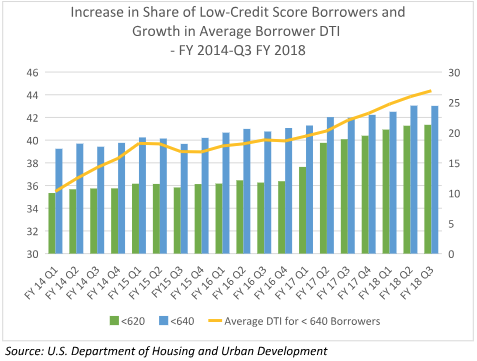

The credit score composition of FHA originations has changed notably. While the share of FHA loans with borrower credit scores below 640 has risen rather steadily in recent years, the share of new originations with credit scores greater than or equal to 720 has fallen – particularly in the most recent years (see chart below).

The credit score composition of FHA originations has changed notably. While the share of FHA loans with borrower credit scores below 640 has risen rather steadily in recent years, the share of new originations with credit scores greater than or equal to 720 has fallen – particularly in the most recent years (see chart below).

With the introduction of 97% LTV products by Fannie Mae and Freddie Mac, many borrowers with strong credit and a small down payment who would have historically obtained an FHA mortgage are now able to utilize conventional financing at lower cost. Conversely, the risk-based pricing employed by private mortgage insurers makes an FHA loan a more affordable option for borrowers with lower credit scores. The result has been a downward shift in the credit score compilation of FHA’s new originations.

At the same time, average debt-to-income ratios have been rising for FHA loans as well. For the second quarter of fiscal year 2018 (first calendar quarter), nearly one-quarter of FHA originations had DTIs that exceeded 50%. The chart below shows both the increase in average DTI and the growth in production for borrowers with lower credit scores.

Because FHA does not utilize risk-based pricing, its MIP must be priced to sufficiently account for losses across its portfolio. Prior to the recession, FHA MIP was underpriced for the risk of the portfolio, leading to billions of dollars in losses that pushed the MMIF’s Capital Reserve Ratio below the mandated two percent level and eventually necessitated a draw from the Treasury to shore up required reserves. FHA leadership remembers well these events and is loath to permit a similar situation to occur under their watch.

HECM Losses

In addition to accounting for future potential losses associated with deteriorating credit quality in the forward mortgage portfolio, anticipated losses from the HECM program will continue to play into MIP pricing for forward mortgages. For fiscal year 2017, FHA’s actuarial analysis estimated that the HECM portfolio had an economic net worth of negative $14.5 billion. Problems with program design, modeling, and premium pricing have resulted in HECM posting outsize losses to the MMIF compared to its relatively small share of the fund’s portfolio.

Despite changes made to the program starting in fiscal year 2018, expected losses from earlier vintages of HECM loans will continue to adversely impact the MMIF for years to come. Because the MMIF is used for both FHA’s forward and HECM programs, and since the vast majority of new FHA business is derived from the forward mortgage program, FHA is forced to price its forward mortgage MIP to compensate not only for expected losses on forward mortgages, but also for losses from the HECM program.

It doesn’t have to be this way, however. The HECM program was added to the MMIF starting in fiscal year 2009 via mandates in the Housing and Economic Recovery Act of 2008. Congress could remove HECM from the MMIF, which would permit the forward mortgage program to set its MIP pricing in accordance with the actual risks of the program. As long as the HECM program continues to share an insurance fund with the forward mortgage program, FHA will find it difficult to provide MIP pricing relief for forward mortgage borrowers.

Absent the removal of the HECM program from the MMIF, FHA will likely be forced to maintain current MIP pricing levels for the foreseeable future. And the declining credit quality of the portfolio only further serves to support sustaining those pricing levels. Unfortunately, those same issues will make the elimination of the life of loan MIP policy a difficult proposition as well. We will know better where things stand with FHA’s portfolio this fall when HUD releases its actuarial review of the MMIF. But for all of the reasons I’ve laid out here, I wouldn’t plan on a reduction of FHA MIP anytime soon.