Applicants looking to get a small-dollar mortgage struggle to get approved, but it has nothing to do with their credit worthiness.

New research from the Urban Institute shows about 80% of homes valued between $70,000 and $150,000 were bought with a mortgage in 2015, but only about 25% of homes valued at $70,000 or less were financed with a mortgage.

On reason for this drop is that small-dollar mortgages face higher mortgage denial rate that have nothing to do with a buyer’s credit worthiness, according to the report.

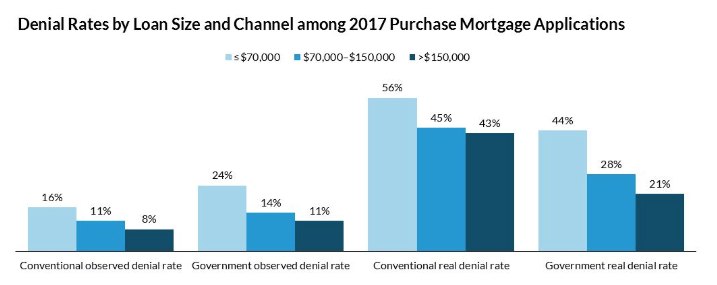

The denial rate for mortgages up to $70,000, or the observed denial rate versus the number of applications, was 18% in 2017. This is about double the denial rate for loans of more than $150,000 that same year.

Laurie Goodman, Urban Institute vice president and codirector of its Housing Finance Policy Center explained the reason for this higher denial rate was not immediately clear.

“It’s not clear, however, why the denial rates are higher for small-dollar mortgages,” Goodman stated. “Applicants for these smaller mortgages might have weaker credit profiles than applicants for larger mortgages. But if denial rates for smaller loans are higher simply because applicants for smaller loans have weaker credit profiles, the loan size is not to blame.”

In order to determine the reason for the higher rates, applicants were divided into two groups: high-credit profile applicants who have virtually no chance of being denied, and low-credit profile applicants who might be denied a mortgage.

The result? There was little variation in applicant’s credit profiles by loan size. The share of low-credit profile applicants remained at 34% for loans up to $70,000, 35% for loans between $70,000 and $150,000 and 30% for loans more than $150,000.

But even after controlling for applicant credit profiles, the chart below shows the gap in denial rates was significant at 52% for mortgages under $70,000 and 29% for mortgages above $150,000.

Click to Enlarge

(Source: Home Mortgage Disclosure Act, CoreLogic, Urban Institute)

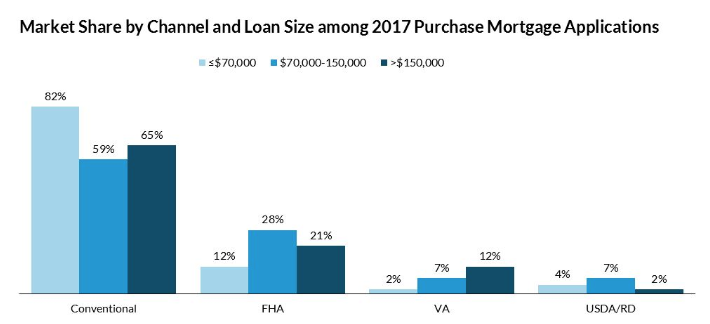

The research also found Conventional loans had higher overall denial rates due to the overrepresentation of small loans in this channel. The chart below shows conventional loans hold an 82% share of loans less than $70,000, compared to a 59% share of loans from $70,000 to $150,000 and 65% of loans $150,000 and above.

Click to Enlarge

(Source: HMDA, CoreLogic, Urban Institute)

The Urban Institute gives three factors that contribute to the conventional channel’s dominance in the small-dollar loan market.

1. Many small-balance conventional loans are in rural and low-cost communities traditionally served by small banks and credit unions, which tend to originate only through the conventional channel.

2. Bank originators who originate fewer government loans must comply with Community Reinvestment Act requirements to meet the needs of the communities in which they operate, including the needs of low- and moderate-income neighborhoods.

3. Borrowers who make large down payments generally choose the conventional channel because it offers lower rates for borrowers with lower loan-to-value ratios. When a borrower in that channel makes a large down payment on a home in the $70,000 to $100,000 range, that loan will fall into the smaller, under $70,000 category, contributing to the prevalence of small loans.

The Urban Institute explained that, simply put, the high cost of originating and servicing a loan makes small-dollar loans unattractive to mortgage lenders, and therefore receives higher rates of denial.