Rental scams abound, and a staggering 5.2 million U.S. renters have lost money to predatory rental scams, according to research from Apartment List.

Of the 5.2 million people who lost money to rental scams, one in three lost over $1,000.

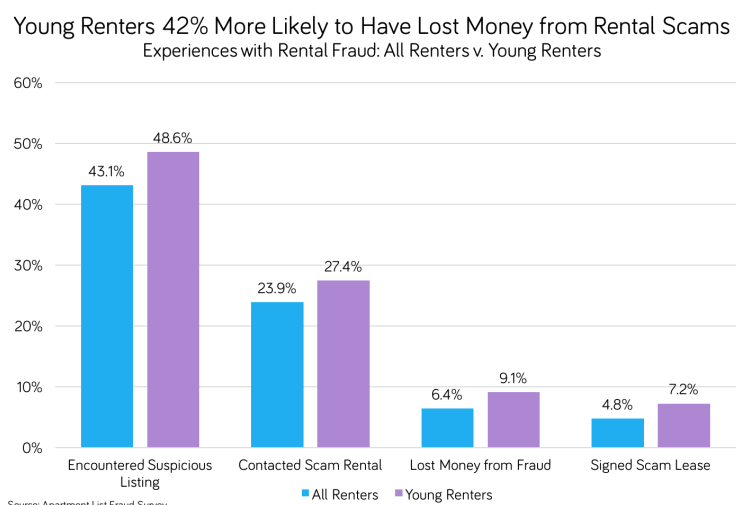

Younger renters are taking the brunt of the scamming. According to the report, 9.1% of all 18 to 29-year-old renters have been scammed as compared to just 6.4% of all renters falling to scams.

The way this typically goes down is young renters, though generally tech savvy, don’t know a fraud when they see it and/or have to sign a lease sight-unseen when they move to a new city for their new jobs. This cohort is 42% more likely to be the victims of rental fraud. Fraudulent listings typically advertise below-market rate, so renters on a budget and unfamiliar with the market are more susceptible to getting taken for a ride.

When fraud does happen, it is more often than not a hefty hit to the wallet. Of those who lost money to a rental scam, 31.4% lost over $1,000 (half of which lost over $2,000); 23.5% lost under $100; 27.5% lost between $100 and $499; and 17.6% lost between $500 and $1,000.

(Courtesy of Apartment List)

So, what can you do to avoid rental scams? The number one thing you can do is visit the property in person. If you want something done right, do it yourself. Get your eyes on the property, tour your desired floor plan and make sure the landlord is delivering on his or her promises.

Other things you can do to avoid getting scammed include verifying the landlord via city records or a conversation with the building manager; speaking to current tenants; refusing to pay with cash or wire transfers; being judicious with your information; and confirming prices and features before signing the lease.

Pay attention to listings, if the prices are too good to be true, there is no screening process, if there is no address and/or there are no photos of the property, you’re probably staring a fake listing right in its grimy, digital face.

Below, you can find a list of the most common scams Apartment List compiled from its survey of scammed renters. Get educated and be safe on your next search for a new home.

Top five most common rental scams:

- Bait-and-Switch:

A different property is advertised than the available rental, and the scammer tries to collect a deposit or get a lease signed for this property. - Phantom Rentals:

A scam-artist makes up listings for places that don’t exist or aren’t rentals, and tries to lure renters with low prices. - Hijacked Ads:

A fake landlord posts advertisements for a real property with altered contact information. Homes for sale are often re-listed as rentals in this type of fraud. - Missing Amenities:

A real rental is listed as having features and amenities it lacks in order to collect a higher rent, the rental market equivalent of catfishing in online dating. The leasing agent tries to get renters to sign the lease before they notice the missing amenities. - Already Leased:

A real or fake landlord attempts to collect application fees or security deposits for a rental that is already leased.