Renters are less likely to be evicted or skip out on their leases thanks to improving economic conditions in the U.S., according to a new report from TransUnion.

The report shows that renter risk decreased by 2% year-over-year as 34% of renters now have renter scores of 720 or higher. The score is based on a TransUnion proprietary scoring method.

According to TransUnion Senior Vice President of Rental Screening Mike Doherty, landlords can thank a strong economy and low unemployment levels for the rise in renter dependability.

“Strong local economies coupled with low unemployment rates are likely driving the improvement in the average ResidentScore," Doherty said in a statement.

“This is positive news for renters as fewer applicants are likely to be declined or be subject to higher deposits. For property management companies, this is a major plus as the likelihood of evictions, which can cost thousands of dollars, drops precipitously when renters have a higher ResidentScore,” he added.

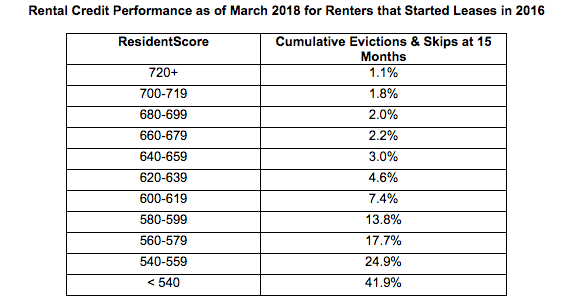

To create this report, TransUnion examined over 500,000 move-ins and payment performance over a 15-month period as reported by property managers.

Over that 15-month period, only 1.1% of the residents with renter scores of 720 or higher were evicted or skipped out on their leases. That percentage increases drastically as you move down in quality of credit. A whopping 41.9% of residents with credit scores below 540 were evicted or skipped their leases. On average, renters who skip out on their leases leave with $4,215 in expenses that property managers must eat.

“When property management companies are steady on their accept or decline criteria, they are declining fewer applicants and the population they are accepting is expected to perform better,” Doherty said.

“Yet, some property management companies should still consider tightening their criteria because it’s clear that applicants with low ResidentScores are far more likely to skip out on a lease or be evicted, causing major losses to property managers,” he added.