Have terrible credit but still want to buy a home? You can get a mortgage, but it will cost you, according to a new lender survey by LendingTree.

If you have bad credit, you could be looking at an additional $15,000 in extra costs over the life of your loan (numbers based off of a 30-year mortgage and the average purchase loan amount of $236,697). According to LendingTree’s report, you can chalk this up to higher interest rates and larger fees.

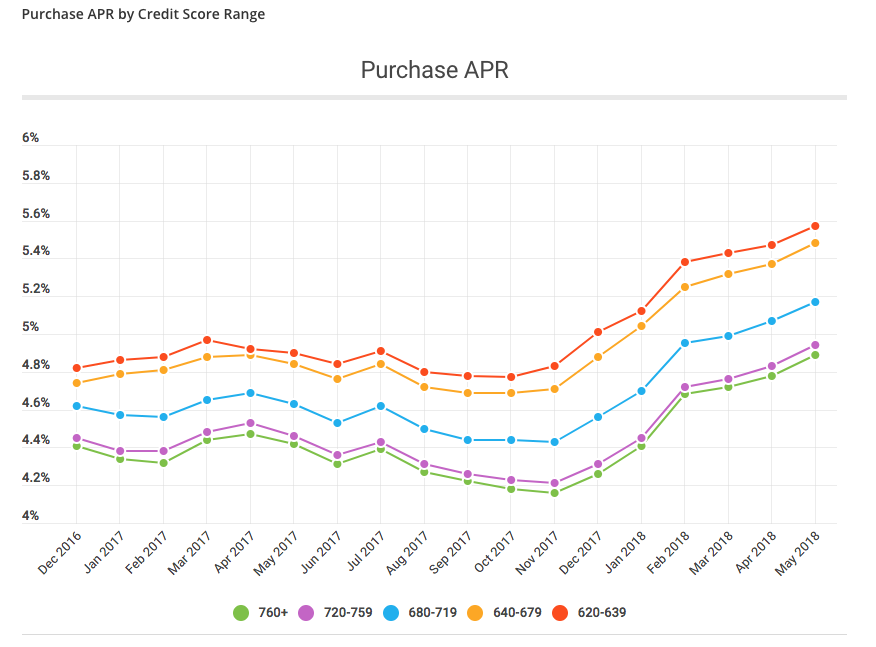

With a credit score in the 620-639 range, lenders could slap you with an APR of nearly 5.6%. That’s up nearly 1 percentage point over last year at this time (see chart below).

(Courtesy of LendingTree and Credit Score Range)

The average lifetime interest paid on an average loan like the example above is $221,783. With great credit (760 and above) that number slides to $215,025, but with bad credit, the average lifetime interest paid increases to $250,727.

That’s a bleak picture, friend. Do everything you can to get your credit shipshape before getting a mortgage because $15,000 is a lot of bread to throw away. Here's what you've got to do, according to FICO:

- Start paying bills on time

Even if you're only a few days late, late payments and collections can put a serious dent in your credit-worthiness.

- Reduce your outstanding debt

Nothing says, "I'm turning this ship around," quite like beating your debt like it owes you money (oh, wait…). First, get your credit report, then make a plan, paying down the accounts with the highest interest rate while maintaining minimum payments on the other accounts in your name.

- Stop creating outstanding debt

Obvious, right? But many people are tempted to open more credit accounts to increase their available credit. This can backfire in two ways. One, if you're already struggling with debt, you're probably going to be tempted to keep spending if you have the option. Don't give yourself the chance. Two, this can actually backfire and lower your credit score.

Getting on the right side of the credit spectrum can be rough, but if you're in the market for a home these days, it is especially important to put in the work to get it right.