CMBS 2.0 defaults are on the rise, with multifamily REOs making up 30% of that increase.

According to a report from Fitch Research, though the volume of CMBS 2.0 defaults is low, the yearly increase remains significant, and of that increase, multifamily and hospitality properties in North Dakota and Texas, harried by the energy downturn, made up the majority of the defaults.

“These loans defaulted due to the decline in the oil and gas industries, with the top two geographic concentrations in North Dakota (28%) and Texas (26%). These two properties types have been hard hit by dried up demand for housing and lodging, especially in the tertiary markets surrounding the Bakken and Eagle Ford shales,” the report states.

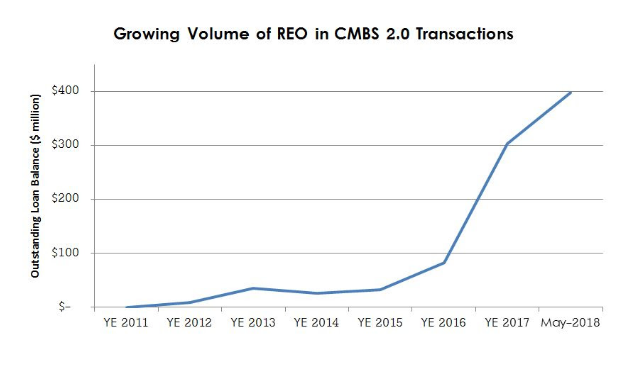

Fitch predicts that this trend of increasing defaults on CMBS 2.0s will continue. From year-end 2016 to year-end 2017, the volume of CMBS 2.0 defaults increased by $221 million, from $82 million to $303 million.

That represents a 269% increase in the volume of CMBS 2.0 defaults.