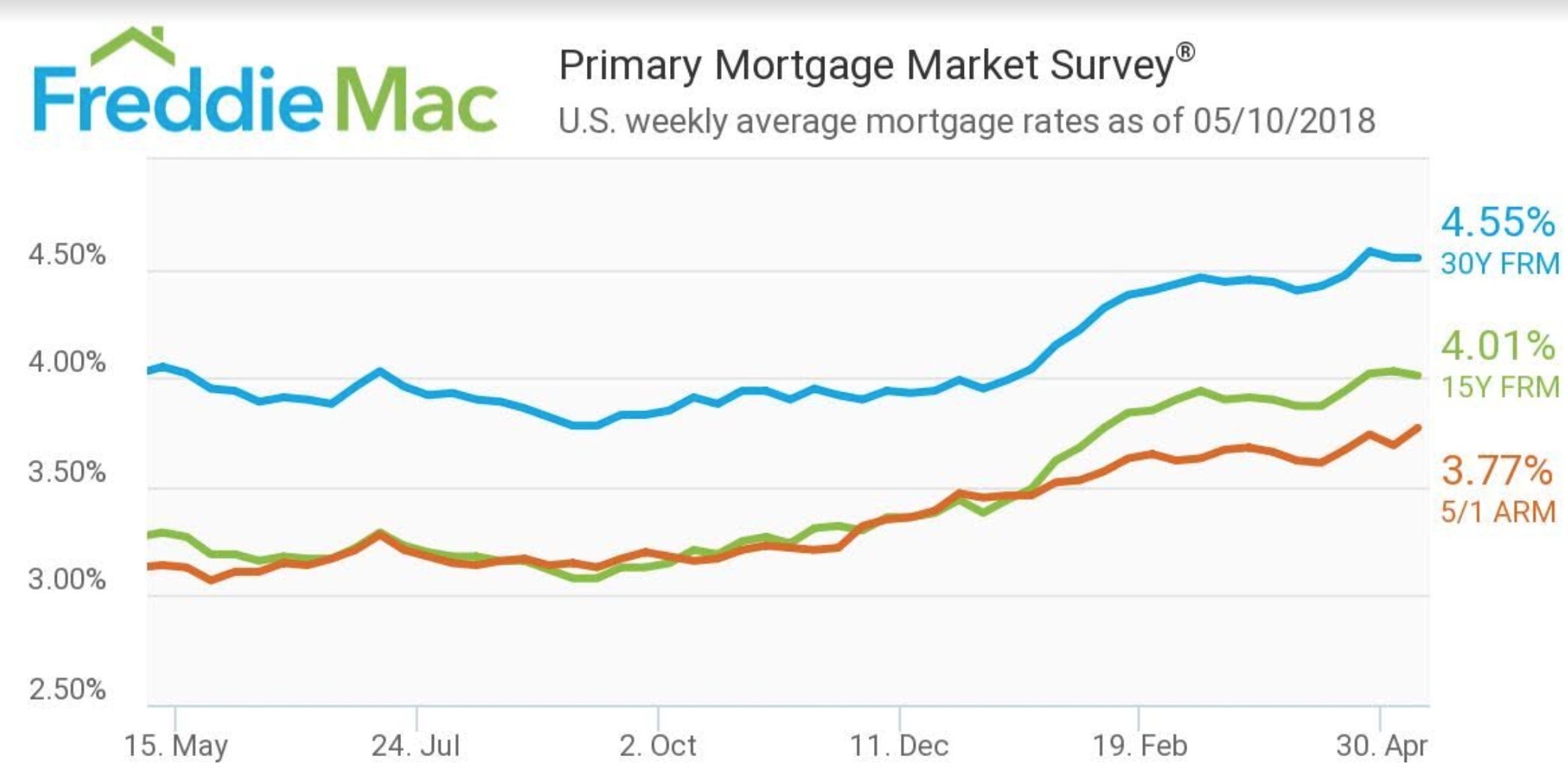

Interest rates remained steady for the week, but even their significant increase from last year isn’t holding back homebuyers, according to Freddie Mac’s Primary Mortgage Market survey.

“While this year’s higher rates, up 50 basis points from a year ago, have put pressure on the budgets of some home shoppers, weak inventory levels are what’s keeping the housing market from a stronger sales pace,” Freddie Mac Chief Economist Sam Khater said.

The 30-year fixed-rate mortgage remained unchanged from its average 4.55% last week for the week ending May 10, 2018. This is up from 4.05% last year.

The 15-year FRM fell slightly, sliding from 4.03% last week to 4.01% this week. But this is still up from 3.29% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to an average 3.77% this week, up from 3.69% last week and 3.14% last year.

“The minimal movement of mortgage rates in these last three weeks reflects the current economic nirvana of a tight labor market, solid economic growth and restrained inflation,” Khater said. “As we head into late spring, the demand for purchase credit remains rock solid, which should set us up for another robust summer home sales season.”