Multifamily sales are up 44% year-over-year in Q1 2018 according to commercial real estate giant Cushman & Wakefield's recent investment outlook.

According, to its capital markets overview, Cushman & Wakefield said the hike in multifamily sales made up 31% of the total U.S. investment sales and spearheaded the 7.2% YoY rise the U.S. saw in investment sales during Q1. This translates to an increase of $100.8 billion in investment sales for the U.S.

The primary source behind the multifamily sales appetite is private capital. JLL Research’s most recent investment outlook reveals that 60.5% of the investment dollars came from private owners or developers.

Cushman & Wakefield’s report said there was an 18% YoY increase in private investments from Q1 2017 to Q1 2018 (note that this is for all asset classes).

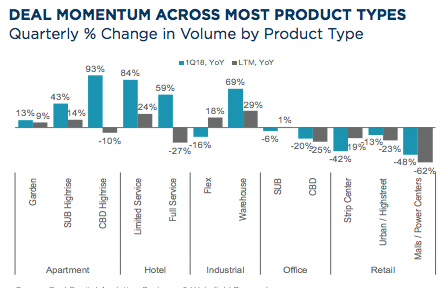

The lion’s share of the growth in multifamily acquisitions was tied up in central business district (read: urban core) high-rise product, the result of investor preference for slightly distressed urban core product due to overbuilding in the urban cores, a trend HousingWire recently reported on. In the graph below you can see a breakdown of investments across product types.