Could Bank of America be taking a step back from its mortgage lending platform? Its earnings report from the first quarter may hold the answer.

Just a few years ago, Bank of America could easily report $1 billion per quarter in its mortgage banking income. However, in the first quarter of 2018, the income from this sector was so small that it was simply lumped into the all other income section from its consumer bank.

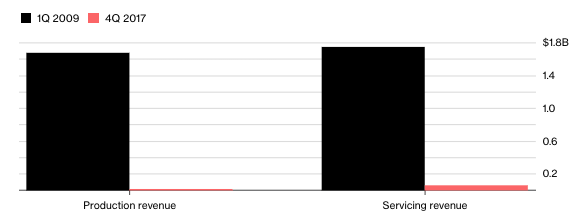

To get a better idea of just how far its mortgage banking revenue has fallen, Bloomberg recently released a chart comparing 2009 levels in mortgage banking’s production and servicing revenue to the first quarter in 2017. The result is nothing short of shocking.

Click to Enlarge

(Source: Bloomberg, Bank of America)

The bank’s earnings for the first quarter stated simply that its non-interest income increased by $19 million or 1%, but the increase in card income was partially offset by lower mortgage banking income. The specifics end there.

Back in 2015, the bank laid off hundreds of workers from its legacy mortgage servicing operations, saying it was continuing to cut back its servicing staff due to a decline in delinquent loans.

And in December last year, First American Financial bought the bank’s lien release business and agreed to perform these services for Bank of America going forward.

But even as it seems to be further distancing itself from mortgage servicing, Bank of America hasn’t given up on mortgage lending. Wednesday, the bank launched its new digital mortgage lending platform.

It also listed this as one of its accomplishments for 2018 in its first quarter earnings release.

And despite these falling numbers, Bank of America still ranked No. 4 in number or mortgages originated and in the volume of its purchase and refinance originations in 2016. Home Mortgage Disclosure Act data prepared by iEmergent shows the bank originated 152,811 loans, or 2% of the mortgage market, a total volume of $58.1 billion.

HousingWire reached out to Bank of America, but the bank did not respond to the request to comment.

Overall, its total revenue increased 4% from $22.2 billion in the first quarter of 2017 to $23.1 billion in the first quarter of 2018. This is also up 13% from $20.4 billion in the fourth quarter.

The company’s net income increased 30% from last year’s net income of $5.3 billion to $6.9 billion in the first quarter. This is up even more significantly, 188%, from $2.4 billion in the fourth quarter. Of course, the fourth quarter also dropped significantly due to adjustments for the newly signed tax reform law.

This represents diluted earnings per share of $0.62 in the first quarter, up from $0.45 in the first quarter last year and $0.2 in the fourth quarter.

“This was a strong quarter,” said Paul Donofrio, Bank of America chief financial officer. “Revenue was up 4% year-over-year and expenses were down 1%, making this the 13th consecutive quarter of positive operating leverage.”

“We also carefully managed credit costs,” Donofrio said. “This enabled us to deliver double-digit EPS growth. We also returned $6.1 billion in capital to our shareholders through dividends and common stock repurchases.”