Monday Morning Cup of Coffee takes a look at news coming across HousingWire’s weekend desk, with more coverage to come on larger issues.

To probably no one’s surprise, affordable housing continues to worsen in buyer and rental markets.

The average national rent increased 2.5% to reach $1,359 in 2017. This is up 24% from 10 years ago, according to a new study by RENTCafé.

This increase means Americans paid an average $400 more in rent in 2017 than the previous year, the study showed.

And in some areas these increases were much higher. In Sacramento, California, for example, rent prices increased 8.8%, while in smaller cities such as Odessa, Texas, and Midland, Texas, renters paid a total of $3,400 more in 2017 than they did in 2016.

But this could take a positive turn in 2018 as many experts continue to predict the market is shaping up for a construction boom.

The construction industry added about 30,000 jobs last month, according to the U.S. Labor Department, making 2017's total 210,000, a 35% increase from 2016.

Of course, all of that could change if the administration continues to crack down on illegal immigration.

Over the weekend, President Donald Trump signaled that Democrats are not working with Republican demands in order to find a compromise for Deferred Action for Childhood Arrivals.

The Democrats are all talk and no action. They are doing nothing to fix DACA. Great opportunity missed. Too bad!

— Donald J. Trump (@realDonaldTrump) January 13, 2018

With one flippant tweet, the president told an estimated 700,000 young immigrants who were brought to the U.S. as children that their future is uncertain.

Back in September, Trump announced he was rescinding the DACA program, giving Congress a six-month deadline to fix the problem.

However, this weekend also brought a sliver of hope for DACA immigrants as the federal government announced Saturday it will begin accepting renewal requests once again.

The decision to accept applications again came after a federal judge in California issued a nationwide injunction Tuesday, ordering the administration to resume the DACA program as a lawsuit against its recension makes its way through court.

Previously, HousingWire explained how the administration’s immigration policy will affect housing, including making immigrants less likely to buy a home due to the uncertainty of their future, and a significant decrease in the construction labor force.

Congress will continue to debate immigration reform, and the fate of DACA recipients has yet to be determined, but of course, perhaps Trump simply thinks they should return to their “shithole countries.”

Pardon the language, but I am, after all, using the president’s exact words.

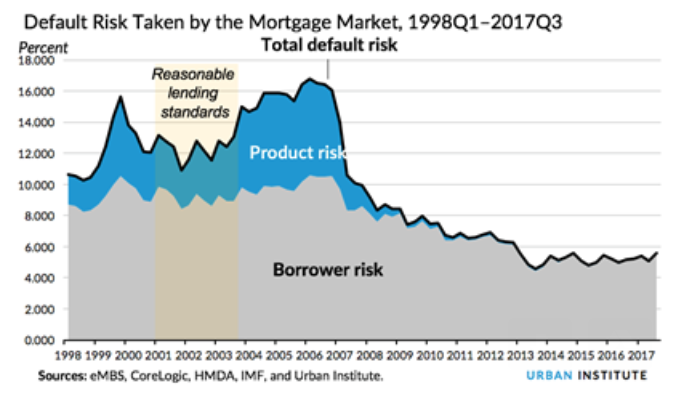

But in more positive news, it is now becoming much easier for borrowers to get a mortgage, according to the Urban Institute’s Housing Finance Policy Center’s latest housing credit availability index.

Mortgage credit availability increased from 5.1% to 5.6% in the third quarter of 2017, the highest level since 2013.

The chart below shows even as credit availability rises, borrower risk remains significantly below its historical levels.

Click to Enlarge

(Source: Urban Institute)

The HCAI measures the percentage of home purchase loans that are likely to default, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it more difficult to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.

The Urban Institute explained this increase was mainly driven by the credit expansions within the government-sponsored enterprise and government channels, thanks to higher interest rates and lower refinance volumes.

Later this week, HousingWire will bring you the latest news live from NEXT, a mortgage tech conference for women.

Until then, keep reading HousingWire and have a great week!